Bitcoin profitable days shows that in the long run holding is usually a solid strategy

- Traders that bought Bitcoin during Q2 of 2022 and Q1 of 2023 are still up on their buys.

- The price action shows that BTC buyers who accumulated halfway through the bear market remain in profit zone, up and above break-even.

- MicroStrategy Saylor tracker corroborates the outlook, pointing to the profit potential of long term holding.

Bitcoin (BTC) is trading with a bullish bias, pulling north after a recent slump in the market fueled by disappointment about the US Securities and Exchange Commission (SEC) delaying decisions on the series of Bitcoin Sport Exchange-Traded Fund (ETF) applications issued by institutional players like BlackRock, among others.

Also Read: XRP is the next Bitcoin if we solve a multi-trillion-dollar problem, Ripple CEO Brad Garlinghouse

Bitcoin profitable days depict the benefits of long-term holding

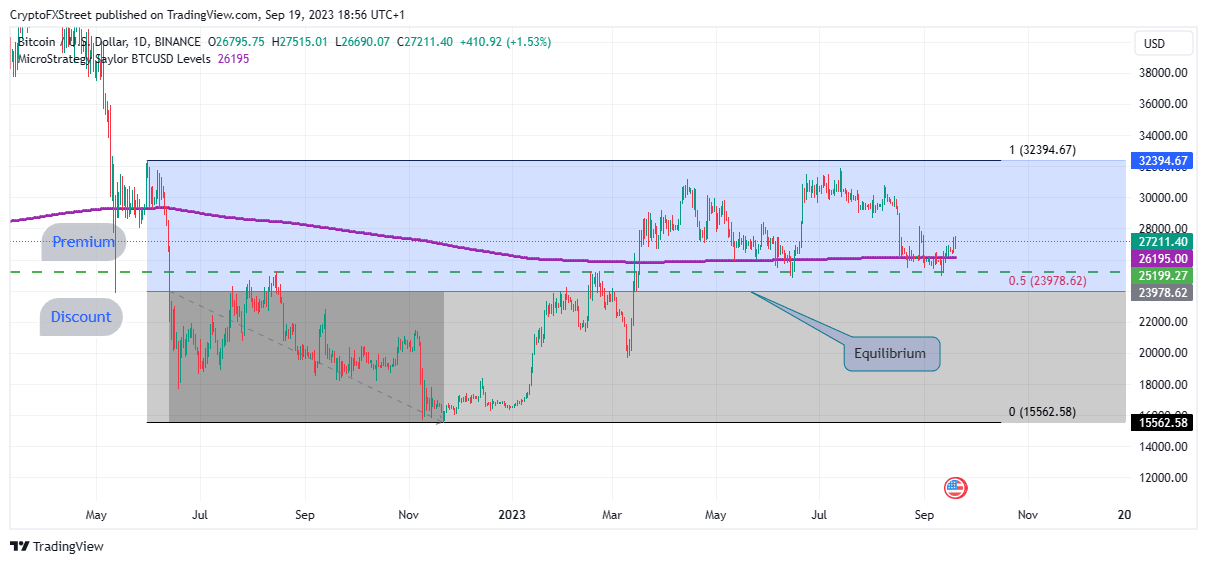

Bitcoin (BTC) profitable days show that in the long run, holding is usually a solid strategy. As indicated in the daily chart below for the BTC/USD pair, investors that bought BTC in the second half (Q2) of 2022 and during the first half (Q1) of 2023 remain in the profit, with the price treading above the equilibrium level of $23,978.

The aforementioned level coincides with the 50% Fibonacci Retracement level, with the market range measured from the range low of $15,562 to the range high of $32,394.

Anyone who bought BTC halfway through the bear market at around $25,199 will still be up or around break even.

With the equilibrium level acting as the break-even price at $23,978, and the Bitcoin price sustaining above $25,199, these long-term holders remain up on their buys.

BTC/USD 1-day chart

The MicroStrategy Saylor BTCUSD index corroborates this outlook. This indicator, which shows the price levels of MicroStrategy's Bitcoin acquisitions based on their 8-K filings, total accumulated BTC, average USD price, and current gain, remains below the current Bitcoin price of $27,211 at $26,195 indicated in purple on the chart above.

A recent report on FXStreet explained and echoed by the behavior analytics platform for cryptocurrencies, Santiment, explained the tight grip that larger holders have on Bitcoin and their calm approach while smaller traders succumb to market changes.

BTC daily active addresses have shown impressive performance over the last five years, but the price action has failed to mirror this action.

BTC active addresses since 2018

The lack of parity between Bitcoin price action and daily active addresses indicates that while large holders have been accumulating, their actions have not impacted the price much. This suggests whales continue to buy in their discrete fashion over the counter (OTC) as opposed to directly on exchanges. Read the full story here.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B00.11.21%2C%252019%2520Sep%2C%25202023%5D-638306758350827234-638307540900844268.png&w=1536&q=95)