Bitcoin price ‘worst-case scenario’ is now $7,000 — Trader Tone Vays

Bitcoin (BTC) hitting $7,000 is now the “worst-case scenario,” veteran trader Tone Vays said on Sep. 23.

In the latest episode of his Market Pulse YouTube series, Vays said he was looking for a BTC price bottom of $9,000.

Vays: $9,000 BTC price is “very good buy the dip” opportunity

BTC/USD has maintained $10,000 support this week but has so far failed to reclaim higher levels after its fall from $11,000 several days ago.

“If we break down, I think $9,000 is a very good ‘buy the dip,’” Vays said.

“What is my worst case scenario low point if we break down? My worst case scenario is $7,000.”

Vays added that $9,000 for him was the “most realistic” outcome of a bearish trend taking hold of Bitcoin markets.

“The longer Bitcoin stays above $10,000, the more bullish Bitcoin is,” he continued.

“Consistency on the way up is bullish; consistency on the way down is bearish.”

Bitcoin has focused on $10,000 in a way which is bullish compared to its bottom of $3,600 in March, but less convincing versus recent highs of $12,500. Reclaim $12,000, however, and for Vays, “the sky’s the limit.”

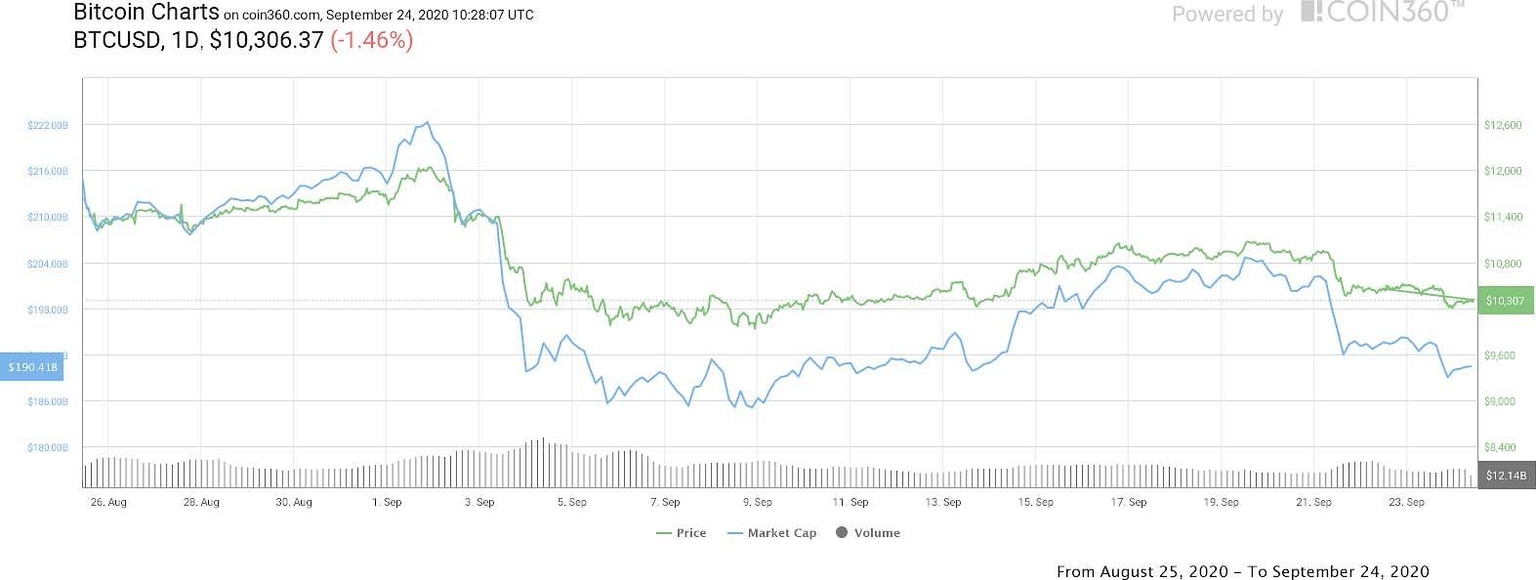

BTC/USD 1-month price chart. Source: Coin360

Downside risk may be no more than 35%

As Cointelegraph reported, analysts are forming consistently more bullish prognoses for Bitcoin, even if short-term price action contains further downside.

This week, quant analyst PlanB highlighted the cryptocurrency’s 200-week moving average, which has never been broken as support, as proof that a realistic price floor is now $6,700. Next month, that level will increase to sit in line with Vays’ $7,000 prediction.

According to Cointelegraph Markets analyst Michaël van de Poppe, however, for the time being, BTC/USD has avoided losing the support that would open up the prospect of retesting the CME futures gap at $9,600.

Still in play from July, the gap is the last noticeable short-term price draw at lower levels from futures, with the only other lying much higher at $16,000.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.