Bitcoin (BTC) held on to fresh gains on April 14 after a rebound in line with Wednesday’s Wall Street open flipped the mood.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

$40,500 now the level to hold

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD still trading above $41,000 Thursday, having reclaimed the $40,000 mark during the move higher.

“So far so good, I expected a move to 41k but I doubt about going for an extra leg down to the green box (blue),” popular trader Crypto Ed commented overnight alongside a chart with near-term price targets.

Coming hours a bit more up, followed by a correction. Retest of 40.5k and when that holds, we'll go for 42-43k (white). Lose 40.5k and we'll go for green box.

BTC/USD chart. Source: Crypto Ed/ Twitter

$40,500 showed no signs of falling at the time of writing, with volatility ebbing into Thursday and Bitcoin seeing no major threat to its bounce.

Zooming out, others took the opportunity to argue that despite the lack of bullish sentiment, Bitcoin itself was far from bearish this year.

The lower the time preference, the less cause for panic — year to year, fellow analyst TechDev demonstrated, Bitcoin had more than a passing resemblance to traditional market behavior, even after dropping over 50% from November's all-time highs.

In focus this month was a similar chart pattern between Bitcoin now and the Dow Jones from the start of the 1990s.

"Times change. Assets change. Macro aggregate human behavior usually doesn't," TechDev summarized.

Bitcoin's stocks correlation is nonetheless a cause for concern for some, with a drawdown tipped to impact price significantly.

Exchange withdrawals heat up

For Blockware lead insights analyst William Clemente, meanwhile, there were other reasons to keep the faith.

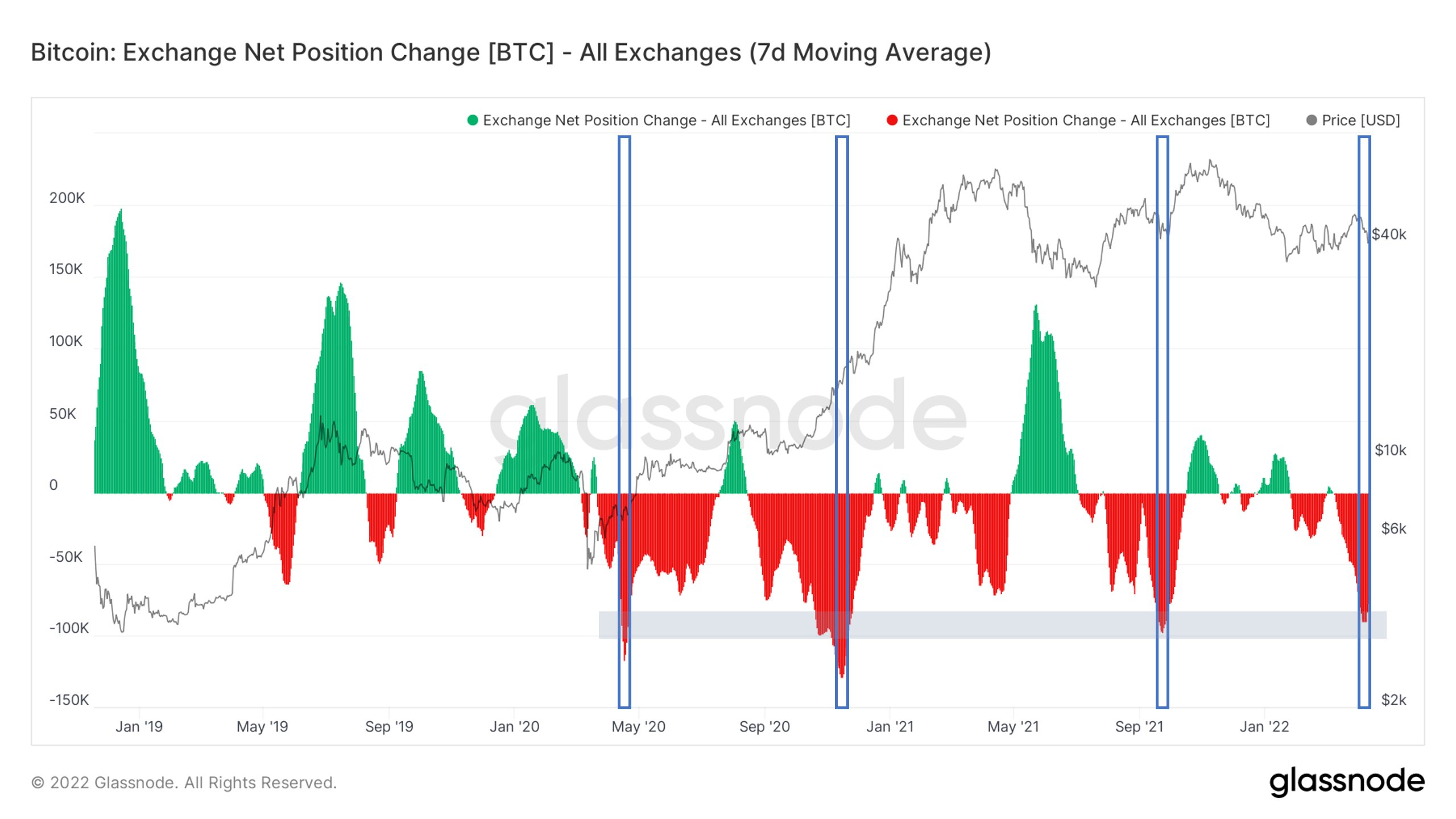

Cryptocurrency exchanges were losing BTC reserves at a rate rarely seen before, he noted Wednesday, implying that any rise in demand would compete with a rapidly-dwindling supply, boosting price performance further.

“On only 3 other occasions have we ever seen Bitcoin withdrawn from exchanges at this rate,” he wrote alongside data from on-chain analytics firm Glassnode.

Glassnode's net position change indicator tracks both upwards and downwards changes in balances on 18 exchanges.

Exchange net position change annotated chart. Source: William Clemente/ Twitter

Exchange withdrawal spikes are a much debated phenomenon, and excitement among pundits has increased this year in line with accelerating demand.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.