- Bitcoin attempted to move above $9,000 but failed.

- Altcoins drove the market higher with Bitcoin SV being a growth leader once again.

- The long-term Bitcoin trend remains bullish at this stage.

Bitcoin (BTC) has been range-bound for the best part of the week. The first digital coin kept calm even though altcoins moved higher underpinned by positive fundamental developments. However, Thursday and Friday injected some excitement into Bitcoin trading as the coin touched the area above $9,000 for the first time since May 2018 and crashed to $8,000 in a matter of hours amid speculative positioning and profit-taking. Despite wild all thous wild gyrations, Bitcoin managed to stay in the green zone. At the time of writing, BTC/USD is changing hands at $8,400. The coin has lost 3.5% in recent 24 hours and gained over 5% in recent seven days.

What's going on in the crypto universe

It's been stirring times for altcoins. Many projects, including IOTA, NEO, Tezos and EOS, announced the upcoming updates or shared their plans and roadmap, creating positive buzz and beneficial environment for price growth. Traders and investors are usually encouraged by the news that the projects are moving forward, working on improvements and dealing with issues. No wonder, that IOTA, NEO and EOS are among the best performing cryptocurrencies on a weekly basis.

IOTA moves towards decentralization with Coordicide solution

NEO gets ready for a significant update

However, the craziest things happened to Bitcoin SV. The coin that forked from Bitcoin Cash in November 2018 gained nearly 90% in recent seven days and topped at $254.00 on Thursday amid a combination of FOMO, fake news and wild price manipulations. Chinese media outlets published and re-published photoshopped screen from WeChat, saying that Binance was going to re-list BSV as Craig Wright proved his status as a Bitcoin creator. Even though the head of the cryptocurrency exchange denied the information, many Chinese investors jumped at the bait.

Moreover, as it turned out, Craig was not the only one who secured a copyright on Bitcoin whitepaper. A Chinese citizen Wei Liu did just the same. Presumably, this "Satoshi" wanted to bully Craig and demonstrate that the copyright actually does not prove anything.

Notably, following the news, Bitcoin SV flash crashed from $254 to $44 on Bitfinex and returned to $185 in a matter of hours, raising concerns about price manipulations.

Meanwhile, Bitcoin volatility hit the highest level since December 2018, meaning that the market has awakened from hibernation. At the same time, it is a signal to traders and investors that the prices might be a bit stretched. In a separate research, an analytical company Diar reported that Bitcoin whales hoarded coins worth of $36 billion. BTC/USD, 1D chart

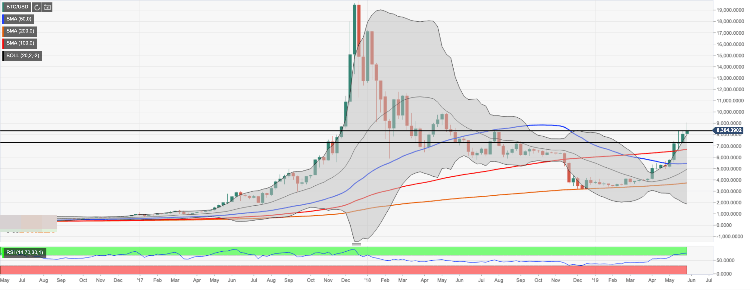

BTC/USD, 1-week chart

A brief spike above $9,000 was followed by a collapse to $8,000. However, this critical support, strengthened by the upper boundary of 1-week Bollinger Band and middle line of 1-day Bollinger Band, withstood an assault and served as a jumping-off place for recovery. At this stage, the price should return above $8,600 handle (middle line of 4-hour Bollinger Band) to bring $9,000 back into focus.

A sustainable move above this barrier looks unlikely in the short-term perspective, as a confluence of technical indicators located on approach will discourage bulls and trigger profit-taking on speculative longs. However, a sustainable move above this handle will set the bull's ball rolling fast.

On the downside, BTC/USD needs to stay above $8,000 to support the bull's case scenario. Once it is cleared, the sell-off is likely to gain traction with the next focus on $7,300 (the lower line of the previous consolidation channel) and $7,000 strengthened by the lower border of 1-day Bollinger Band and SMA200 (Simple Moving Average) on 4-hour chart.

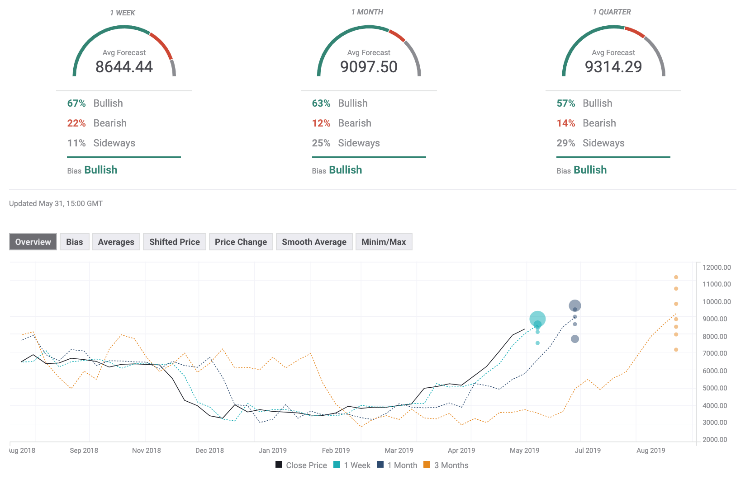

The Forecast Poll of experts improved since the previous week. Expectations on all timeframes remain bullish, while average price forecasts in 1 month and one quarter are above $9,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.