Bitcoin price will hit $65K as network effect has 'taken over' – Mike Novogratz

A Twitter survey of whether Williams should buy Bitcoin attracts the likes of Elon Musk as bull run publicity mounts.

Bitcoin (BTC) will hit $65,000 due to a combination of low supply and “tons of new buyers,” major investor Mike Novogratz says.

In an increasingly popular Twitter debate on Nov. 17, Novogratz, who is well known for his prominent Bitcoin plugs, told actress Maisie Williams not to hesitate in buying the cryptocurrency.

Novogratz on Bitcoin: Network effect has “taken over”

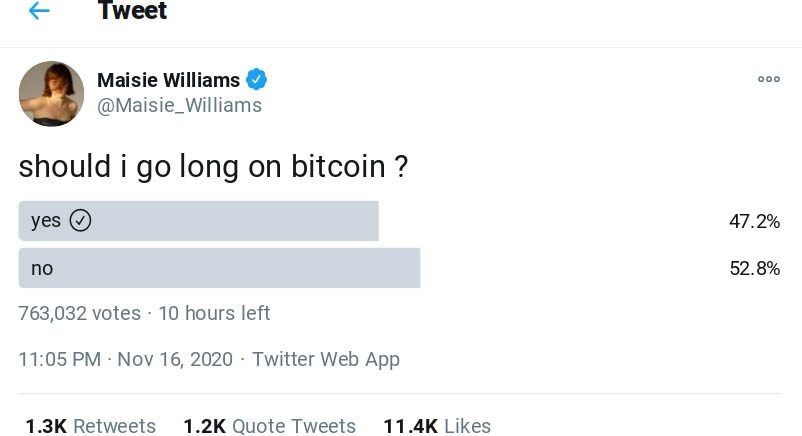

Williams had released a poll asking Twitter followers whether or not she should invest in BTC. At press time, the verdict was split, with 47% of the roughly 750,000 responses supporting an investment.

The poll soon caught the attention of famous Twitter users, among them Tesla CEO Elon Musk.

“I bought more BTC last night at 15,800. It’s going to 20K and (then) To 65K,” Novogratz commented.

“The network effect has taken over. I see tons of new buyers and there is very little supply. It’s an easier trade here (than) at 11K. So YES, buy it.”

Williams did not disclose what made her suddenly consider Bitcoin, with the publicity coming on the back of near 50% monthly gains for BTC/USD. At press time, the pair circled $16,700.

A low-key bull run

Other responses included podcast host Stephan Livera, Blockstream chief security officer Samson Mow, and Barry Silbert, CEO of investment fund giant Digital Currency Group. Silbert’s asset manager, Grayscale, is responsible for buying up increasingly large amounts of the Bitcoin supply, with its holdings passing 500,000 BTC ($8.37 billion) this week.

As Cointelegraph reported, Bitcoin’s recent rise has been noticeable for the lack of associated media attention it has received.

Despite being at levels not enjoyed by the token longer than two weeks in its history, Bitcoin has not yet sparked the same frenzy of publicity that accompanied its rise to $20,000 all-time highs in 2017.

Behind the scenes, however, institutions that were previously unlikely supporters are coming around to the idea of a future in which Bitcoin stars as a major investment asset. Among them was Citibank this week, which forecast a December 2021 Bitcoin price of up to $318,000.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.