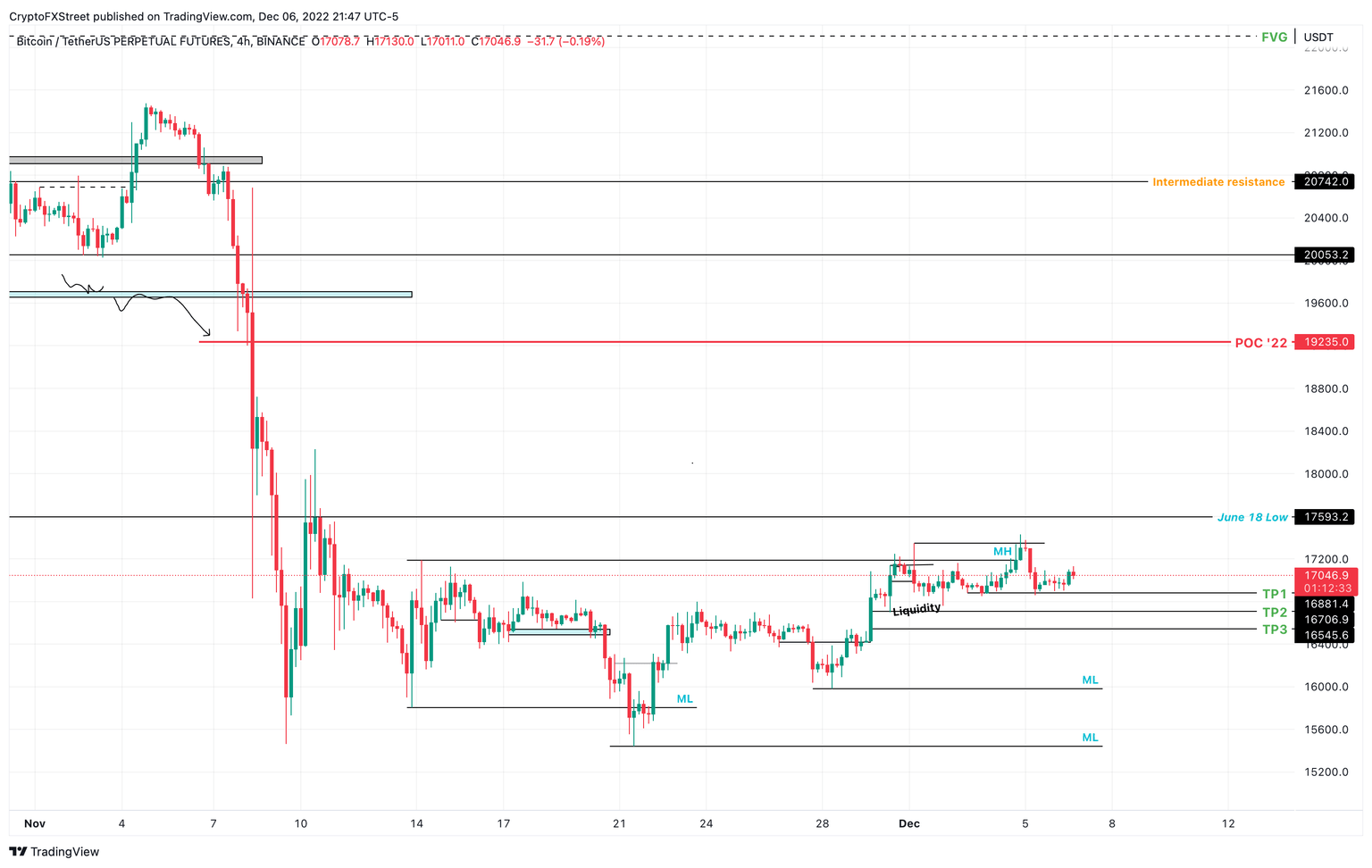

Bitcoin price will provide patient investors an opportunity to accumulate before $20,000

- Bitcoin price shows a tight consolidation below the midpoint of an ascending parallel channel.

- A sweep of the range high at $17,433 will be a signal before sliding down to the $16,502 accumulation level.

- A four-hour candlestick close below $16,502 and a failure to recover above this level will invalidate the bullish thesis for BTC.

Bitcoin price has been consolidating inside a tight range since November 21. Over the last three days, this range has tightened, signaling that a volatile move is likely.

Bitcoin price hints at an opportunity

Bitcoin price has produced three higher lows and higher highs since November 21. Connecting these swing points using trend lines reveals an ascending parallel channel. Investors can see that the last 24 hours have produced a tight consolidation below the midpoint of this setup.

A spike in buying pressure that pushes Bitcoin price to sweep the range high of $17,433 will be crucial. If this move fails to stay above the said level and slides below it, it will signal a bearish in play. In such a case, Bitcoin price will likely aim to retest the $16,502 level, indicating a 5.36% drop from the range high.

From a high timeframe perspective, this area is an excellent level to accumulate, especially if the Bitcoin price is in a bear market rally. If true, BTC will revisit the $19,235 hurdle and the $20,000 psychological level.

BTC/USDT 1-day chart

On the other hand, if Bitcoin price fails to build up momentum for the uptrend but instead kick-starts a downtrend, investors can still look at accumulating at $16,502. However, if BTC breaks down this level in a four-hour timeframe by producing a decisive close below it, things will start to skew in the bears’ favor.

This move will invalidate the bullish thesis and potentially target equal lows at $15,462.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.