- Bitcoin price is on the verge of a deep bearish correction that will likely precede another bullish wave.

- At least four market signs prove that the selling pressure is building.

- The potential downside target comes as low as $13,000.

Downside corrections are not something to be fearful of. They are an essential part of a bullish trend, and a sell-off always comes after a strong rally, just like the dusk always comes after the dawn.

Bitcoin hit a new multi-year high at $19,500 on November 25, having gained over 200% since the beginning of the year and nearly 500% since the mid-March market crash. Price movements of such a magnitude usually require a healthy correction before the growth is resumed. This development is typical for any financial asset, and Bitcoin is no exception.

The retrospective analysis of the last bull market reveals that Bitcoin price had at least nine 30-40% slumps before it surged to a new all-time high of nearly $20,000 in mid-December 2017. Considering that the ongoing bullish cycle has only seen a few 20% corrections, the flagship cryptocurrency can be regarded as overstretched by historical standards. And, multiple signs suggest that a market top has been reached.

FOMO reigns the cryptocurrency market

Fear of missing out, or FOMO, is a social disease of modern times. People experience escalating anxiety that others might be having fun or earning big money, while the person, gripped by FOMO, stays aside.

This syndrome is prevalent in the financial markets. Amplified by herd behavior, it spreads like wildfire among traders and investors once an asset price starts growing. Eventually, FOMO drives the asset price to ridiculously high levels, the number of people willing to buy it drops, and so does the price. The crash is usually no less spectacular than the rally, except that it is no longer fun.

Bitcoin is vulnerable to FOMO more than any other class of asset in the world. The recent rally from $10,000 to nearly $20,000 in less than two months confirms the theory.

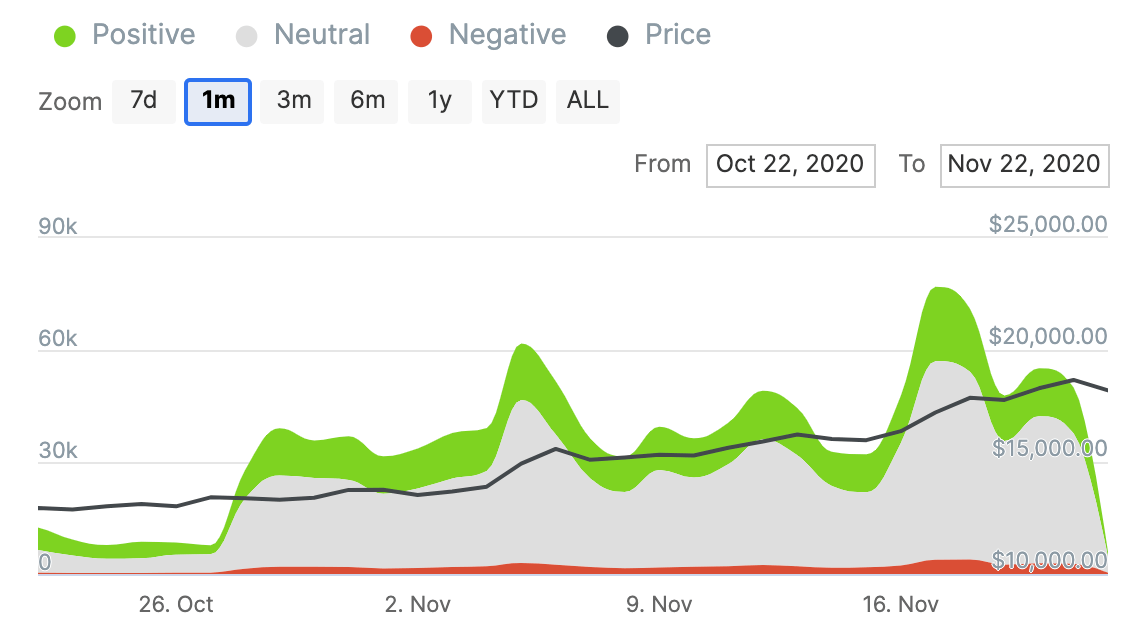

IntoTheBlock shows that the number of tweets about Bitcoin jumped from 7,700 at the end of October to peak at 77,000 in mid-November.

Bitcoin's Twitter Sentiment

A spike in social volume and the extensive coverage in the traditional media are the first red flags that the market is overhyped. While the prices can still go higher and even reach a new all-time high, traders should be extra-cautious at this stage.

