Bitcoin price spikes to $42,000 in response to November US CPI data release

- Bitcoin holders are likely to experience relief as inflation in the US declines to 3.1% in accordance with market expectations.

- BTC climbed to $42,069 briefly as the November CPI print came within market expectations.

- Bitcoin price trend likely to remain unchanged ahead of the FOMC meeting scheduled for Wednesday.

Market participants de-risked ahead of the November US Consumer Price Index (CPI) print and Federal Open Market Committee (FOMC) meeting, as Bitcoin (BTC) price declined 5% since Monday. BTC continues to consolidate after a bounce from $40,222 on Tuesday.

Bitcoin price briefly rallied to $42,069 in response to the November US CPI data release. Inflation rate in the US was 3.1% in November, as expected by market participants.

US CPI November release and Bitcoin price reaction

The annual Core CPI inflation, excluding volatile food and energy prices, came at 4%, as expected and on a monthly basis, the CPI and the Core CPI climbed 0.1% and 0.3%, respectively. The CPI release brings relief to Bitcoin holders after the recent pullback in BTC price, ahead of key macroeconomic events.

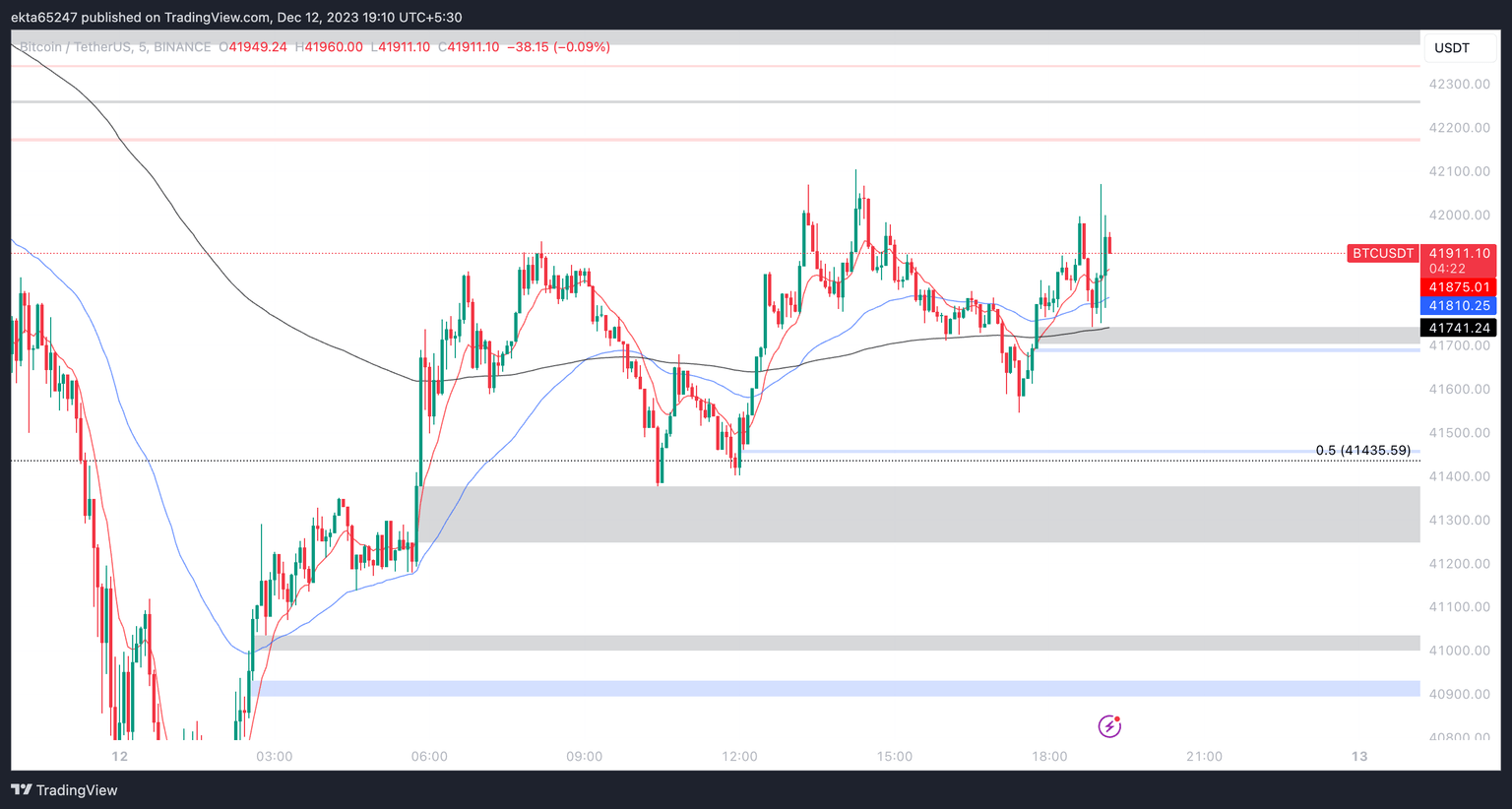

At the time of writing, Bitcoin price is $41,949, the asset is trading sideways below the $42,000 level.

