- Bitcoin price has been hovering around the $40,000 mark for the past four days, slipping under the 50-day EMA.

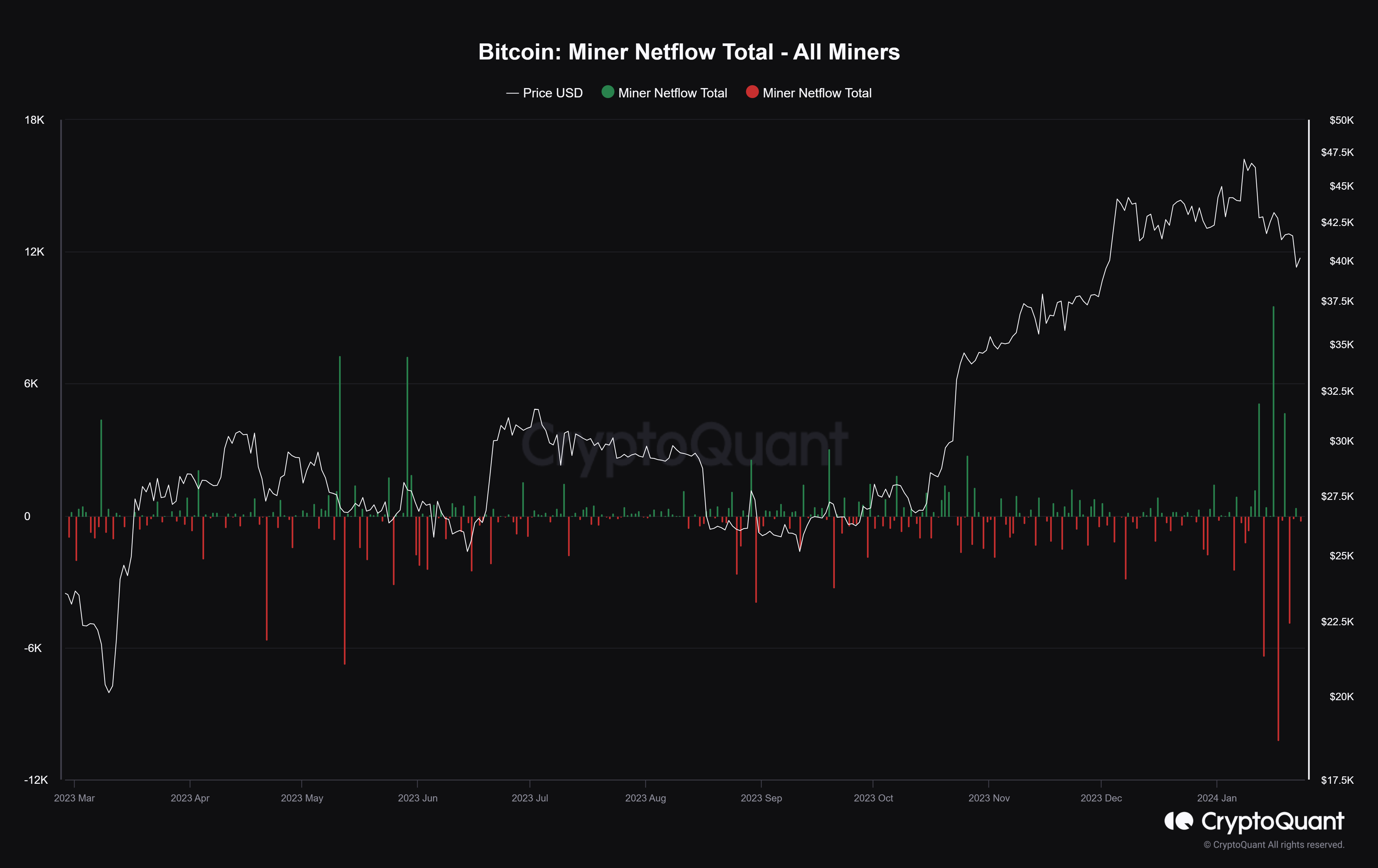

- Miners have added more than 6,500 BTC worth over $264 million to their reserves in two weeks as BTC price tanked.

