Bitcoin price retreats as US core PCE inflation comes hotter than expected

- Bitcoin price drops below $26,400 as US core PCE inflation rate came at 0.4% MoM and 4.7% YoY.

- The core PCE numbers support the idea that inflation is sticky and risk assets like Bitcoin and Ethereum could nosedive in 2023.

- The April 2023 PCE release could keep the pressure on the US Federal Reserve to raise interest rates.

Bitcoin price declined in response to April's US core Personal Consumption Expenditures (PCE) inflation data, which came higher than anticipated. The knee-jerk reaction from market participants increased the selling pressure on the asset, pushing it below $26,400. However, Bitcoin price has managed to return to pre-data levels minutes after the release.

Core PCE numbers support the thesis of “sticky inflation” and this increases the likelihood of further rate hikes by the US Federal Reserve.

Also read: Breaking: US Core PCE inflation rises to 4.7% vs. 4.6% expected

Bitcoin price drops in response to US core PCE inflation numbers

As of last week, market participants anticipated rate cuts by the US Federal Reserve. The US core PCE inflation rate came in hotter than expected, at 0.4% MoM and 4.7% YoY, boosting expectations of a looming interest rate hike.

Bitcoin’s rally to its bullish target of $30,000 is likely to be delayed as the selling pressure on the asset climbs. The trading environment is not as conducive to risk assets as traders expected and tighter market conditions could further intensify selling in Bitcoin and Ethereum.

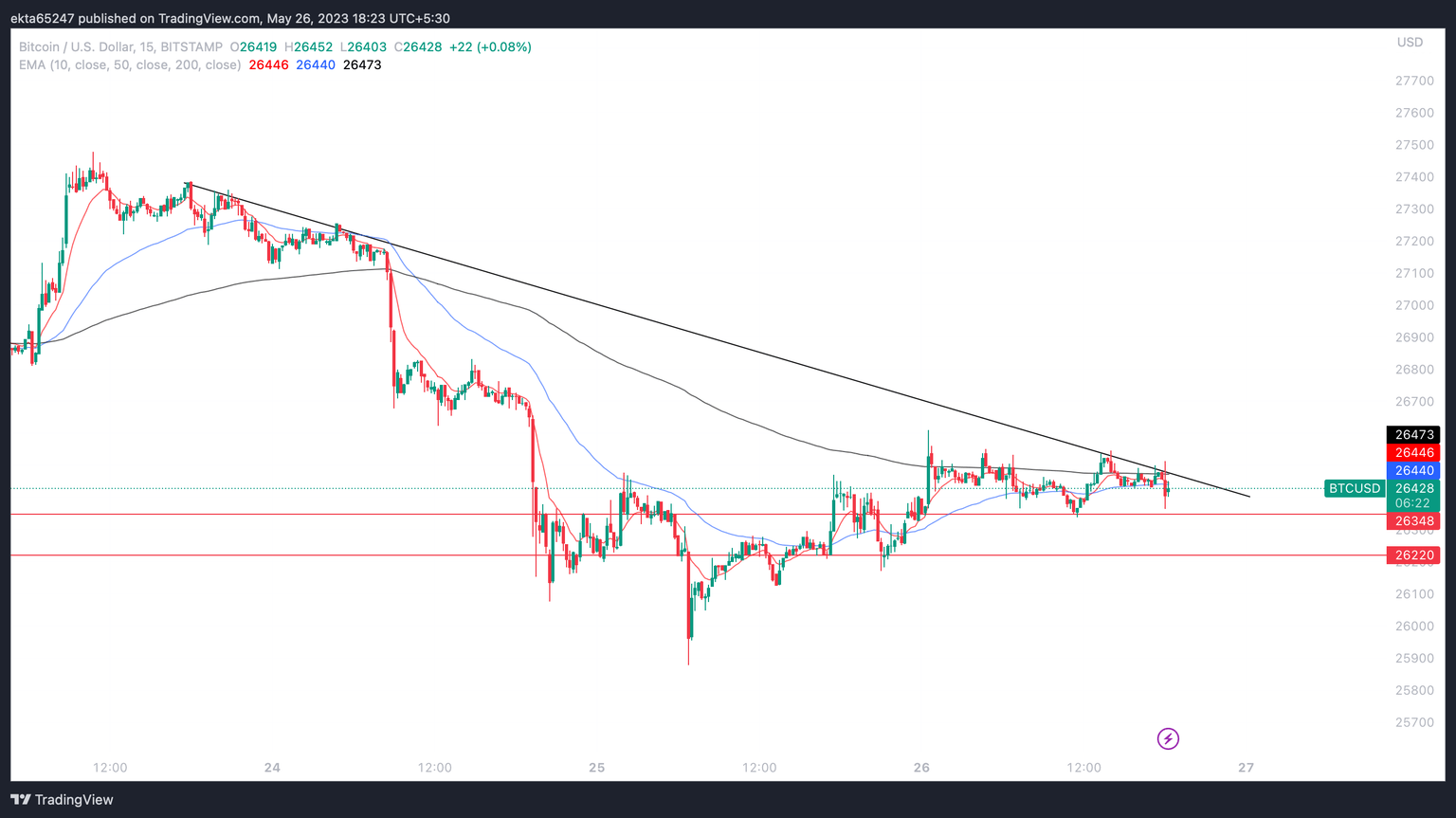

Bitcoin price is currently in a downward trend, and the release of the US PCE inflation data has pushed the asset lower. BTC could find support at $26,348 and $26,220, two levels that acted as contention for the asset previously.

BTC price is currently below its three long-term Exponential Moving Averages 10, 50 and 200-day at $26,446, $26,440, and $26,473 respectively.

Bitcoin/ US Dollar 15-minute price chart

Investors are likely to rotate capital to alternate sectors and head back to safe havens as there is no sign of inflation easing in the short term. If Bitcoin and Ethereum prices observe gains, they are likely to be short-lived, before a longer, more significant drawdown puts risk assets to the test.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.