A bounce off $11,500 saves investors from serious pain but $12,000 remains a problematic level to flip to support.

Bitcoin (BTC) dropped several hundred dollars in seconds on Aug. 10 as $12,000 once more proved too hot to handle.

Cryptocurrency market daily snapshot Aug. 6. Source: Coin360

BTC price finds new focus at $11,700

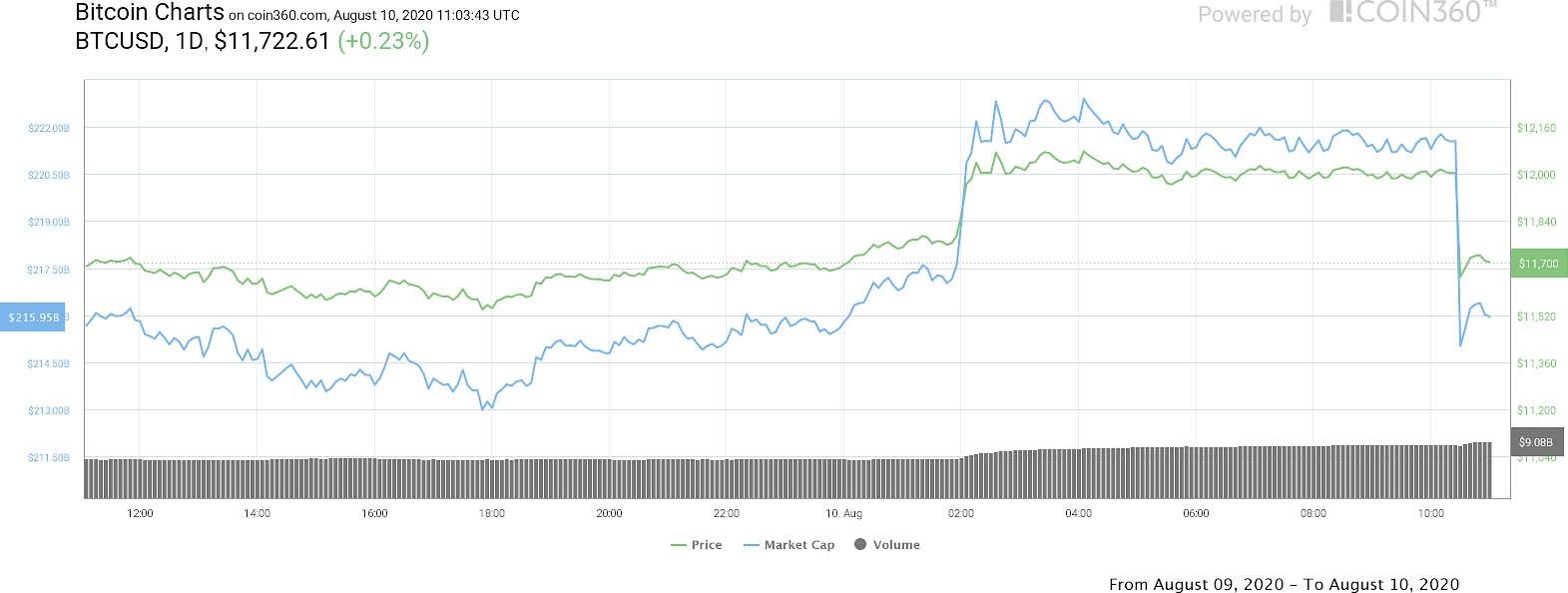

Data from Cointelegraph Markets and Coin360 showed BTC/USD nosedive 4% during Monday trading, bouncing off $11,500 and since returning to $11,700.

In doing so, Bitcoin neatly filled the latest gap in CME Group’s Bitcoin futures markets, which lay just below $11,700.

BTC/USD 1-day price chart. Source: Coin360

A classic move, Cointelegraph predicted on the day that markets would likely attempt to go lower on short timeframes to fill the gap, in line with standard behavior.

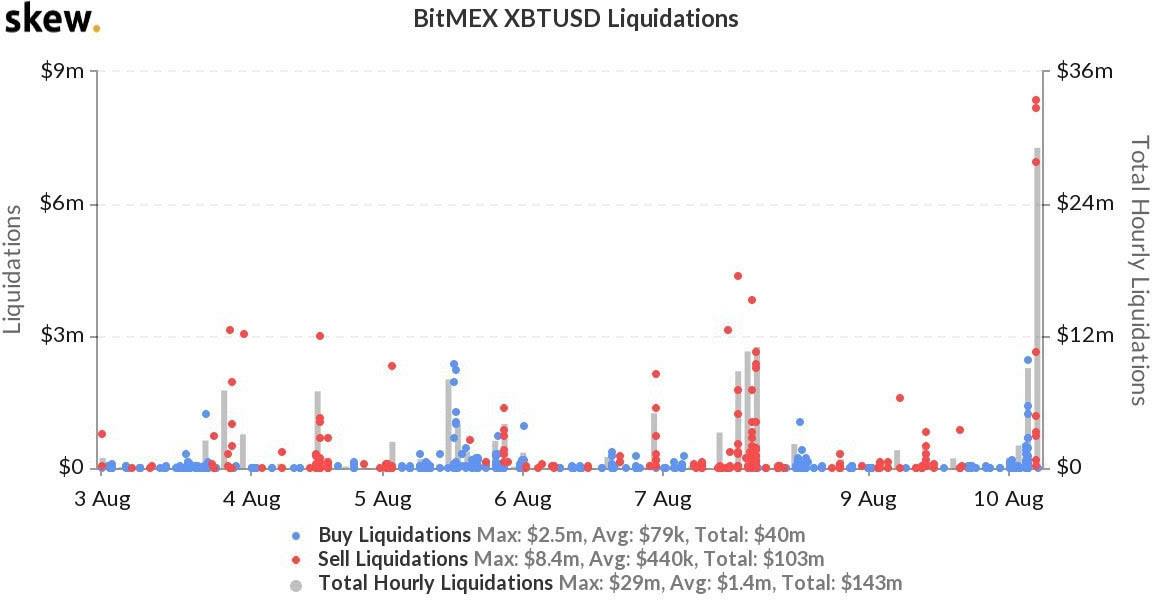

The event caused a dramatic spike in liquidations on derivatives giant BitMEX, data from monitoring resource Skew confirms.

BTC/USD liquidations on BitMEX. Source: Skew

Analyst: $13,000 will follow a $12,000 breakout

For Cointelegraph Markets analyst Michaël van de Poppe, the sudden dip suggested that Bitcoin was returning to the pattern of behavior seen in recent months.

“Smaller timeframe chart explaining what just happened. Essentially, we're back into the ranging gameplan,” he told Twitter followers.

“Ranging” within a certain price corridor has become a feature of BTC/USD in 2020, with recent gains upending a protracted period, which slowly narrowed to point — a process known as compression.

Going forward, lower levels could see a retest, with significant support just above $10,000 still apt to form the price floor, Van de Poppe thinks.

“Larger timeframe; still expecting such a scenario,” he continued.

“If we break $12K however, I assume we'll see $13k.”

Attention will thus now focus on bulls’ ability to cement $12,000 as a support zone, something which has yet to occur on any meaningful level for Bitcoin.

Nonetheless, the latest weekly close marked the highest since January 2018 and the initial fall from Bitcoin’s all-time highs of $20,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.