- Bitcoin price is struggling to stay above $26,500 at the moment as the bearishness continues to persist.

- The risk of investing in BTC is at a low right now, making rewards all the more tempting.

- HODLing is currently the primary market dynamic as investors remain focused on making profits once recovery begins.

Bitcoin price has not been able to bounce back from the crash witnessed at the beginning of the month. The impact on investors, surprisingly, has not been as significant since their behavior has not changed much since the end of March. This suggests that the next trigger for profit-taking won't arrive until BTC actually notes a bankable rally.

Bitcoin price leaves investors HODLing

Bitcoin price is currently trading at $26,844, consolidating between $27,500 and $26,500 for more than ten days now. The decline noted on the charts since mid-April has dragged BTC down from $30,500 to its current price. Interestingly this did not trigger excessive selling among investors, which is a positive sign.

BTC/USD 1-day chart

This confidence suggests that investors are willing to hold on to their assets as potential recovery will bring about profits.

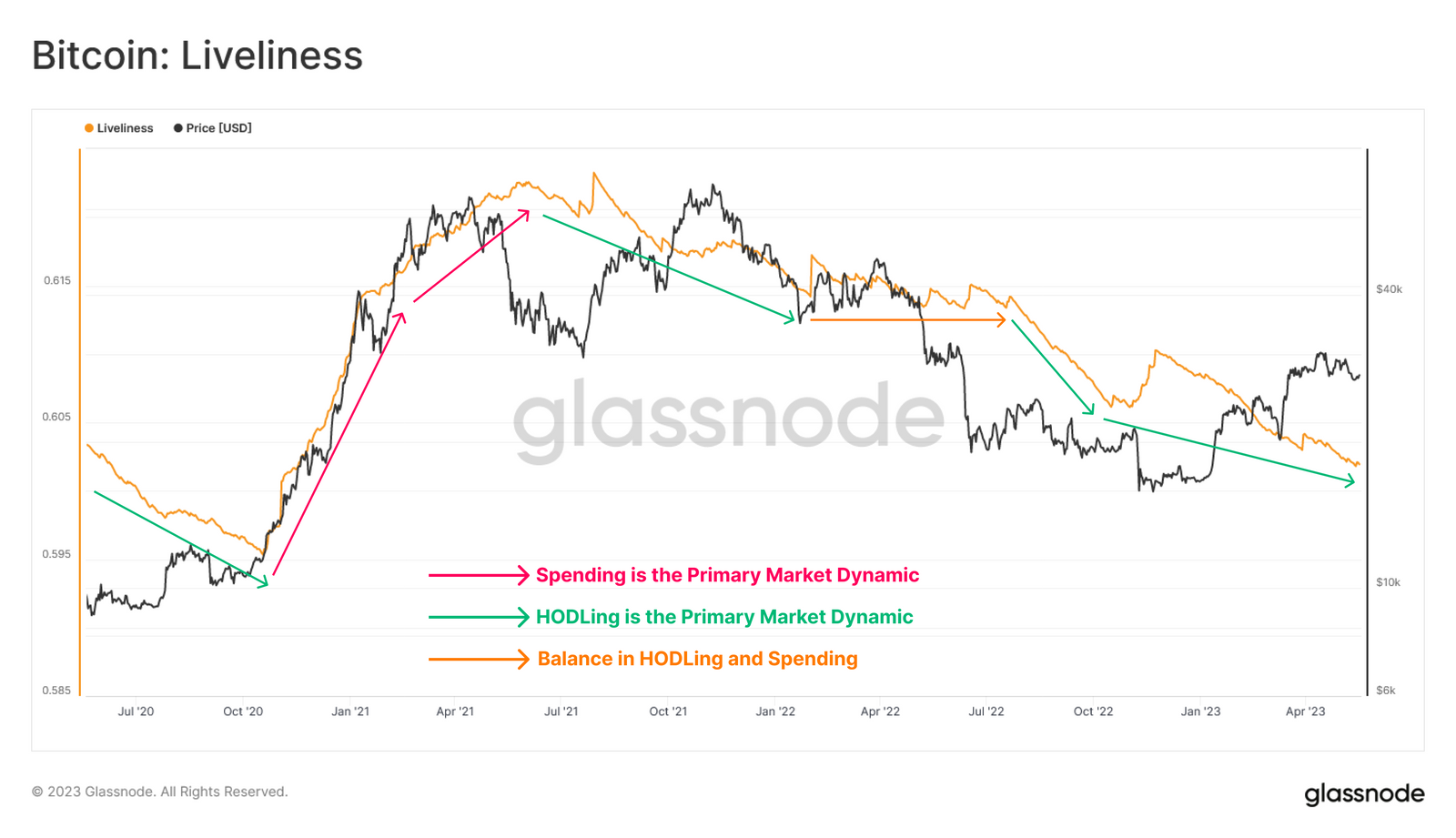

Although some bouts of selling have been observed in the market over the last few months, for the majority of the last 12 months, HODLing has been the primary market dynamic. This is visible in the decline in liveliness.

