Bitcoin price dips with over $250 million in total liquidations as judge rules out Craig Wright as BTC founder

- Bitcoin price retracted to a low of $70,543 on Binance, causing over $250 million in liquidations.

- A UK judge has determined that Craig Wright is not Satoshi Nakamoto and that he did not create BTC.

- Sidelined and late investors could have another buying opportunity before the next leg up ahead of halving.

Bitcoin (BTC) price dropped on Thursday, losing the critical support at $70,000 briefly before a pullback. The move, which saw hundreds of millions in total liquidations came after a UK high court ruled out Craig Wright as BTC founder.

Also Read: Bitcoin cleared $70,000 and Ethereum, $4,000: What’s next for crypto?

Judge rules out Craig Wright as BTC founder

The identity of Bitcoin’s creator, the pseudonymous Satoshi Nakamoto, has remained a mystery for years. Among the prominent theories include:

- Nick Szabo - Computer scientist and cryptographer

- Hal Finney - Cryptographic pioneer and the first person to receive a Bitcoin transaction from Satoshi Nakamoto

- Dorian Nakamoto - he denied any involvement after a discovery article in 2024

- Craig Wright - Australian computer scientist who claimed he is Satoshi with cryptographic evidence to support his claim.

- A Group of Individuals - There are theories that Satoshi is not a single person.

However, at least one theory might now be put to rest. A high court judge in London cited “overwhelming evidence” after a two-month trial that Craig Wright is not Satoshi Nakamoto.

BREAKING: UK Judge says Craig Wright is NOT Satoshi or the creator of #Bitcoin pic.twitter.com/mCBctAREBi

— Radar (@RadarHits) March 14, 2024

The presiding judge, Mr Justice Mellor, said, “…having considered all the evidence and submissions presented to me in this trial, I’ve reached the conclusion that the evidence is overwhelming,” and committed to issuing a “fairly lengthy written judgment” in due course. According to a report on The Guardian, Justice Mellor summarized:

- Wright is not the author of the Bitcoin white paper

- Wright is not the person who adopted or operated under the pseudonym Satoshi Nakamoto in the period 2008 to 2011

- Wright is not the person who created the Bitcoin system

- He is not the author of the initial versions of the Bitcoin software

It all comes after a conglomerate of cryptocurrency companies, dubbed Crypto Open Patent Alliance (Copa), levied charges against Wright. The objective was to prevent him from claiming he had invented Bitcoin as he was already using this to expand his influence over the crypto sector.

Nevertheless, while Wright may not be the elusive inventor, the quest for Satoshi’s true identity continues, with the anonymity adding to the intrigue that surrounds the creation of Bitcoin and its impact on the world of finance and technology.

The news created waves in the BTC market. After advancing toward the $80,000 milestone, Bitcoin price has pulled back to record an intraday low of $70,605 against the Tether (USDT) stablecoin on Binance Exchange. The move resulted in over $250 million in total liquidations, comprising $181 million in long positions against $70 million in short positions across the market.

Total liquidations

In the BTC market, almost $70 million worth of positions were blown out of the water, comprising $56 million longs against $13 million in short positions. In a 24-hour span, BTC open interest rose by $63 million, from $35.8 billion to $36.4 billion between Wednesday and Thursday. This comprises the sum of all open short and long positions for the pioneer cryptocurrency.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Bitcoin price outlook as judge denies claims of Wright being Satoshi

Bitcoin price dipped to an intraday low of $70,543 on Binance and $69,919 on Coinbase against USDT and USD, respectively. Nevertheless, the big-picture outlook remains strongly bullish. The slump could provide a good buying opportunity for investors as the BTC market heats up ahead of the halving.

