- Bitcoin price remains trading above $19,000, awaiting a clear breakout or breakdown.

- Several on-chain metrics suggest Bitcoin is poised for a big move above $20,000.

Bitcoin has been trading inside a tight range between $18,500 and $20,000 for the past week, trying to create a clear breakout or breakdown. It seems that many on-chain metrics are in favor of Bitcoin price, while patient investors still wait for a potential 30% correction.

Bitcoin price eying up to $20,000 as the next price target

According to recent statistics from Glassnode, it seems that around 10% of Bitcoin’s total supply was moved at a price of $18,000 or higher. This indicates that investors are interested in the digital asset even at a price of $18,000 or above.

Around 10% of the #Bitcoin supply was moved at a price above $18,000.

— glassnode (@glassnode) December 6, 2020

Many investors are valuing BTC above this level, which may indicate their conviction for further $BTC price appreciation.

In contrast: In 2017 at ATH this number was only 2%.

Chart: https://t.co/jrq9kjut6j pic.twitter.com/IdDizGNtxK

Most importantly, during the bull rally in 2017 when Bitcoin hit its all-time high, this number was only 2%, which is a significant difference. Additionally, Jarvis Labs, an artificial intelligence system that analyzes network statistics, notes that the miner reserves have started going sideways during this bull rally.

1/3 Bitcoin Miner Reserve Thread

— JarvisLabs (@Jarvis_Labs_LLC) December 7, 2020

In 2018, the miner reserves started declining. The BCH hard fork in November led to the capitulation of many small miners and also led to a 50% price drop on BTC and a larger drop on ETH. pic.twitter.com/B8AXnG28Za

Apparently, back in 2019, the same trend was observed, which led to Bitcoin price jumping from $4,000 to $14,000. At the same time, popular and prominent investors like Kevin O’Leary state that an SEC-approved Bitcoin ETF would be exciting.

The star of the popular TV show, Shark Tank, has recently stated that he is ready to put around 5% of his investment portfolio in a Bitcoin ETF approved by the SEC. Billionaire Hedge Fund Manager Paul Tudor Jones has said that Bitcoin’s total market capitalization should grow beyond $500 billion in the near term, adding:

Bitcoin reminds me so much of the internet stocks of 1999 because the internet was in its infancy. No one knew how to value it because of the world of possibilities that lay ahead.

