- Bitcoin price gained momentum on Monday, attempting higher highs after week-long downtrend.

- A break above $63,354, previous lower high, would be a sign of strength, but $65,500 is more enticing.

- Analysts warn that Bitcoin could trigger 'panic selling’ if it falls below $60,000.

- Mainland China managed 50% attendance at Hong Kong's Bitcoin Asia conference following BTC and ETH ETF approval.

Bitcoin (BTC) price outlook is lull on higher periods, but the outlook is completely different on lower time frames. The pioneer cryptocurrency is showing strengyh, with the Asian session progressively proving more actionable for traders.

Also Read: Week Ahead: Crypto market eyes a bullish turnaround

Daily digest market mover: Mainland China wants in on Hong Kong spot Bitcoin ETF

The Asian session was good for the Bitcoin price on Monday, mostly attributed to the ongoing hype about the Hong Kong exchange-traded funds (ETFs). While the Chinese government prohibits sale of virtual asset-related products to mainland Chinese, a report on the South China Morning Post indicates that Mainland China managed 50% attendance at Hong Kong's Bitcoin Asia conference.

NEW: Hong Kong's #Bitcoin Asia conference saw 50% of attendance from mainland China: South China Morning Post

— Bitcoin Magazine (@BitcoinMagazine) May 13, 2024

The tides are turning pic.twitter.com/Fc6J0aDTux

Pointing to growing interest from mainland China, it fires speculation that trade agreements between China and Hong Kong could allow mainland investors to access spot BTC ETFs in Hong Kong. Given mainland China has been the biggest buyer of Hong Kong ETFs in the past three years, this is a significant move.

Besides Asia, the BTC ETF narrative continues to shape and accelerate markets in the US as well. Recent findings indicate:

- Switzerland's largest bank, UBS, owns 3,600 shares in the BlackRock ETF, filings with the US Securities & Exchange Commission (SEC) show.

- Boston-based Bracebridge Capital has reported owning $433 million worth of Bitcoin through ETFs.

- Bank of Montreal discloses spot BTC ETF holdings in new SEC filing.

As institutional players start to build positions in Bitcoin through the ETF, it suggests the next phase of adoption is underway, where both institutions and governments venture in. The El Salvadorian market is way ahead in this endeavor, launching a website to monitor their national Bitcoin treasury.

EL SALVADOR IS PUTTING ALL OTHER GOVERNMENTS TO SHAME

— Kyle Chassé (@kyle_chasse) May 13, 2024

El Salvador just launched a LEGENDARY website to monitor their national Bitcoin treasury.

I definitely don't see any other governments doing the same thing.

MAJOR TRANSPARENCY & STEP IN THE RIGHT DIRECTION FOR GOVT'S! pic.twitter.com/IGU19COOn3

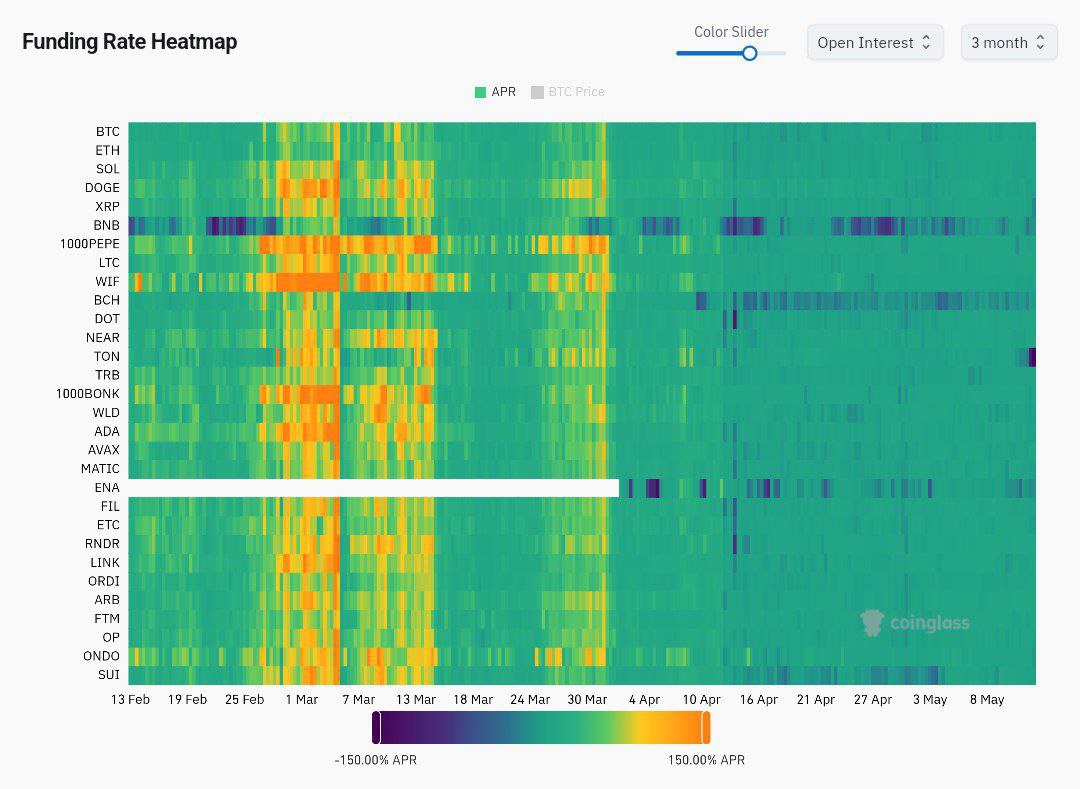

Elsewhere, funding rates continue to flash neutral, which points to a healthier market. Funding rates are the mechanism used in perpetual futures contracts to ensure that the contract price remains in line with the spot price of the underlying asset. These rates are essentially a way to balance out the trading positions between long and short traders.

Funding rate heat map

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Technical analysis: Bitcoin attempts change in market structure

Bitcoin price is attempting a change in market structure after breaking above resistance due to a critical trendline. This trendline connects lower highs since April 8. With another trendline providing support since the early May bottom of $56,552, BTC could have a bullish turnaround in the works.

A break above $63,354, the previous lower high, would be a sign of strength, but $65,500 would be a better deal and could attract more bulls. The Relative Strength Index (RSI) is also climbing, pointing to growing buying strength. The Awesome Oscillator (AO) has also flipped positive after maintaining green bars, indicating burgeoning bullish sentiment.

In a highly bullish case where Bitcoin price takes back the $70,000 psychological level, it would make for a change in market structure. This would potentially lead to a move toward range highs at $72,797 again. Beyond this level, BTC could recapture the $73,777 all-time high and possibly set a new peak.

BTC/USDT 4-hour chart

However, analysts warn that Bitcoin price could trigger 'panic selling’ if it falls below $60,000. Traders must, therefore, defend the $60,630 level, below which the cliff could see BTC roll over to the depths of $57,500.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.