Bitcoin price reclaims $65K as Fed still considers three rate cuts this year

- Federal Reserve kept interest rates paused for the fifth time on Wednesday at 5.25% to 5.50% as expected.

- Fed is still committed to 2% core inflation target overtime and anticipates three rate cuts this year.

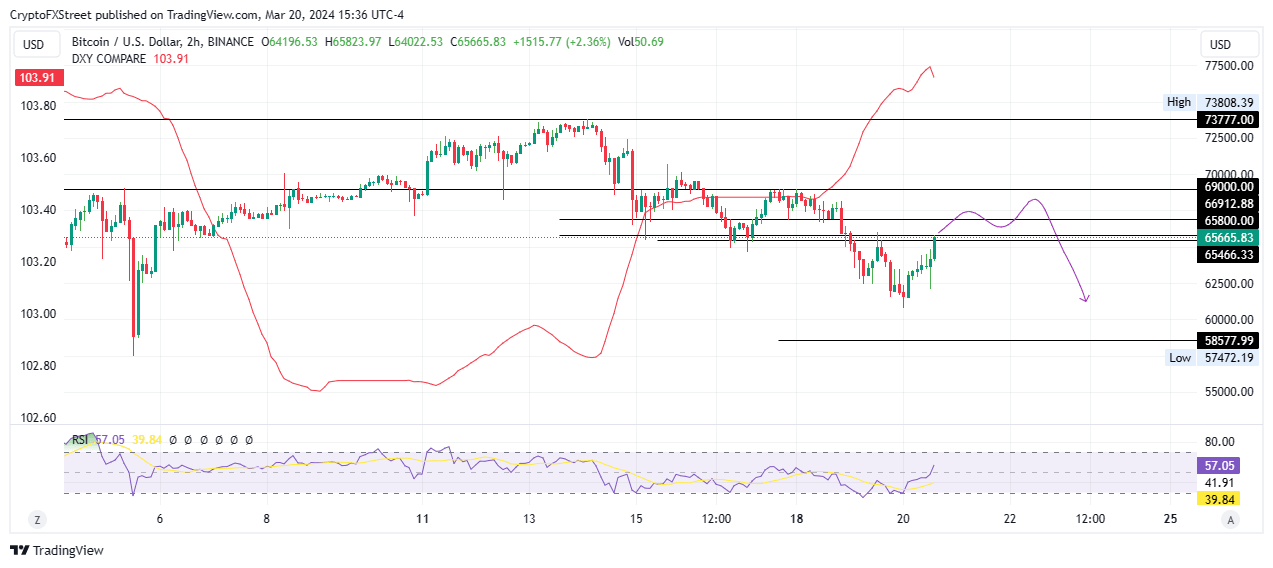

- Bitcoin price showed little volatility, reclaiming ground above $65,000 as rate hold already priced in.

In the March Federal Open Market Committee (FOMC) meeting, the Federal Reserve (Fed) announced that it would keep its benchmark interest rate unchanged in the range of 5.25%-5.50%. This is the highest level in two decades and was kept unchanged for the fifth consecutive time in line with market expectations.

Bitcoin price recorded a small but notable reaction to the FOMC decision, reclaiming above $65,000 as markets noted a small bump in volatility. Investors looking for opportunities targeted small market cap cryptocurrencies, restoring green candles to the market.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC stuck under $65K ahead of FOMC

Fed keeps interest rates unchanged

Federal Reserve Chair Jerome Powell gave a new Summary of Economic Projections (SEP) in a Wednesday press conference following the March FOMC meeting. The impact of rates staying unchanged was neutral for the market, seeing as the outcome was expected and already priced in. It shows that no rate cuts are expected until the FOMC has greater confidence that inflation will sustainably fall to 2%.

After reports that the Fed had left interest rates unchanged, the median Dot Plot - or the median forecast of Fed members - for rate cuts this year was the next most important thing. Going into the meeting, the general expectation was 75bp of cuts for this year as had been hinted at in the December SEP release. Policymakers stuck to this benchmark, while leaning toward beginning to dial back policy restraint at some point in 2024.

Policy rate is likely at its peak for this cycle and if the economy evolved broadly as expected, it would likely be appropriate to begin dialing back policy restraint at some point this year.

Further, the 2024 median rate forecast in the new DOT plot remains unchanged as the Fed continues to expect three rate cuts for 2024.

#FOMC The latest Fed dot plot indicates a thin median for 3-rate cuts are expected in 2024. pic.twitter.com/IcaHnm3Fxu

— Wall St Engine (@wallstengine) March 20, 2024

As the Fed projections show, only one official sees more than three 25 bp rate cuts this year. Other key takeaways from the Fed's dot plot for 2024 data include:

- Expected real GDP growth raised to 2.1%

- Expected unemployment rate lowered to 4.0%

- Expected PCE inflation maintained at 2.4%

- Expected core PCE inflation raised to 2.6%

- Expected federal funds rate maintained at 4.6%

Bitcoin price retracted, pulling back above $65,000 to trade for $65,665 at the time of writing.

BTC/USDT 2-hour chart

The FOMC decision will settle in by Thursday, as markets usually take time to process. Was Powell dovish enough to reverse the trend for Bitcoin?

If Bitcoin continues its momentum, moving above $69,000 or higher, the thesis that expects a leg down to the weekly imbalance (FVG) may change.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.