Bitcoin price analysis: Key levels to watch out for

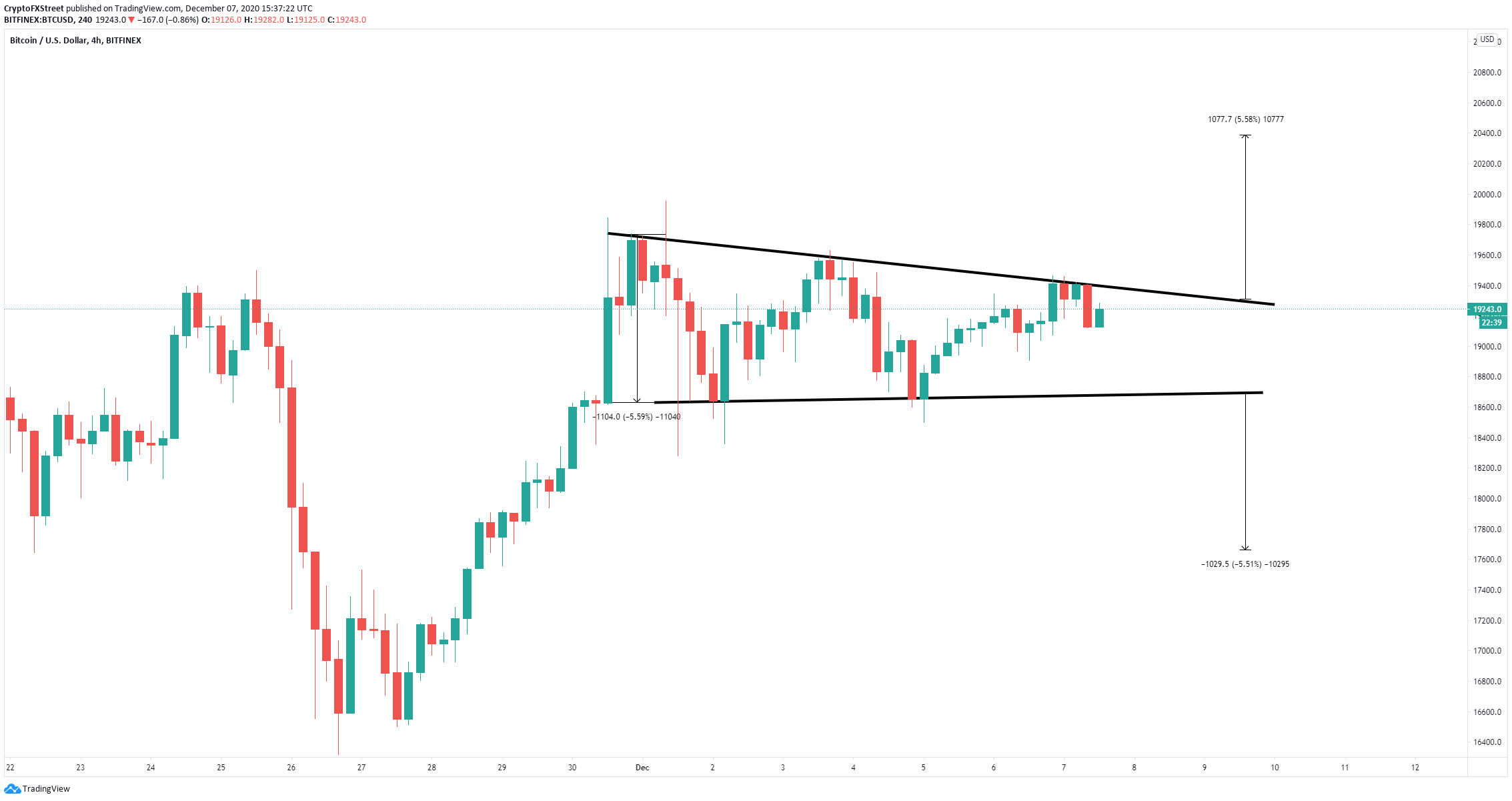

On a shorter time-frame, like the 4-hour chart, Bitcoin price has established a descending triangle pattern, which still has a lot of room to expand. A breakout above the upper trendline would currently push BTC towards $20,400, setting a new all-time high.

BTC/USD 4-hour chart

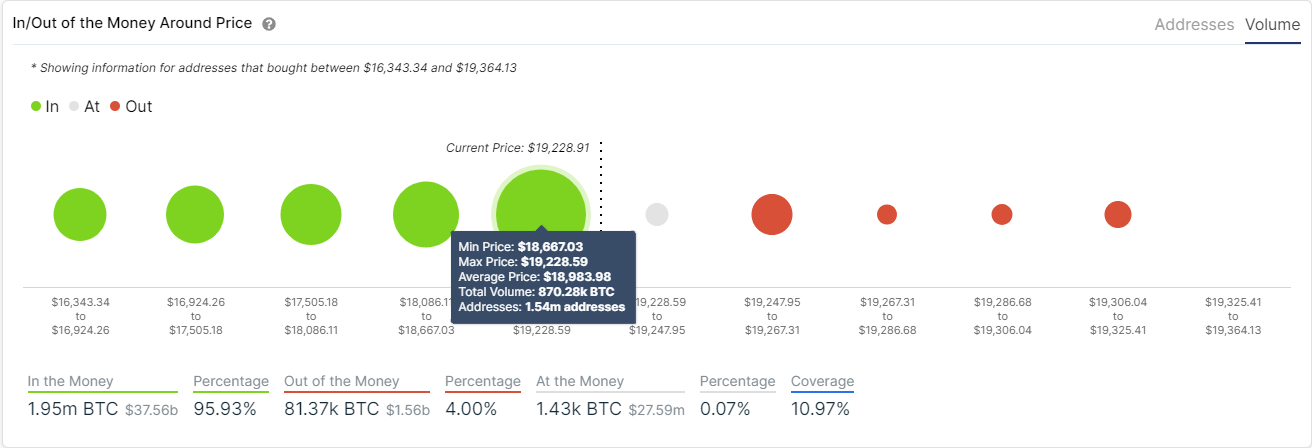

It’s also important to note that the In/Out of the Money Around Price (IOMAP) chart shows practically no resistance to the upside and a robust support area between $18,667 and $19,228, where 1.54 million addresses purchased 870,280 BTC.

BTC IOMAP chart

However, despite the many bullish metrics in favor of Bitcoin, a bearish breakdown below the lower boundary of the pattern at $18,674 would lead Bitcoin price towards $17,600. This theory seems to coincide with the one posted by Whalemap on Twitter.

Here is what we are working with.

— whalemap (@whale_map) December 7, 2020

$18,979 is a big level. If it doesnt hold, $17,651 is our next support with possible wicks down to $17,170.

You can view the bubbles for yourself at https://t.co/i190UjTGCE pic.twitter.com/60IA4IWHLu

Whalemap is a Twitter account that focuses on on-chain metrics and notes that $18,979 is a big level in the short-term. The next support point would be located at $17,651, which coincides with the price target in case of a breakdown of the descending triangle pattern.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.