- Bitcoin price tumbled from a daily high above $48,900 after spot BTC ETF trading began on Thursday.

- Soaring trading volumes reach millions of Dollars in minutes and billions of Dollars within the hour.

- BTC could rise 9% to the $50,000 psychological level, a level last tested in December 2021.

- The bullish thesis would be invalidated if the price closes below the $43,916 weekly mean threshold.

Bitcoin (BTC) price’s immediate response to the spot exchange-traded funds (ETFs) approval was a 2% correction as traders cashed in on the sell-the-news situation. The turnout quelled anticipation for the $50,000 target, but the optimism is coming back as the spot BTC ETFs have turned out to be a bullish fundamental after all.

Also Read: Spot BTC ETFs approached $2 billion in trading volume within an hour of trading after SEC approvals

Bitcoin spot ETFs trading volumes skyrocket

Minutes after spot BTC ETFs went live, their trading volumes skyrocketed, recording millions of dollars in minutes and billions of dollars in hours. ETF specialist Eric Balchunas said the numbers were “UNREAL” for the first day of trading, let alone hours.

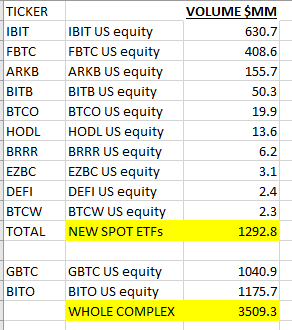

Specifically, with only ten spot bitcoin ETFs already live, over $1.3 billion in trading volume has been recorded on Thursday. Factor in Grayscale’s GBTC and the numbers fly to $2.3 billion. This figure rises to $3.5 billion if ProShare’s BITO, which is not in the spot race, is factored in.

Spot BTC ETF volumes

ETF specialist James Seyffart articulated that the trading volumes crossed the $1.2 billion trading volume mark within the first half hour after trading started. Notably, the volume points to buying, save for GBTC and BITO.

Re what all these dollars flying around means. For the 10 fresh ETFs volume = buying btc today. Clear cut. But, GBTC volume prob ALL selling and maybe $BITO has some too so likely a lot offsetting going on. Just my take tho, not 100%, we'll know more when flows hit tonight