BTC/USDT 5-minute chart

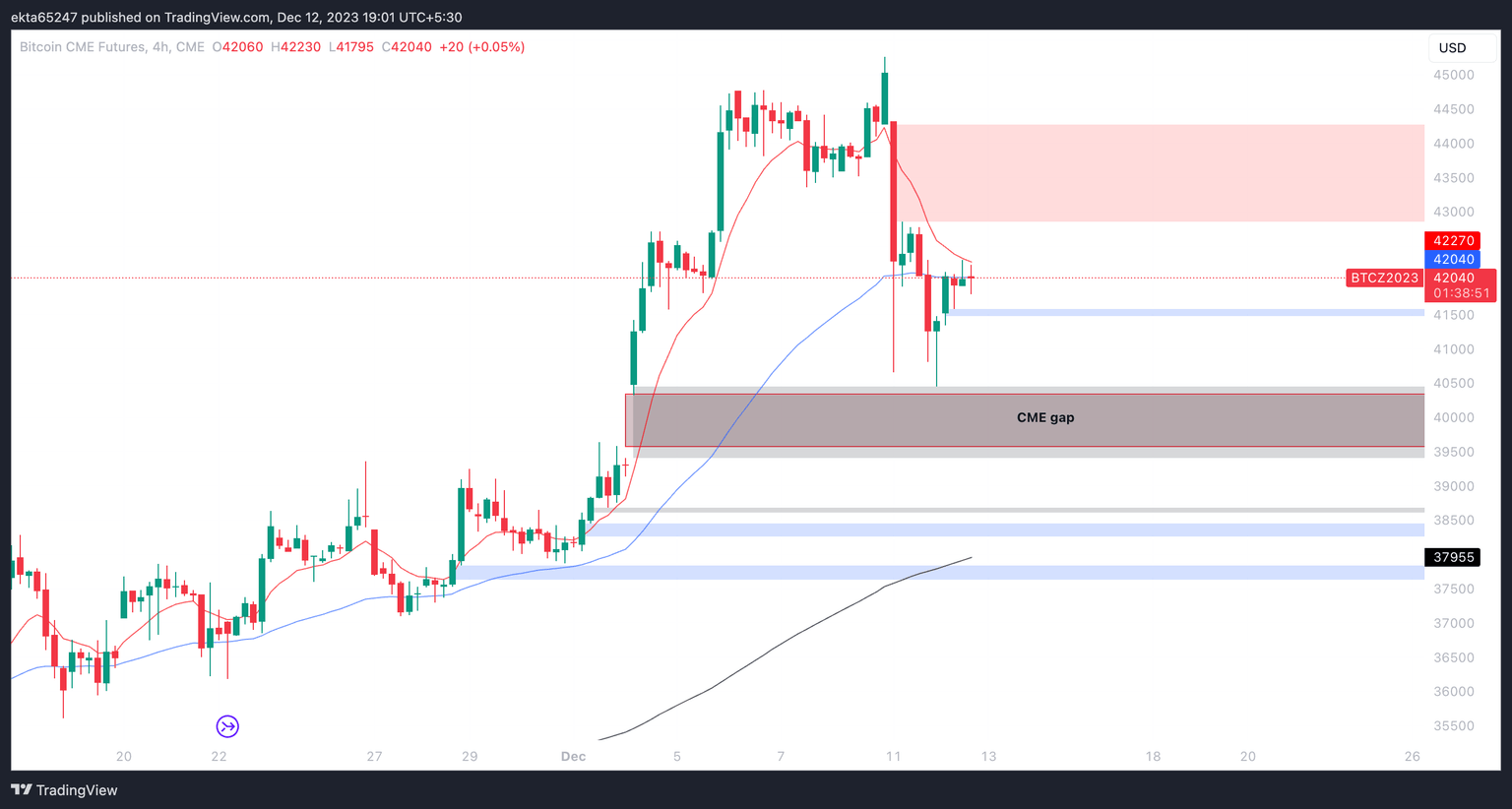

With the FOMC meeting scheduled for Wednesday, Bitcoin is likely to experience heightened volatility. Key Bitcoin price levels to watch are the upper and lower boundary of the CME gap, where liquidations are also present, at $40,335 and $39,580. Bitcoin price could visit the CME gap in the event of further decline.

BTC CME futures 4-hour chart

BTC liquidation levels heatmap. Source:hyblockcapital.com

Crypto investor and analyst Axel Bitblaze, behind the X (formerly Twitter) handle @Axel_bitblaze69, believes the recent decline in Bitcoin and altcoin prices is likely short-lived. The dips in crypto prices are likely to be bought up soon since macroeconomic events are lined up this week.

In my opinion, any dips in most of the coins will be quickly bought up soon.

— Axel Bitblaze (@Axel_bitblaze69) December 11, 2023

There are several significant events happening this week, which may explain why we're seeing some dips across the board.

• CPI tomorrow

• FOMC on Wednesday

bottom tomorrow & a bounce thereafter..

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.