- Miner accumulation has been a positive signal in the past as prices reversed upon their buying spree.

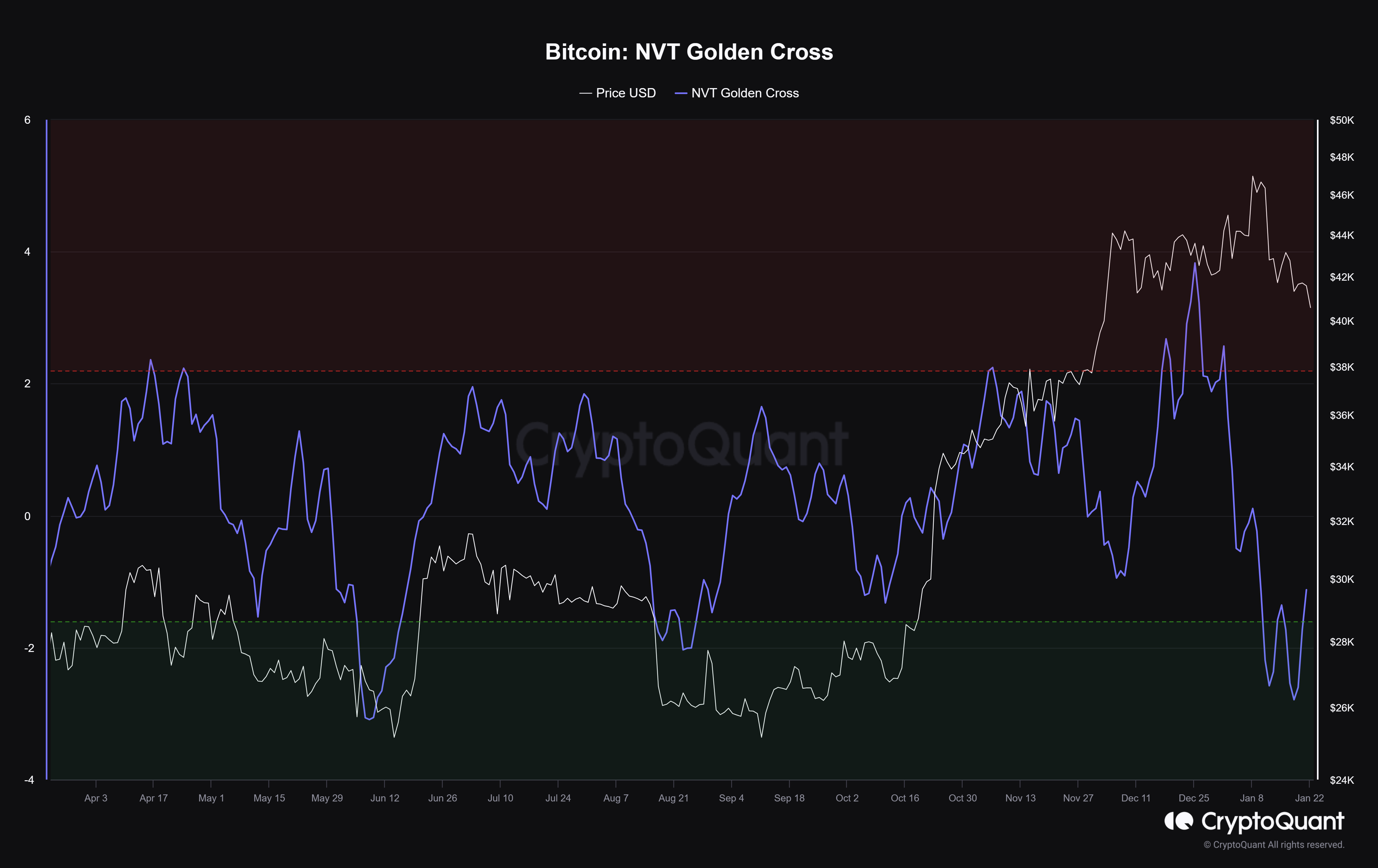

Coincidentally, the NVT Golden Cross is indicating a bullish outlook for the first time in five months.