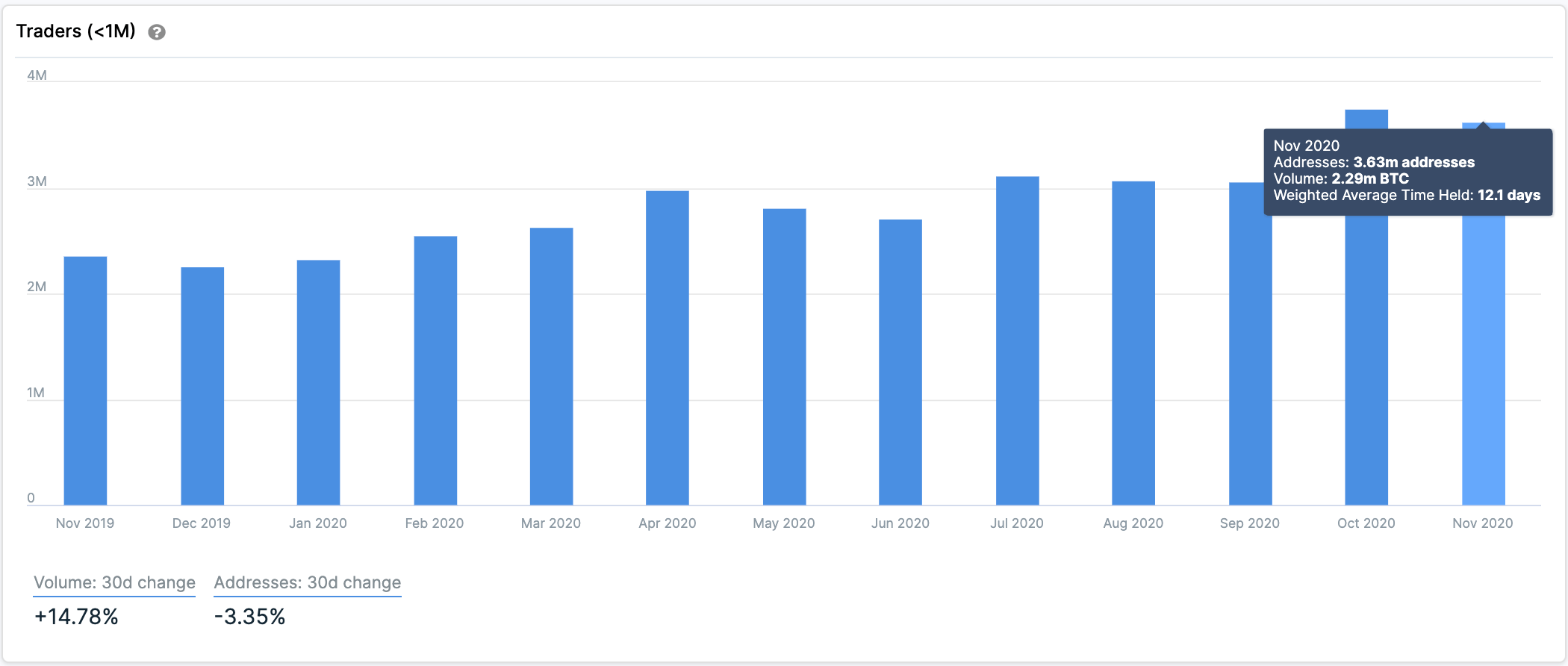

Retail traders come in droves

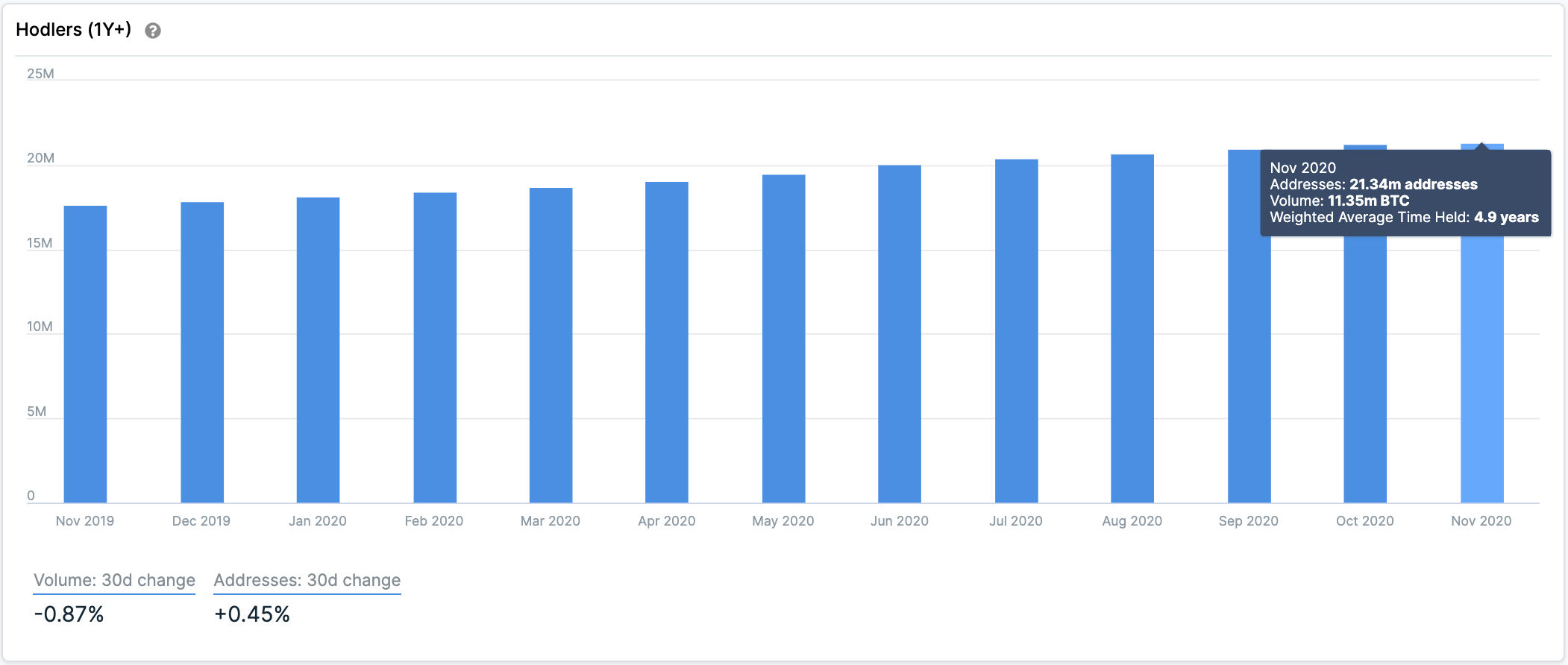

Typically, the growing number of new addresses is a good signal as it means that new users are coming in, and the network is expanding. However, a more detailed analysis reveals that the market is dominated by speculators and short-term traders, while the long-term investors have been reducing their holdings recently.

As the graph below shows, the number of idle BTC for more than a year dropped from 11.76 million tokens in September to 11.35 million coins in November.

Bitcoin Hodlers

Simultaneously, short-term traders now control nearly 2.3 million BTC from surging from a low of 1.8 million BTC in September. The number of speculative addresses that keep Bitcoin for less than a month also jumped from 3 million to 3.6 million over the reported period.

Bitcoin Traders

This trend usually means that speculators have flooded the market, making it vulnerable to sharp corrections. Short-term traders are focused on short-term profits. When they start dominating the market, the volatility and the risk of the correction increases.

Bitcoin whales are swimming away

Whales activity is another reliable indicator that allows an understanding of what's going on behind the scenes. When large investors start moving, the market usually feels the ripple effect. Currently, Santiment's Holder Distribution chart shows that the number of addresses holding 10,000 to 100,000 BTC, colloquially known as "whales," has been leaving the network or redistributing their tokens after the recent rally.

Since mid-November, the number of Bitcoin whales dropped from 113 to 108, which is indicative of a substantial increase in selling pressure.

Bitcoin's Holder Distribution

At first glance, the recent decrease in the number of large investors behind BTC may seem insignificant. However, when considering that these whales hold between $180 million and $1.8 billion in BTC, the sudden spike in sell orders can translate into billions of dollars.

Exchange supply is growing