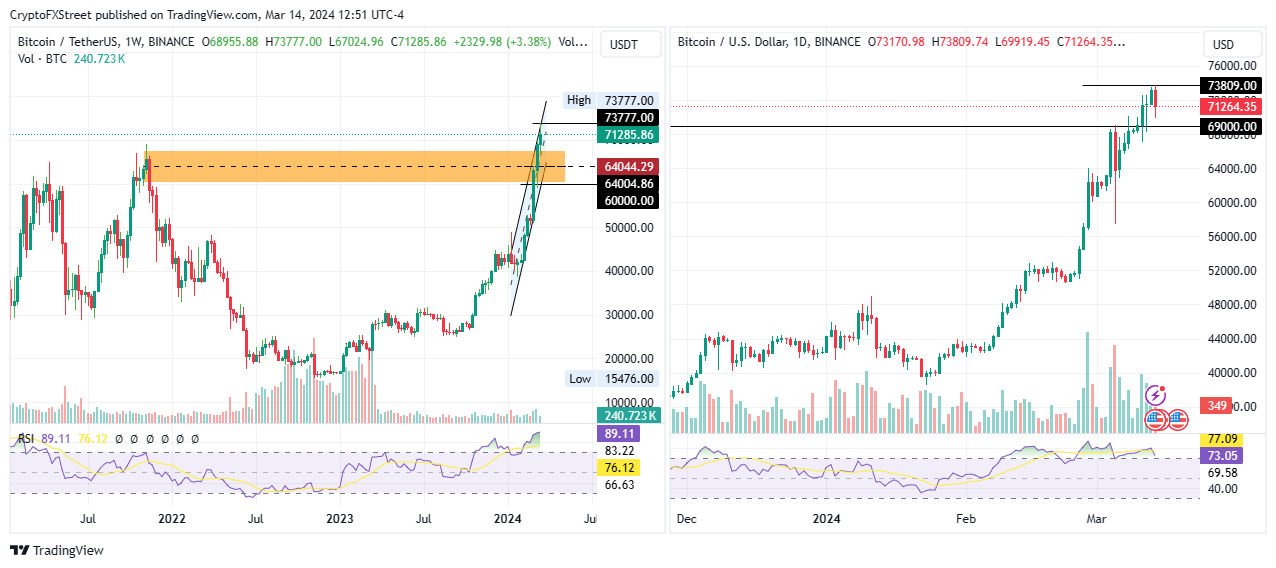

BTC/USDT 1-week chart, BTC/USD 1-day chart

If the bulls seize the opportunity to buy the correction, Bitcoin price could push north, clearing the range high at $73,777. Enhanced buying pressure could see the apex crypto record a new all-time high at $75,000 or, in a highly bullish case, tag the $80,000 milestone. This would denote a climb of about 10% above current levels.

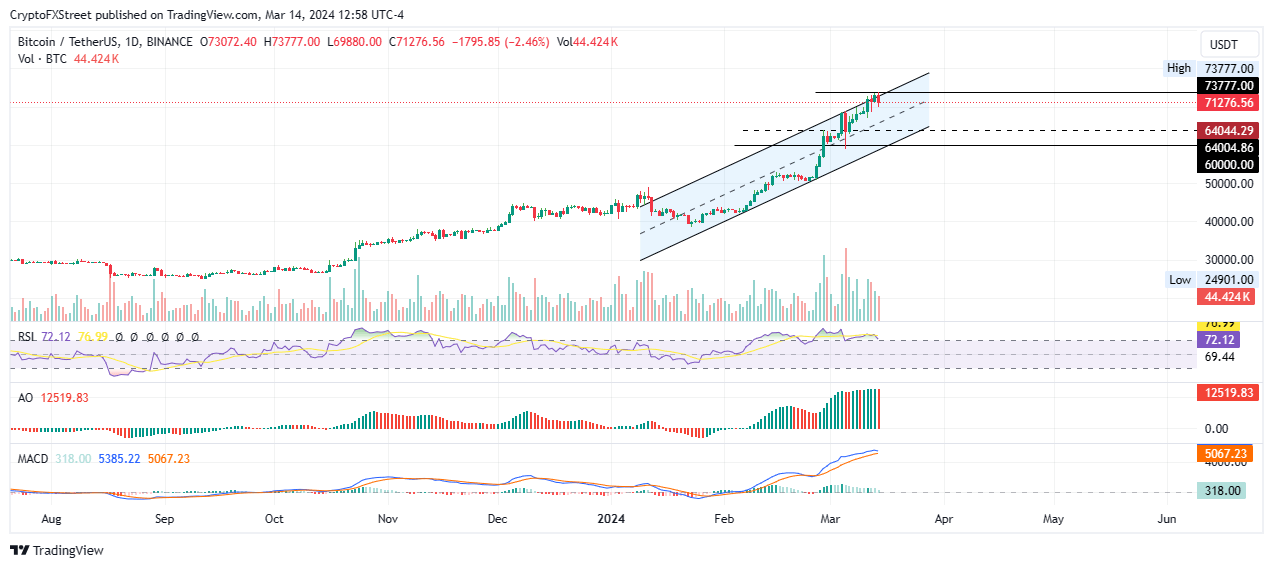

Multiple technical indicators support this outlook, starting with the Moving Average Convergence Divergence (MACD) moving well above the orange band of the signal line. This suggests a strong bullish cycle, accentuated by the large bars of the volume indicator.

Also, the Awesome Oscillator is well above the midline. The position of the Relative Strength Index (RSI) also points to a strong price strength, adding credence to the bullish thesis.

BTC/USDT 1-day chart

On the other hand, the RSI is dropping to show falling momentum. If the trajectory extends and the RSI crosses below the 70 threshold, it would trigger a sell signal. This could see Bitcoin price fall back below the $69,000 threshold, or in a dire case, extend a leg lower to tag the $60,000 psychological level. This would denote a 15% fall below current levels. Sidelined and later buyers could have an opportunity to buy the dip here.

Also Read: Bitcoin price continues to rise, but do not ignore strong signals of correction

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.