- U.S. spot Bitcoin ETFs registered slight outflows on Tuesday.

- The German Government transferred another 832.7 BTC, valued at $52 million, on Tuesday.

- On-chain data shows that Bitcoin miners have increased their selling activity at the beginning of this week.

Bitcoin (BTC) extends correction on Wednesday and hovers around $61,000 after finding resistance near the $64,000 level on Monday. Recent on-chain data indicates heightened selling activity from Bitcoin miners early in the week. Meanwhile, U.S. spot Bitcoin ETFs experienced minor outflows on Tuesday, coinciding with the German Government transferring an additional 832.7 BTC, valued at $52 million, on the same day.

Daily digest market movers: Bitcoin price declines as German government transfers weigh

- According to data from Lookonchain, the German Government transferred 832.7 BTC, valued at $52 million, from its wallet on Tuesday. Of this, 282.7 BTC, worth $17.65 million, were transferred to Coinbase, Bitstamp and Kraken exchanges.

- Over the past week, German authorities have moved 2,240 BTC worth $142 million to Coinbase, Bitstamp, Flow Traders, and Kraken. This significant transfer activity may have fueled FUD (Fear, Uncertainty, Doubt) among traders, potentially influencing Bitcoin's 2.5% price decline this week.

The German Government transferred 832.7 $BTC($52M) out again 35 minutes ago, of which 282.7 $BTC($17.65M) was transferred to #Bitstamp, #Coinbase and #Kraken.

— Lookonchain (@lookonchain) July 2, 2024

German Government currently holds 43,859 $BTC($2.74B).https://t.co/uBaH2Wtxev pic.twitter.com/f15sht8Npc

