Bitcoin Price Outlook: Will BTC reclaim $70K despite Coinbase exchange being crash-prone?

- Bitcoin price tagged the $70K milestone on Coinbase, among other exchanges before a quick retraction.

- Coinbase exchange crashed for the third time as BTC skyrocketed to new highs.

- Community members call out the trading platform, citing manipulation.

Bitcoin (BTC) price is trying to take back the $70,000 milestone after a brief test on Friday. However, after a third series crash of Coinbase Exchange, a panic state spread across the market. Community members now say it is what is causing BTC not to extend higher.

Also Read: Bitcoin price clears previous ATH, tops out at $69,990 on Binance

Bitcoin retracts after Coinbase third-series crash in the month

Bitcoin (BTC) price tagged the $70,000 psychological level on Coinbase Exchange on Friday, only for a moment though before a quick retraction. The pioneer cryptocurrency also nicked $70,000 on BitMex Exchange and recorded an intra-day high of $70,154 on FXStreet’s charts against the US Dollar (USD). On Binance, BTC peaked at $69,990.

Among all trading platforms, however, Coinbase Exchange was the outlier as it crashed for the third time this month. The timing made an impression as it has happened everytime when Bitcoin price was attempting to record new peaks.

Do you think Coinbase is trying to

— Ash Crypto (@Ashcryptoreal) March 8, 2024

Manipulate the Bitcoin price ?

Last 3 times when Bitcoin have came

close to new all time high, Coinbase

crashed all the 3 times.

For some, the crash was not a surprise, given Coinbase’s track record of going offline during instances of exponential trading volume. For others, however, the crash appears to be calculated, intended to benefit its wealthy clientele.

you dont front-run a wealthy investor, they will fud and manipulate that investment into a major correction then slip in thru the back door - notice how coinbase acts near that high price? your wallets suddenly go empty while rich clients get to buy or sell $velo veloprotocol

— Dave (@TruckerDave89) March 8, 2024

One user, going by @BritishHodl on X, alleges a proper chronology of events wherein Coinbase waits for the market to rally up to a point where OTC dealers run out of BTC, then they “shut down the engine.” The result is panic among retail traders, causing trading algorithms to start dumping, which causes OTC desks to become flush again. At this point, “Coinbase turns back on the engine and allows BlackRock, Fidelity and the big boys to buy up all that Bitcoin.”

Even Eric Balchunas, a specialist from Bloomberg Intelligence focusing on exchange-traded funds (ETFs) has remarked on the series of crashes, questioning the impact on ETFs as he wonders how such a rich, technology-oriented company crashes with such frequency.

Bitwise CIO Matt Hougan, who recently lauded BTC investors for “steadfast optimism and confidence,” says that while the series of crashes is a bad look, it does not change business for Coinbase.

…users care about uptime, but average users do not. Most users are average users.

Nevertheless, Hougan observes that the crash only affects retail because custody, which serves institutional players, is unaffected.

Moreover, most ETFs trade through multiple OTC counterparties that tap into global liquidity, and there is plenty of liquidity in non-Coinbase platforms.

According to the Bitwise executive, the thing to watch is how these crashes will impact the reputation of Coinbase, its heft as the largest US-based crypto exchange notwithstanding.

It's a bad look for sure. But will it change anything for their business? On an immediate basis, I doubt it. Coinbase crashed all the time in past bull markets, yet it still grew like crazy.

— Matt Hougan (@Matt_Hougan) March 8, 2024

That's actually a theme through internet history. Facebook crashed all the time; it…

Bitcoin price outlook as crypto community calls out Coinbase after third crash

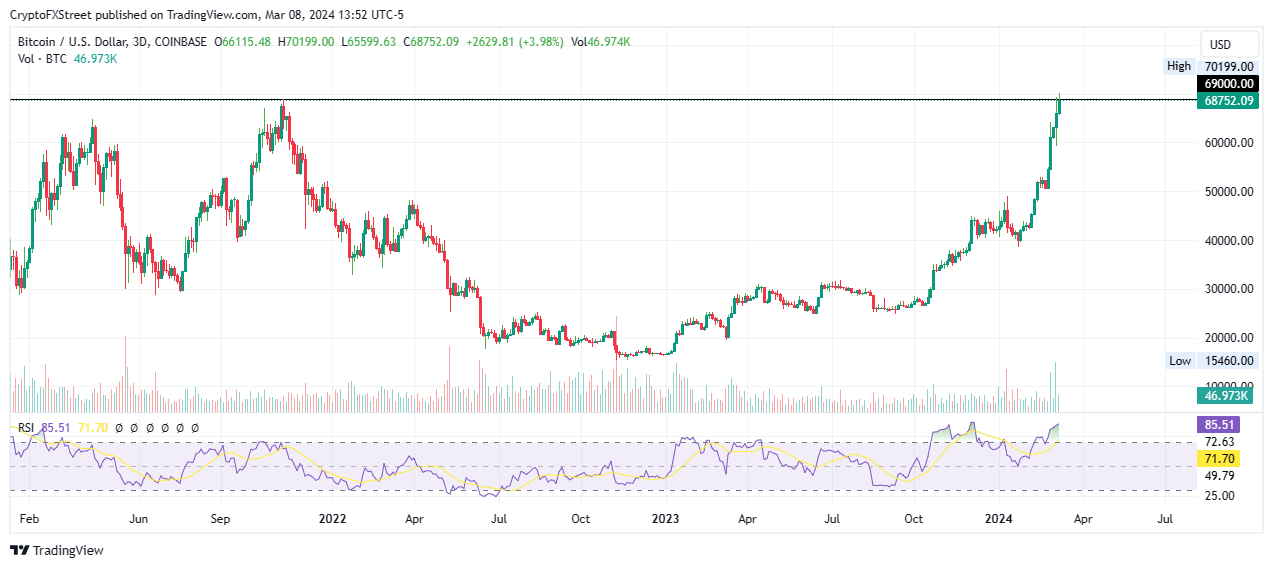

Bitcoin price is confronting resistance due to the $69,000 threshold, a level last tested on March 5 when BTC recorded a peak of $69,324. Despite the quick rejection from $70,000, the upside potential remains viable with BTC price pushing against the roadblock.

Momentum continues to rise, seen with the ascending Relative Strength Index (RSI), accentuated by the growing histogram bars of the volume indicator. This points to a trend that is only gaining strength. Increased buying pressure could see Bitcoin price revisit the $70,000 threshold. A decisive move above this level would pave way for extended gains.

BTC/USDT 1-day chart

On the other hand, profit-taking could see Bitcoin price drop toward the $60,000 psychological level.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.