Bitcoin price dips to a low of $65,600 as weekend volatility creeps in

- Bitcoin price dropped below the $70,000 threshold, bottoming out at $65,600 on Friday.

- El Salvador’s President Nayib Bukele says a big chunk of the country’s BTC holdings have been moved to a cold wallet.

- MicroStrategy has announced pricing for its convertible senior notes, users decry unfriendly terms relative to MSTR.

Bitcoin (BTC) price plummeted during the early hours of the New York session, recording an intra-day low of $65,600. The effects of the crash spread across the market with most altcoins flashing red.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Also Read: Bitcoin Weekly Forecast: Can BTC hit $100,000 without a correction?

Bitcoin provokes market crash after MicroStrategy, El Salvador news

Bitcoin (BTC) price has recorded an intraday low of $65,600 on Friday, and despite recovery efforts, it is likely to close the week in the red.

It comes after reports by Nayib Bukele, the second-term president of El Salvador, that the country has moved a big chunk of its BTC portfolio to cold wallet storage to be stored in a physical vault within the country.

We've decided to transfer a big chunk of our #Bitcoin to a cold wallet, and store that cold wallet in a physical vault within our national territory.

— Nayib Bukele (@nayibbukele) March 14, 2024

You can call it our first #Bitcoin piggy bank

It's not much, but it's honest work pic.twitter.com/dqzedykxT1

Referring to it as the country’s first “piggy bank”, the move is bullish as it communicates intention to hodl. For the layperson, when holders move their assets to exchanges, it normally suggests they plan to sell, influencing bearish pressure.

El Salvador’s preference for cold storage depicts:

- Plans for long-term holding,

- Pursuit for the added layer of protection against potential security breaches on online platforms

- A long-term investment strategy as opposed to short-term trading

- Confidence in the long-term value of the assets, aligning with a bullish sentiment

- Responsible management as well as commitment to safeguard the country’s wealth

Notably, while this move may not directly influence the current market trend, it suggests a bullish sentiment toward BTC.

Elsewhere, MicroStrategy CEO Michael Saylor has reported that the firm has announced the pricing of a further offering of convertible senior notes.

MicroStrategy Announces Pricing of Offering of Convertible Senior Notes $MSTR https://t.co/sArDcspn26

— Michael Saylor⚡️ (@saylor) March 15, 2024

Key takeaways from the pricing model are that:

- The offering was upsized from the previously announced offering of $500 million to $525 million.

- Notes will bear interest at a rate of 0.875% per annum.

- The conversion rate for the notes will initially be 0.4297 shares of MicroStrategy class A common stock per $1,000 principal amount of notes. This is equivalent to an initial conversion price of approximately $2,327.21 per share.

- Estimated net proceeds from the sale of the notes will be approximately $515 million.

- Net proceeds from the sale of the notes will be used to acquire additional Bitcoin and for general corporate purposes.

One community member has decried the offering, saying, “Impossible for me to get a loan on those terms,” adding that MicroStrategy’s (MSTR) stock was a better alternative.

Notably, the report from Saylor has not impacted the market, suggesting that it was already priced in on March 5, when the senior notes offering proposal was first made public.

Bitcoin price outlook as BTC closes week in red

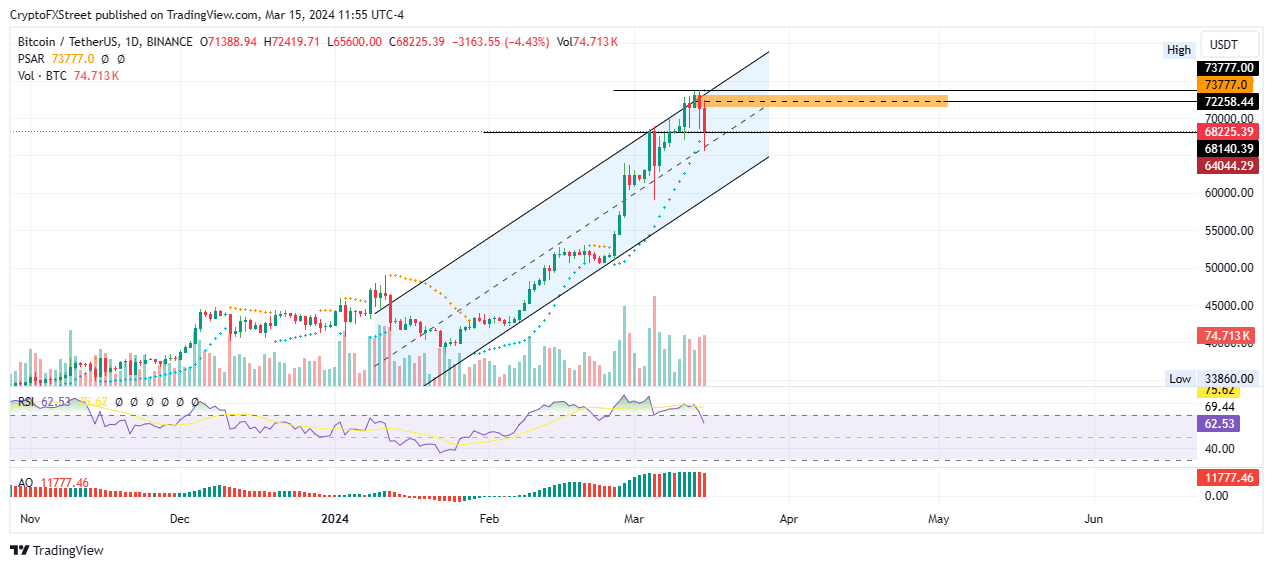

Bitcoin price remains within the ascending parallel channel, sustaining above the midline of the technical formation. While the bullish outlook is still intact, it is threatened as Bitcoin price slipped below the $70,000 threshold.

The Relative Strength Index (RSI) is nose-diving pointing to falling momentum, accentuated by the red histogram bars of the Awesome Oscillator (AO). If the bears have their way, Bitcoin price could extend the fall past the $65,000 milestone, or in a dire case, tag the $60,000 psychological level.

The maximum pain scenario would entail Bitcoin price sliding lower and dipping into the weekly imbalance stretching between $53,120 and $59,111 before a possible leg north.

BTC/USDT 1-day chart

However, if BTC die-hards look at the dip as a buying opportunity and buy the correction, the ensuing buying pressure could propel Bitcoin price north, potentially seeing it reclaim above $70,000.

Enhanced buyer momentum beyond the psychological level could see BTC reclaim the $73,777 peak, or in a highly bullish case, extend a neck higher to tag the $80,000 milestone. Such a move would denote an 18% move above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.