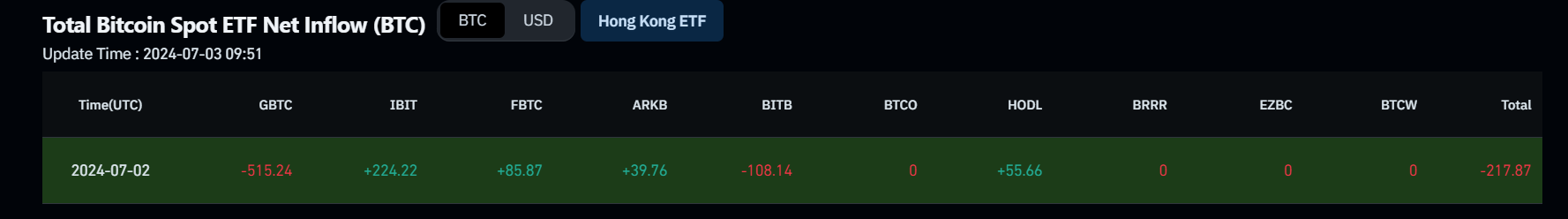

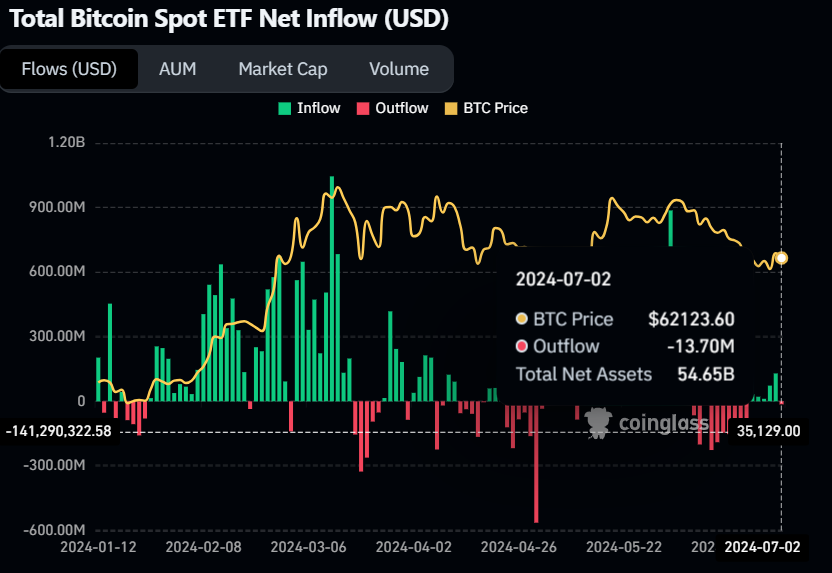

- On Tuesday, U.S. spot Bitcoin ETFs recorded outflows totaling $13.70 million. Grayscale (GBTC) and Bitwise (BITB) saw decreases of 515.12 BTC and 108.14 BTC, respectively, while Blackrock (IBIT), Fidelity (FBTC), ARK 21Shares (ARKB), and VanEck (HODL) added 224.22 BTC, 85.87 BTC, 39.76 BTC, and 55.66 BTC, respectively.

- This decline suggests a slight weakening in investor confidence, potentially indicating a temporary downturn in Bitcoin's price. ETF net inflow data is crucial in assessing investor sentiment and market dynamics in Bitcoin ETFs. Together, the 11 spot BTC ETFs hold reserves totaling $54.65 billion in Bitcoin.

Bitcoin Spot ETF Net Inflow (BTC) chart

- According to CryptoQuant data, Bitcoin miners have increased their selling activity at the beginning of this week. On Monday, miners transferred 9,096.67 BTC to exchanges, followed by 6,751.91 BTC on Tuesday. Selling was subdued over the weekend but picked up as the week began. This uptick in transfers may reflect miners' efforts to cover operational costs or capitalize on perceived price overvaluation, contributing to selling pressure. Such actions typically signal a bearish sentiment in the market, potentially foreshadowing a price decline.

%20-%20All%20Miners,%20All%20Exchanges%20(3)-638555921689923407.png)

Bitcoin Miners to Exchange Flow (Total) chart

- Conio revealed on social media platform X their partnership with Mesh, a U.S. fintech firm supported by Paypal Ventures, introducing Europe's first Open Banking solutions for Bitcoin. This collaboration enables Conio app users to access 10 top crypto exchanges, such as Binance and Coinbase, and transfer purchased bitcoins directly into their Conio wallets. By leveraging open banking technology, a Mesh account can authenticate users across over 300 centralized crypto exchanges and self-custody wallets.

➡️ We are thrilled to announce Conio’s partnership with Mesh @meshconnectapi, launching the first #OpenBanking solutions for #Bitcoin in #Europe. This partnership has two main objectives: reducing friction and simplifying transfers, and promoting the use of secure #custody… https://t.co/DGL2ZDD7rv

— Conio (@conio) July 1, 2024

Technical analysis: BTC declines after retesting daily resistance around $64,000 level

Bitcoin price was rejected by the daily resistance level at $63,956 on Monday, and fell by more than 1% on Tuesday. BTC is extending losses and trades down by 1.8% on a daily basis at $60,987 on Wednesday.

If BTC's price closes above the hurdle at the $63,956 daily resistance level, it could rise 5% to retest its next weekly resistance at $67,147.

The Relative Strength Index (RSI) and the Awesome Oscillator in the daily chart are below their neutral levels of 50 and zero. If bulls are indeed returning, then both momentum indicators must regain their positions above their respective neutral levels.

If the bulls are aggressive and the overall crypto market outlook is positive, BTC could extend an additional rally of 6% to revisit its weekly resistance at $71,280.

BTC/USDT daily chart

However, if BTC closes below the $58,375 level and forms a lower low in the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 3% decline in Bitcoin's price, to revisit its low of $56,522 from May 1.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

The crypto market is stuck in the mud

The crypto market has been hovering in a narrow range for the past four days, adding just over 2.5% over the past seven days to $2.72 trillion. These are levels below the 200-day moving average, indicating that the balance of power is now on the sellers' side.

Fintech and crypto firms push for bank licenses under Trump administration

Fintech and crypto firms seek bank charters under Trump, aiming for growth, lower costs, and legitimacy amid expectations of a more business-friendly regulation.

ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Standard Chartered analysts led by Geoffrey Kendrick lowered the bank's expectations for Ethereum's price in 2025. The bank adjusted its latest prediction, reducing Ethereum's 2025 price target from $10,000 to $4,000.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.