- Bitcoin price is currently susceptible to further decline unless broader market cues turn bullish.

- BTC and NASDAQ now share a negative correlation of -0.44.

- NASDAQ managed to mark a 13-month high on June 1.

Bitcoin price has had a pretty good run since the beginning of the year despite its ups and downs, but one of the most notable achievements was its decoupling from the stock markets. Although BTC initially experienced benefits from this, the past few days may seem to hold a contrary viewpoint.

NASDAQ overtakes Bitcoin price

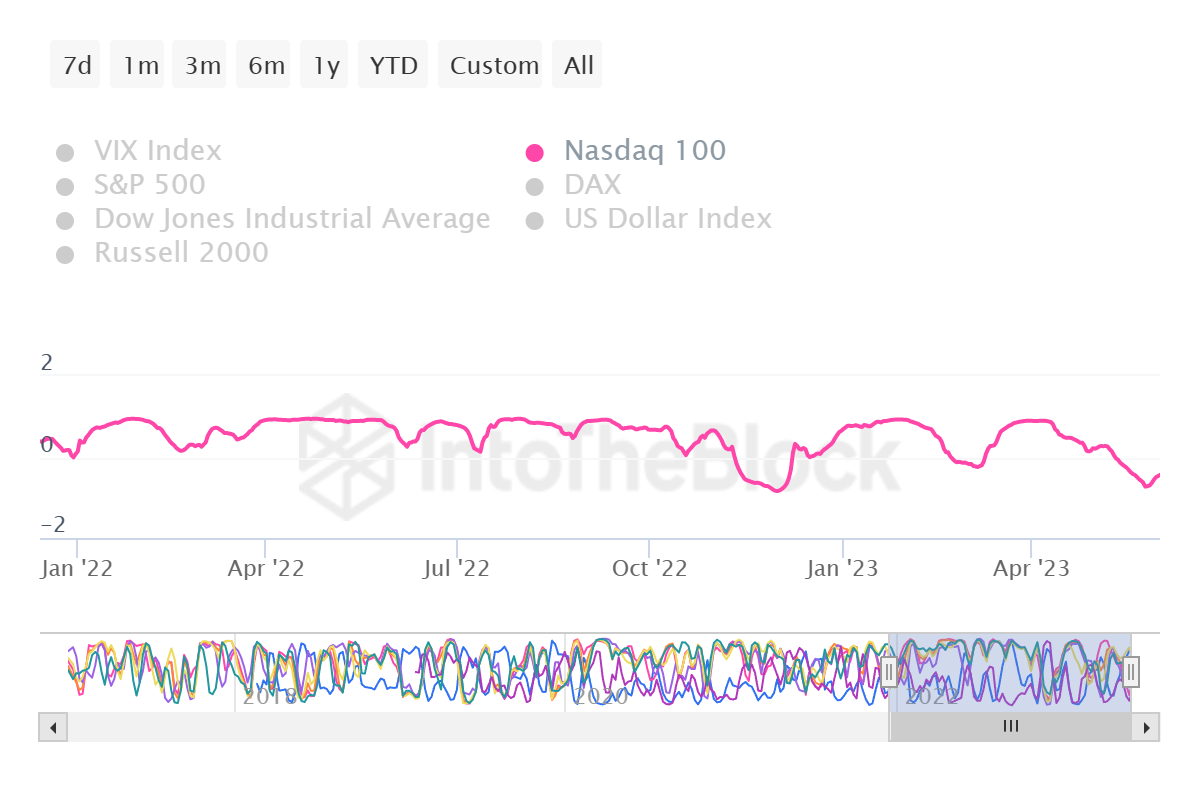

The stock market towards the end of 2022 observed heavy bearishness in the market, but Bitcoin price and the rest of the crypto market failed to realize a similar decline. This was the first sign of decoupling, which towards mid-April, turned negative. Since then, the two markets have shared a negative correlation, currently at -0.44.

Bitcoin - NASDAQ correlation

Despite the concerns surrounding the debt ceiling last month, NASDAQ (NDX) has been observing an uptick. Come June 1, the stock market has grown by nearly 12%, in part mostly due to Nvidia. The chipmaker’s stock NVDA soared in value in the last couple of days, with the company’s market capitalization even hitting $1 trillion.

On the other hand, while the debt ceiling was raised, and the stock market seemed bullish at the time of writing, Bitcoin price did not follow suit. BTC investors and the broader market bearishness have increasingly undone a part of the March rally, which managed to pull Bitcoin price back up from $20,000 to $30,900 by mid-April.

But the decline since then has not only wiped out profits for a lot of the investors in the digital asset market but also pushed Bitcoin price down below $27,000. Trading at $26,730 at the time of writing, BTC is observing increasing uncertainty.

At the same time, NASDAQ has hit its highest point in the last 13 months. The last time NDX registered a closing level at the 14,441 points mark was back in April 2022. Thus while BTC kept slipping on the charts, the stock market index managed to note short-term records.

NASDAQ 1-day chart

This is explained by the negative correlation, which showcases the current conditions of both markets. As BTC continues to attempt a recovery to climb above $30,000, it will find a barrier at the $28,745 mark, which has been a multiple times tested support as well as a resistance level. Flipping it into a support floor would enable a further rise.

BTC/USD 1-day chart

But if the breach is rejected and the cryptocurrency declines and loses the support of the 100-day Exponential Moving Average (EMA), it could end up testing the critical support. Coinciding with the 200-day EMA, this level is marked at $25,113, and a drop below it would invalidate the bullish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resignation

Bitcoin edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Fed Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

Injective Price Prediction: INJ 3.0 upgrade reduces the token supply

Injective price extends its gains for the seventh day in a row, trading above $26 on Tuesday after rallying more than 25% the previous week. The announcement of the INJ 3.0 upgrade on Sunday, which focuses on significantly decreasing the token supply, could further fuel the ongoing rally.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% in the previous week. On-chain data paints a bullish picture as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Ripple's XRP eyes rally to new all-time high after 40% spike in open interest

XRP open interest surged by 40% in the past 24 hours. Buying pressure across exchanges and investment products helped XRP to maintain a bullish outlook. XRP could be on the verge of a massive breakout after testing the resistance of a bullish pennant.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.