Bitcoin (BTC) extended its price drop on Wednesday amid warnings that excessive long positions needed to be flushed out to allow for fresh gains.

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

BTC price barely clings to $56,000 support

Cointelegraph Markets Pro and TradingView showed BTC/USD hitting new local lows of $55,760 during Wednesday trading.

A second day of more substantial losses for the pair came as altcoins also began to reverse their earlier successes, with Ether (ETH) dropping below $2,000.

A look at trader behavior pointed to leveraged long positions in place at previous spot price, indicating belief that further upside is more likely than another correction. These positions, analyst Filbfilb believes, need to be liquidated before Bitcoin can make a meaningful attempt at new all-time highs.

The latest price action went some way to refreshing market composition — $2 billion in liquidations in the past 24 hours, $600 million of which in a single hour alone, according to data from monitoring resource Bybt.

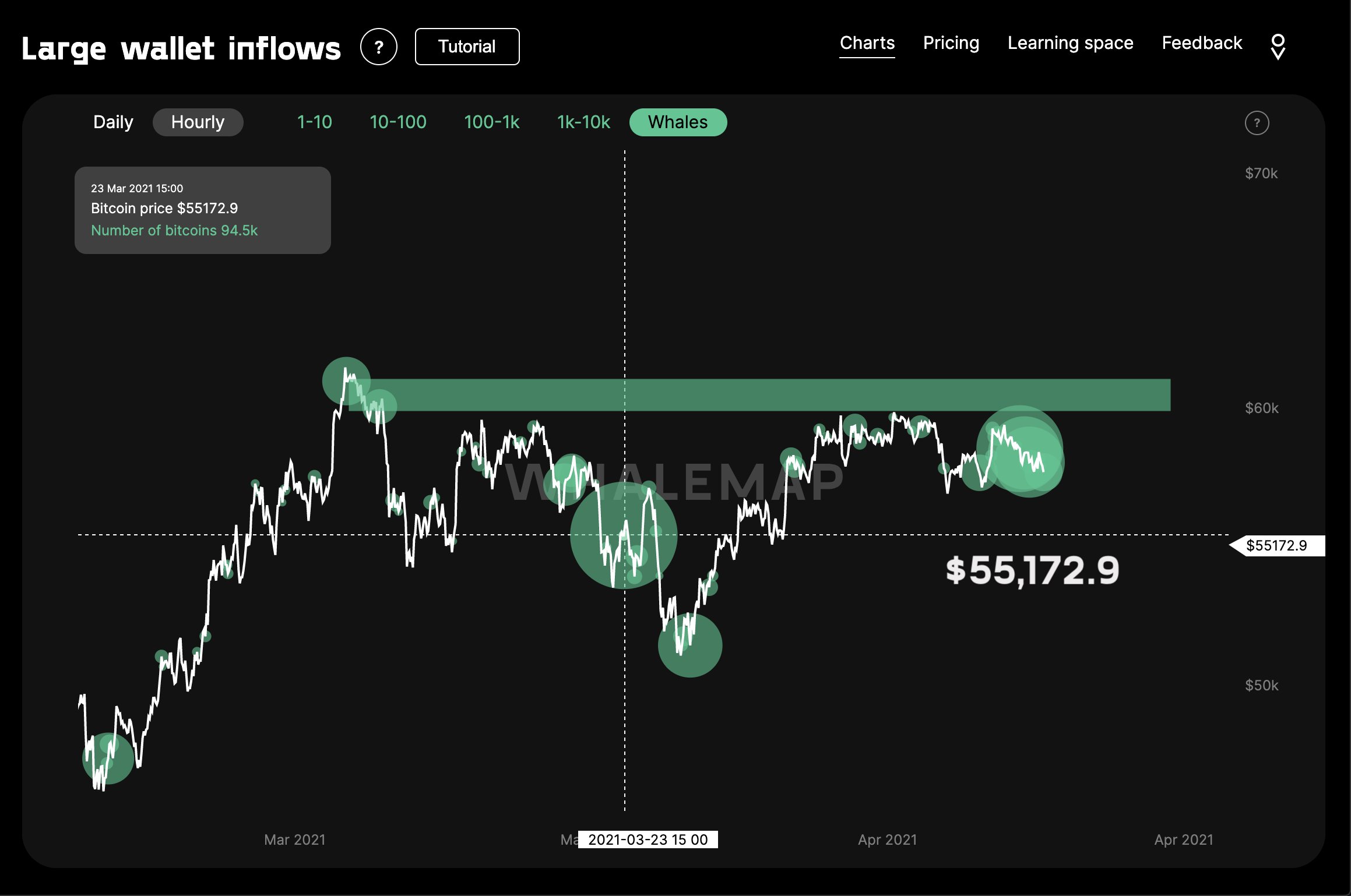

“A large inflow to a whale wallet happened at $55172 on the 23rd of March,” monitoring service Whalemap added, eyeing a possible floor.

“Lets see how price reacts to this level. Usually price bounces from such strong supports.”

BTC/USD chart showing clusters of whale orders. Source: Whalemap

Altcoins reverse strong weekly start

On altcoins, strong performance was in jeopardy at the time of writing, with Ether back below its historic $2,000 marker and heading away from all-time highs.

ETH/USD 1-hour candle chart (Bitstamp). Source: Tradingview

XRP and Polkadot’s DOT were the biggest losers in the top 10 cryptocurrencies by market cap, shedding over 10% on the day. All but one of the top 50 tokens, excluding stablecoins, were in the red.

Commenting, popular trader Scott Melker blamed overly sensitive traders.

“Bitcoin sneezes and drops a few hundred dollars, edgy traders panic sell their alts like jabronis and Bitcoin Dominance rises. Good times,” he tweeted.

“Reminder just how delicate these windows of alt coin trading are.”

Alts remain tipped for a dramatic return to form in summer, with Filbfilb even arguing that the second incarnation of “Alt Season” is already here.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.