- Crypto tokens added nearly 4% to market capitalization, pushing it to $2.52 trillion as traders digest news of the shooting at Donald Trump’s rally.

- Spot Ethereum ETF approval is expected this week, fueling the anticipation of Ether token holders and crypto traders.

- Bitcoin sustains above $65,000 as Ethereum, Solana, and XRP extend gains on Wednesday.

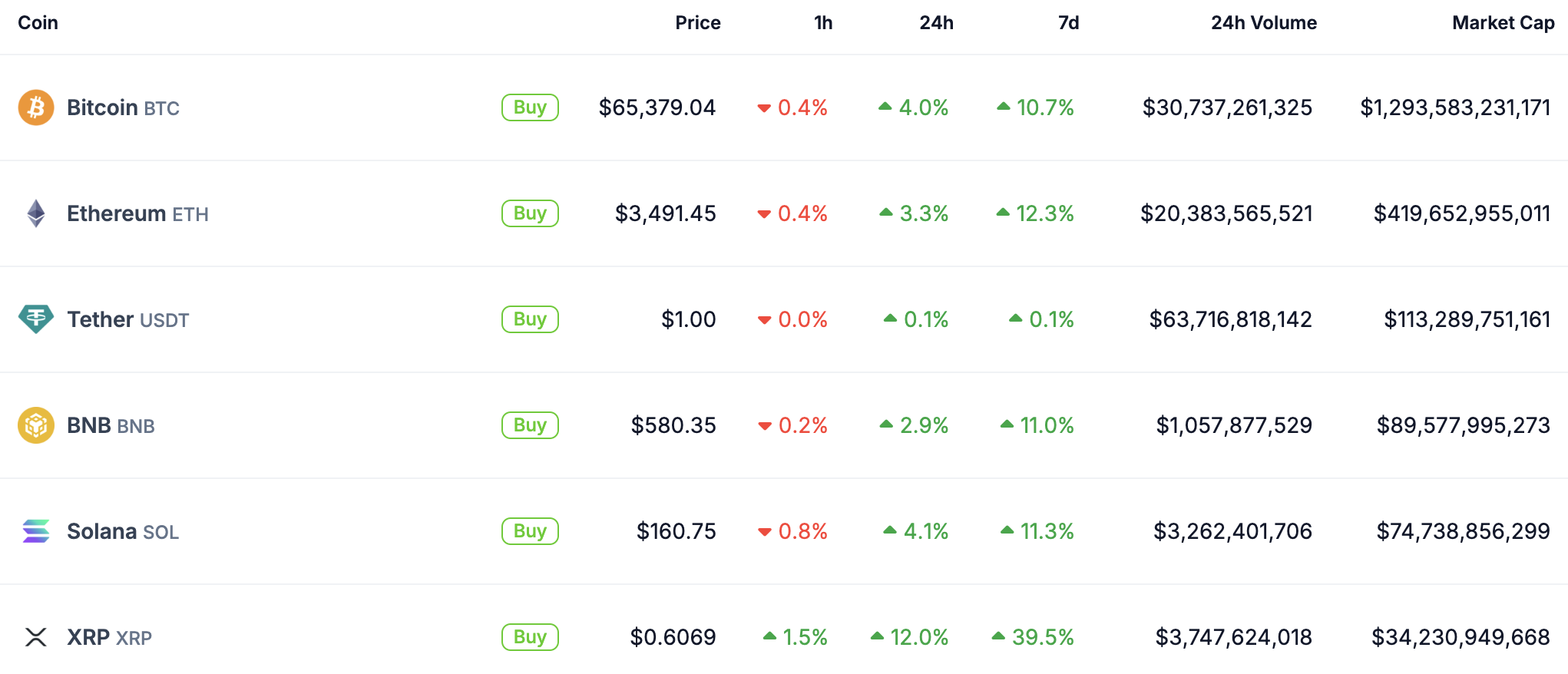

Crypto market capitalization increased nearly 4% in the last 24 hours and climbed to $2.522 trillion on Wednesday, as seen on CoinGecko. Almost all cryptocurrencies ranked in the top 10 assets by market capitalization have rallied in that period.

Bitcoin’s gains have likely catalyzed rallies in Ethereum, Solana, and XRP, among other assets. At the time of writing, Bitcoin trades at $65,260, and Ethereum, Solana, and XRP extend recent gains.

Additionally, Spot Ethereum ETF approval is anticipated this week, and this is likely the other key market mover for the assets.

Ethereum, Solana, and XRP rally amidst ETF hype, Donald Trump rally incident

ETF experts and analysts believe that a Spot Ethereum ETF approval is likely this week. As anticipation brews, Ether holders and traders expect gains, and the sentiment is positive, as seen on cryptoeq.io.

Eric Balchunas, Senior ETF analyst at Bloomberg, believes that the US Securities & Exchange Commission (SEC) will likely approve the ETF by Thursday, July 18.

We don't have a new over/under launch date yet because we haven't heard what the SEC's game plan is. Hope to hear soon. But if you forced me gun to head style to give my best guess for date I'd go with July 18th.

— Eric Balchunas (@EricBalchunas) July 8, 2024

Crypto traders are likely digesting the news of the events that unfolded at former US President and candidate Donald Trump’s rally on Saturday, as the shooting was followed by a rally in crypto prices. Analysts at on-chain data tracker Santiment attributed this to traders anticipating Trump’s win in the November 2024 Presidential elections and his pro-crypto stance.

Former US President Trump is scheduled to deliver a speech at a Bitcoin Conference later this month, on July 27. The Presidential candidate is expected to deliver his speech in Tennessee, in person, despite injuries sustained at the shooting.

In the last 24 hours, Ethereum, Solana and XRP extended gains by 3.2%, 4.1% and 12% respectively, per CoinGecko data. The three assets have positive returns for the last seven days period.

Bitcoin, Ethereum, Solana and XRP extend gains

At the time of writing, Ethereum trades at $3,488, hitting a new two-week high at $3,517 previously on the day, while XRP touched a three-month high at $0.6188.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP show signs of short-term correction

Bitcoin price edges slightly down during the Asian session on Wednesday. Ethereum and Ripple followed BTC’s footsteps and declined slightly; all coins’ technical indicators and price action suggest a possible short-term correction on the cards.

Ripple investors book $1.5 billion in profits after RLUSD launch, XRP struggles near $2.58 resistance

Ripple is up 3% on Wednesday after witnessing significant profit-taking among its investors following the launch of the RLUSD stablecoin. Whales have soaked up the selling pressure from profit-takers as XRP struggles near the $2.58 resistance level.

Alleged anti-crypto Caroline Crenshaw denied renomination vote to serve as SEC Commissioner

The Senate Banking Committee had scheduled a vote for Wednesday regarding the reappointment of Securities and Exchange Commission Commissioner Caroline Crenshaw, but this vote was canceled on Tuesday.

Ethereum Price Forecast: RWA tokenization could boost ETH's price in 2025, Bitwise

Ethereum is down 3% on Tuesday following Bitwise predictions of increased RWA tokenization boosting appeal for the top altcoin. Meanwhile, large whales have continued accumulating ETH in the past month.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.