Bitcoin Liveliness

This sentiment grew stronger since the FTX collapse as the amount of BTC accrued in that duration is now maturing to a long-term holder status. For a coin to reach the LTH status, it must remain unmoved for a period of 155 days or more, which translates to a little over five months.

Bitcoin LTH supply

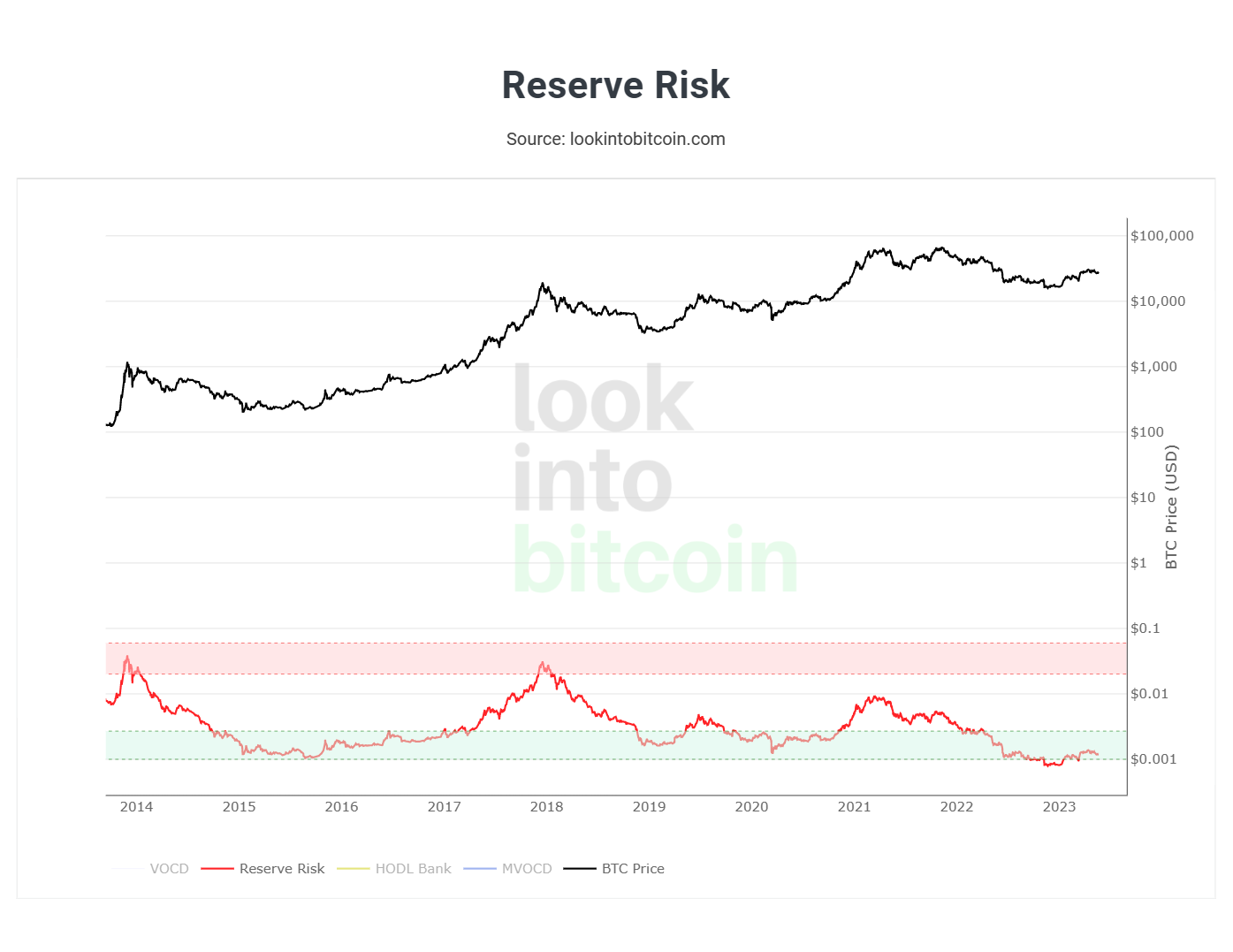

However, even after five months, the market has not changed much. While Bitcoin price has bounced back from lows of $20,000, it is still struggling to stay above $26,500. The optimism present in the market still makes accumulation the preferred stance to take, as is indicated by Reserve Risk (RR).

This indicator highlights the confidence of investors relative to the price action. A low RR is suggestive of high confidence and low risk, which translates to an attractive reward for investing in the asset. The indicator has been in this zone since last May when Bitcoin price was a little above $31,000.

Bitcoin Reverse Risk

Thus at least until this level is breached and flipped into a support floor once again, accumulation is the way to go. Declining macroeconomic conditions are also a contributing factor to the price action, making BTC capable of recovery soon.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.