Bitcoin price is potentially set to take a detour, much to the surprise of the bears, who were expecting further drawdown as signals indicate a recovery at hand. Much of this comes from the miners, who have historically acted as a strong signal of a probable rally.

Bitcoin price hits $40,000

Bitcoin price over the past 24 hours dipped below the $40,000 mark after hovering around it for nearly four days now. Recovering from this low, the cryptocurrency is trading at $40,040 at the time of writing.

Now, considering price indicators such as the Relative Strength Index (RSI), it may seem like the downtrend might continue since the indicator is in the bearish zone below the neutral mark of 50.0.

BTC/USD 1-day chart

However, considering broader market cues and a solid bullish reversal signal visible on the chain, a reversal may not be out of the question. Reclaiming the $40,000 mark as a support floor would translate to enough bullish strength for Bitcoin price to climb back towards $42,000. This price point coincides with the 50-day Exponential Moving Average (EMA), and flipping it into support would invalidate the bearish thesis.

Mining reserves suggest a rally is likely

Bitcoin miners are just as strong an indicator as the whales since their actions directly affect the market. Generally, these miners tend to accumulate when the price is low and sell when they see potential profits. In the former event, a rally occurs, while in the latter, a decline takes place. This phenomenon can be observed from past instances when the miner reserves increased and decreased.

In the past couple of days, despite the net flows noting a mix of inflows and outflows, the miner reserves have risen by 6,562 BTC altogether. This $264 million worth of addition of BTC brought the total miner reserves to 1.834 million BTC. This is a positive sign for Bitcoin price since the chances of recovery are high now.

Bitcoin miner net flows

Secondly, the Network Value Transaction (NVT) Golden Cross metric is also making a comeback from the bullish zone under the -1.6 value. The reason behind this bullish assumption is that if the long-term trend is way greater than the short-term trend, the network can be interpreted as underpriced and will soon revert to mean value, translating to a long signal.

Bitcoin fell to -1.7 and only came out of it about 48 hours ago; this was the first time NVT Golden Cross fell to this low in more than five months. Traders consider this to be a long signal since the price tends to make a recovery after hitting the green zone.

Bitcoin NVT Golden Cross

If history repeats itself, the potential for a recovery is strong, and Bitcoin price could climb back.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin reaches new highs near $90,000, on-chain data show chances of pullback

Bitcoin hit a new all-time high of $89,900 on Tuesday before easing to around $86,000, following a 30% surge since November 5. Technical indicators suggest the rally may be overstretched, with a potential corrective pullback ahead.

GIGA investor loses $6M to phishing scam via fake Zoom link

On Monday, a Gigachad (GIGA) investor lost $6.09 million due to a phishing attack involving a fake Zoom link. Crypto investigation firm Scam Sniffer declared the scam that led the victim to a malicious site, compromising their wallet.

Tron, Avalanche and Uniswap: Double-digit gains on the cards, technical indicators show

Tron is breaking above an ascending triangle formation on Tuesday, signaling a potential rally continuation. While AVAX and UNI are retesting their crucial support level — if supported, this suggests an upside move — all three altcoins look poised for double-digit gains as the crypto rally continues.

BNB: Bullish technical pattern validated, eyes all-time high

Binance Coin trades slightly down on Tuesday after breaking above an ascending triangle formation on the weekly chart, following a 12.5% rally last week. The technical outlook suggests a bullish breakout pattern and continuation of the rally, with a target set for a new all-time high of $825.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.