— Eric Balchunas (@EricBalchunas) January 11, 2024

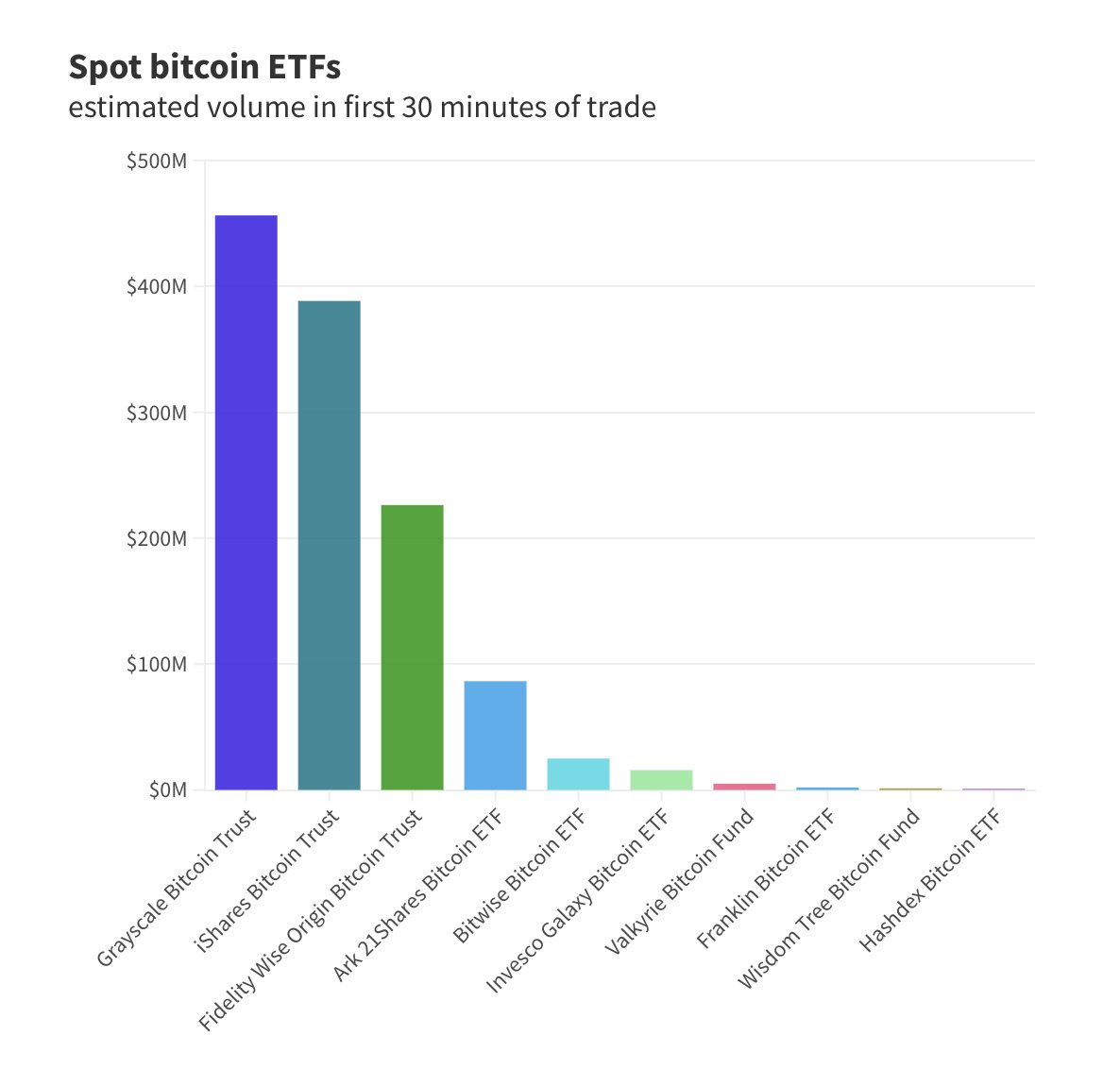

Based on the leaderboard, Grayscale’s GBTC is leading with $446 million, followed by the IBIT from iShares Bitcoin Trust with $388 million. Fidelity’s FBTC is in third place with $230 million, while Cathie Wood’s Ark 21Shares records $82 million as of the time of writing.

Spot BTC ETF trading volume leaderboard

With the trading volumes hitting the roof, hope for Bitcoin price hitting $50,000 is rekindled, despite assumptions that the purchases are over the counter.

According to CryptoQuant, Coinbase’s BTC OTC trading volume reached $7.7 billion today, reaching the second highest level in history. This means that the purchase of BTC through OTC transactions may be related to the passage of the spot BTC ETF. Crypto exchange BTC daily trading… pic.twitter.com/1zX31aJkqh

— Wu Blockchain (@WuBlockchain) January 11, 2024

Notably, OTC purchases happen away from exchanges. Theoretically, they should not affect Bitcoin price. Nevertheless, the presence of large buyers (or sellers) making inquiries in the OTC market, is likely to be leaked, such that word spreads. This leaked information should see to it that the price on exchanges is also affected. This explains the fluctuations in Bitcoin price while pointing to demand pressure.

Bitcoin price outlook as $50,000 becomes attainable again

On the four-hour timeframe, Bitcoin price is consolidating within an ascending parallel channel, with the reaction to spot BTC ETF trading and the US CPI inflation reading sending BTC above $48,000, recording an intra-day high of $48,969.

BTC.USDT 4-hour chart

On the daily timeframe, Bitcoin price is trading within the weekly supply zone extending between $40,467 and $46,999. To confirm the continuation of the trend, BTC must flip this order block into a bullish breaker, confirmed by a break and close above the $48,000 psychological level.

Increased buying pressure above current levels could see Bitcoin price extend north to clear the range high at 48,969. In a highly bullish case, the gains could extrapolate for the king of cryptocurrency to complete the 9% climb to the $50,000 psychological level.

The position of the Relative Strength Index (RSI) above the 50 midline points to a strong price strength. Its stance at 60 shows there is still more room to the north. In the same way, the Awesome Oscillator (AO) is in positive territory, suggesting the bulls maintain a strong presence in the big picture BTC market. This evidence favors the upside.

BTC/USDT 1-day chart

Conversely, if selling pressure increases, Bitcoin price could descend, testing the confluence between the midline of the weekly supply zone at $43,916 and the 25-day Exponential Moving Average (EMA). An extended fall could see BTC find support due to the 50-day EMA at $42,010. If these buyer congestion levels fail to hold as support, BTC could spiral out of the supply barrier to test the 100-day EMA, or lower, the critical support at $37,800.

Rolling over past $37,800 would see Bitcoin price hit a cliff, potentially descending to the 200-day EMA at $34,599.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.