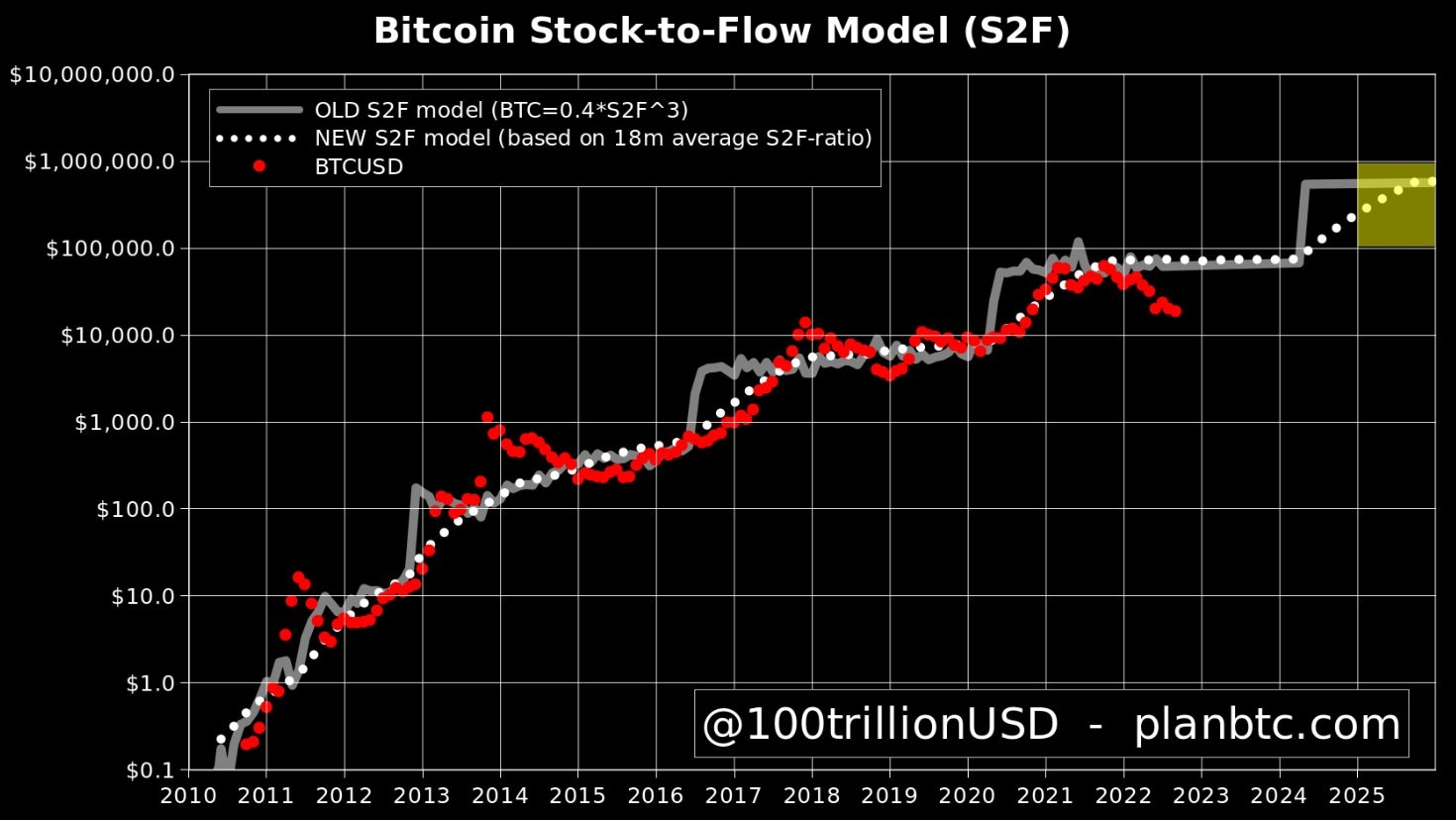

Bitcoin Price: Why Plan B predicts 5x rally in Bitcoin price using stock-to-flow model

- Creator of the Bitcoin stock-to-flow model believes Bitcoin price could rally to the wide $100,000 to $1 million range.

- Plan B argues that Bitcoin price is ready for 5x growth based on the stock-to-flow model projections.