Bitcoin's supply on the centralized cryptocurrency exchanges has been creeping higher. The figure bottomed at 694,000 BTC in November and climbed to 711,000 by the time of writing. While it is still well below early November's peak of 746,000, the emerging trend implies that Bitcoin holders are getting ready to sell.

Bitcoin's Supply on Exchanges

Meanwhile, Philip Gradwell, chief economist at Chainalysis, notes that BTC's exchange inflows remain subdued. Demand for the pioneer cryptocurrency is still growing faster than its supply, which may allow it to retain its upside potential.

#BITCOIN inflows to exchanges in the last seven days have been only slightly above long term averages despite the rapid increase in price, suggesting the supply available to buy remains constrained.

— Philip Gradwell (@philip_gradwell) November 25, 2020

See daily inflows data at https://t.co/pOtdWVHfeP pic.twitter.com/98BjzNafVs

A steep correction ahead

Given the bearish signs seen throughout this rally, it seems like Bitcoin price is bound for a steep retracement. Trading veteran Peter Brandt believes that a sell-off may trigger panic selling among those investors that got in the market too late. If this were to happen, the technical analyst estimates BTC could target $13,000.

"In regards to the profits that I have taken, I'm looking to re-place that long position if we re-test the factor 18-week moving average... The factor weekly trend lies substantially below the market at $12,700. Am I predicting a correction down to $12,700? No, not really; I don’t predict markets, I respond to them," said Brandt.

Bitcoin topped at $19,500 on Wednesday, November 25, and retreated to $17,300 by the time of writing. The bellwether cryptocurrency lost 8% on a day-to-day basis and returned to the levels seen over a week ago. The sharp move implies that the correction might have already started with the final bears' destination at $13,000 as it will represent about a 37% decline from the price current levels.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[10.49.38, 26 Nov, 2020]-637419766598230919.png)

[11.38.03, 26 Nov, 2020]-637419767008897766.png)