- Bitcoin price is set to book its best weekly gain for April.

- BTC price starts a winning streak with consecutive gains as risks fade.

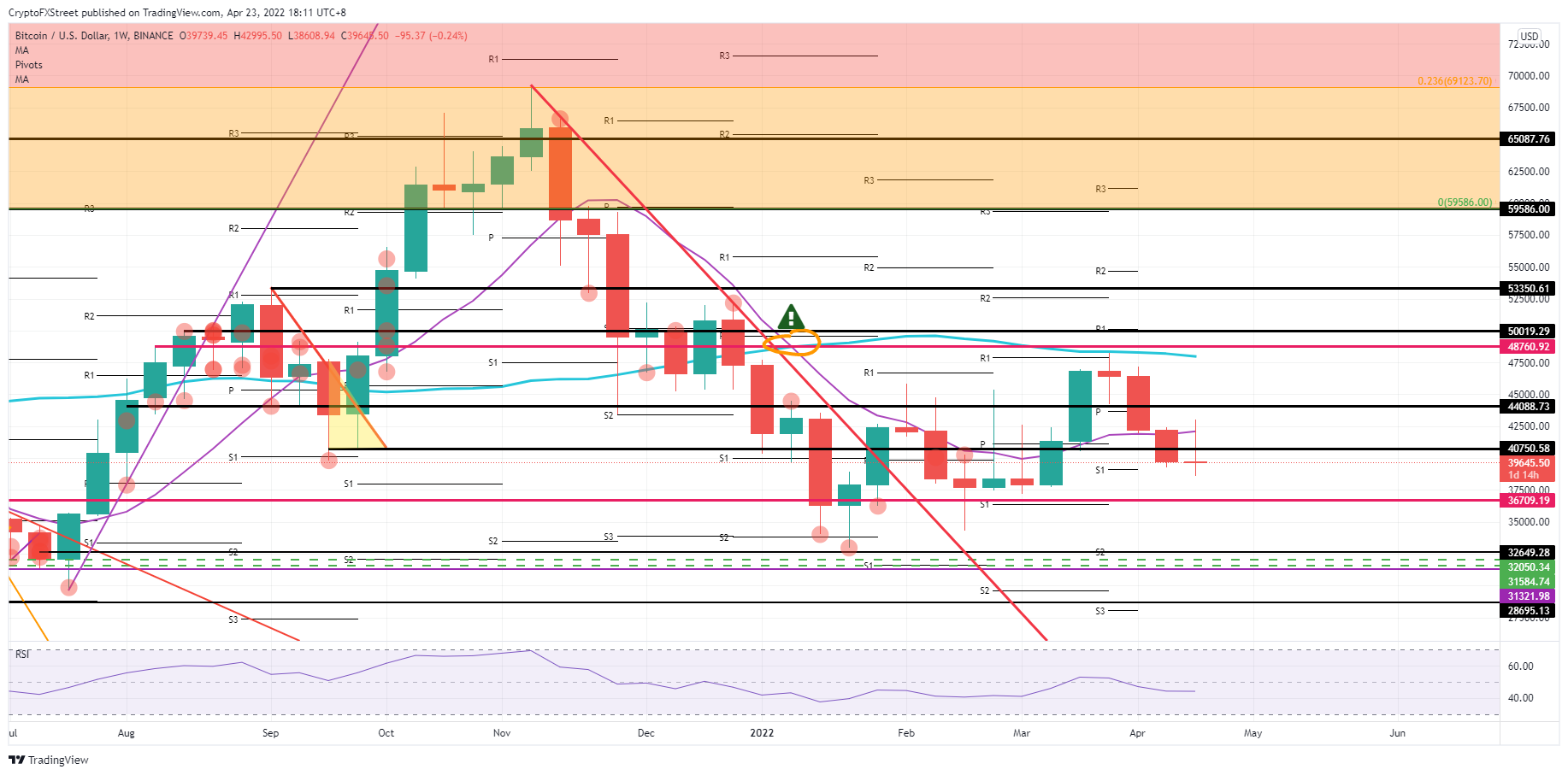

- A weekly close above $44,088.73 sets the scene for a weekly close above $50,000.00 next week.

Bitcoin (BTC) price has long been tied and changed by several tail risks, plaguing bulls and triggering short-term profit-taking. However, this week proved to be a big game-changer with BTC price set to eke out its best week for April and setting the tone going into next week as more and more tail risks are diminishing and tailwinds are starting to pick up speed. Under that scenario, Bitcoin price is set to break above $50,000.00 next week and, in the process, reclaim a few critical thresholds to watch for.

BTC price sees investor sentiment rising as tail risks fade

Bitcoin price is set to start a rally of weekly gains as this week the rally got jumpstarted on some positive elements. The positive news came on Thursday with a clear winner in the Macron-Le Pen debate pointing to a victory yet again for Macron and, in the process, eased the dollar strength as risk premiums were being priced out of the risk trade. With that move, investors not only became bolder again, but the dollar weakness opened up more room to the upside with rather exponential gains.

BTC price needs to open on Monday above $44,088.73 as an election victory for Macron will make the Greenback backoff further, opening up more upside potential. Add to that the fact that news out of Ukraine is becoming more and more second-tier and fading a bit to the background, showing that talks are still ongoing and a solution could still be brokered any day now, as the Russian military actions are now only focused on the west and no longer on the hole of Ukraine. A stead rally on this momentum will push BTC price above $50,019.29 by the end of next week, and within that process, have acquired the 200-day Simple Moving Average (SMA) and the psychological $50,000 area as support for any further upticks towards $54,000.00.

BTC/USD weekly chart

The most significant event risk over the weekend comes, of course, with the French election. Should Le Pen, as a far-right candidate, win the election from Macron, expect to see a significant shift and shock through the markets on Sunday evening and Monday morning in the ASIA PAC session. First, the initial reaction will be risk-off, with equity markets and cryptocurrencies on the back foot and safe havens such as treasuries bid. Investors will try to reassess the new situation in the already divided euro bloc. Expect BTC price to be priced in as all occurred gains from this week lost with price action back sub $40,000 towards $38,000.00, near $36,709.19.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC in positive tone ahead of third highest-returning month

Bitcoin price hovers around $104,000 on Friday after bouncing off its 50-day Exponential Moving Average earlier this week. A K33 Research explains how Nvidia’s big drop in stock valuation this week, driven by DeepSeek, affected Bitcoin’s price.

Altcoins LINK, AVAX and LTC Price Prediction: Double-digit gains ahead

Altcoins Chainlink (LINK), Avalanche (AVAX) and Litecoin (LTC) prices found support around key levels earlier this week. Their technical outlook shows a bullish picture and hints at double-digit gains ahead.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP recovery could be short-lived

Bitcoin price hovers around $104,000 on Friday after bouncing off from its 50-day Exponential Moving Average of around 98,800 earlier this week. Ethereum and Ripple approach key resistance levels; if rejected, they could lead to a correction ahead.

XRP on the brink of 27% rally amid surge in crypto ETF filing activities

Ripple's XRP is up 2% in the Asian session on Friday following the New York Stock Exchange (NYSE) Arca 19b-4 filing with the US Securities and Exchange Commission (SEC) for the conversion of Grayscale's XRP Trust into a spot ETF.

Bitcoin: BTC in positive tone ahead of third highest-returning month

Bitcoin (BTC) price hovers around $104,000 on Friday after bouncing off its 50-day Exponential Moving Average earlier this week. A K33 Research explains how Nvidia’s big drop in stock valuation this week, driven by DeepSeek, affected Bitcoin’s price.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.