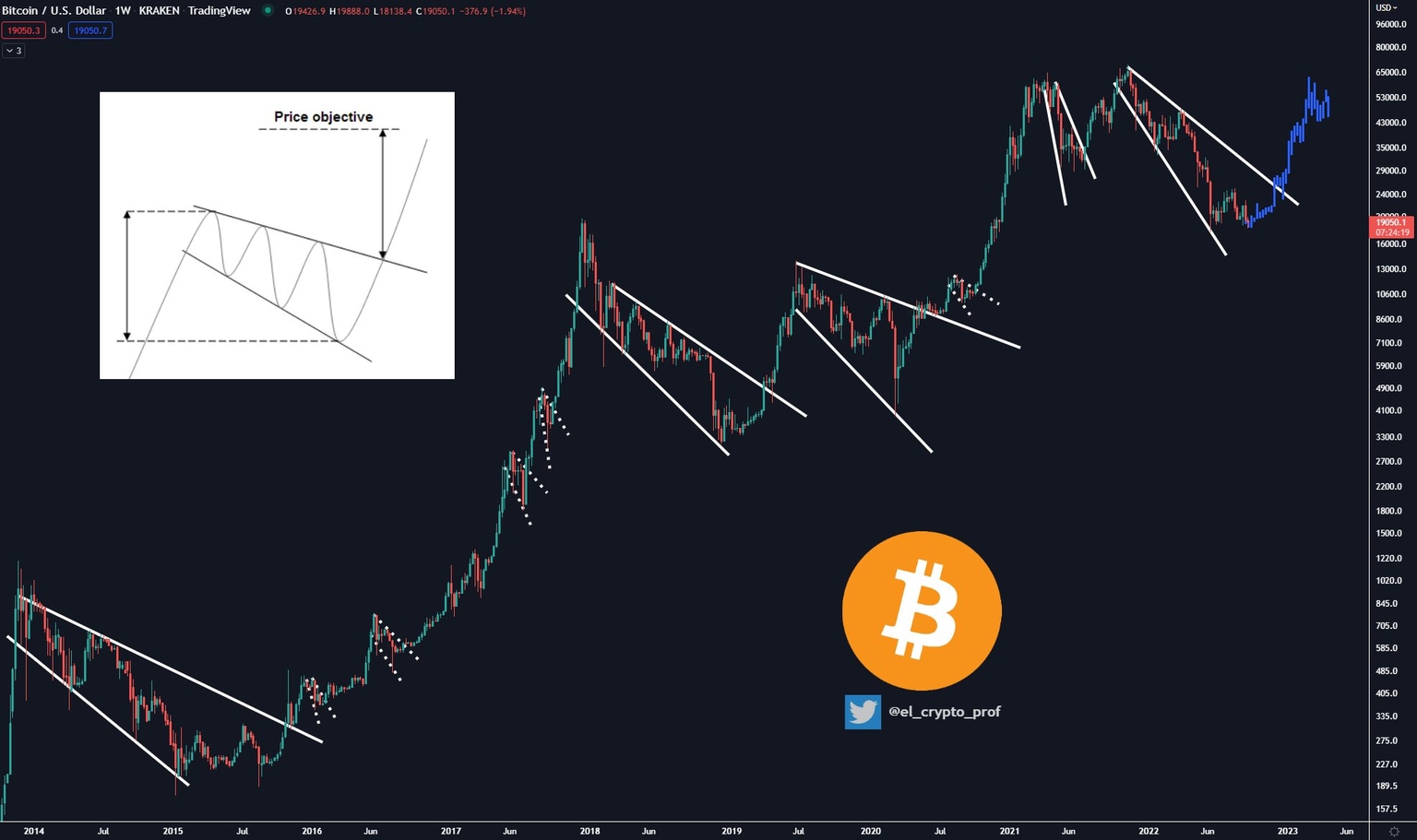

- Analysts identify a descending broadening wedge in Bitcoin price chart and reveal bullish outlook on BTC.

Creator of Bitcoin’s stock-to-flow (S2F) model believes BTC price has the potential to grow 5x despite the bearish outlook. The analyst backs his prediction through the S2F model that predicts the future price of Bitcoin based on its circulating supply relative to the number of BTC mined every year.

Also read: Bitcoin price: BTC struggles to stay afloat amid reverse currency war

Plan B’s stock-to-flow model predicts Bitcoin price has potential for 5x

The idea of the Bitcoin stock-to-flow model was introduced by creator Plan B, a pseudonymous investor with over two decades of experience in quantitative finance. The S2F model gained popularity in March 2019 after its publication. S2F is considered a widely accepted method for predicting Bitcoin price based on its scarcity. The underlying idea is scarcity drives Bitcoin’s price higher. Therefore, quantifying scarcity can help predict the Bitcoin price.

Plan B’s stock-to-flow model predicts the future price of Bitcoin based on its circulating supply relative to the amount of coins mined each year. The number of coins mined decreases by 50% each four years through a mechanism known as “halving.” This plays a key role in Bitcoin’s rally, according to the S2F model.

In a recent tweet, Plan B included new data to improve the 2019 Bitcoin S2F model and represented it through a white dotted line. Plan B has set a bullish target of the $100,000 to $1 million range for Bitcoin and asks users to read it as "BTC will increase at least 5x".

Bitcoin stock-to-flow model (S2F)

Analysts defend bullish outlook on Bitcoin, set $68,000 target

Despite bearish market conditions and predictions, Crypto Prof, a pseudonymous analyst and trader, has set a $68,000 target for Bitcoin price through the Elliott Wave Theory. The analyst believes Bitcoin price has a good chance of returning to Wave B ($68,000) in the next few months as it did in the last two cycles.

Crypto Prof also predicts that the Bitcoin bottom is an indicator of the upcoming rally in the asset.

Bitcoin-USD price chart

Descending Broadening Wedge (DBW) is a bullish chart pattern, considered a reversal pattern, formed by two diverging bullish lines. A Descending Broadening Wedge is confirmed if it has good oscillation between two upward lines.

Crypto Prof recently identified a DBW in the Bitcoin price chart.

Bitcoin-USD price chart 2013-2022

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.