- Bitcoin price is showing signs of strength despite the recent surge.

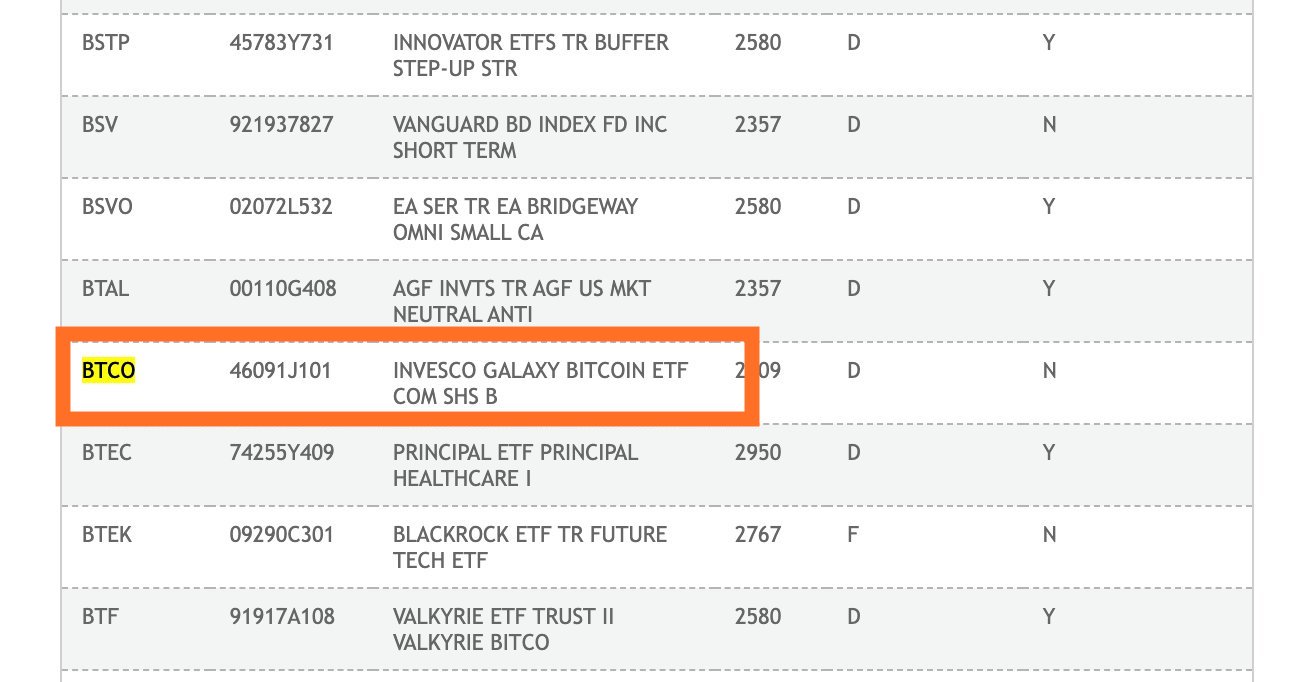

- The listing of ARK Invest, BlackRock, and Invesco’s spot BTC ETF hints at the target audience for these investment products being the institutional and richer cohort.

- Thanks to Bitcoin’s 109% year-to-date rally, the optimism has reached a two-year high.

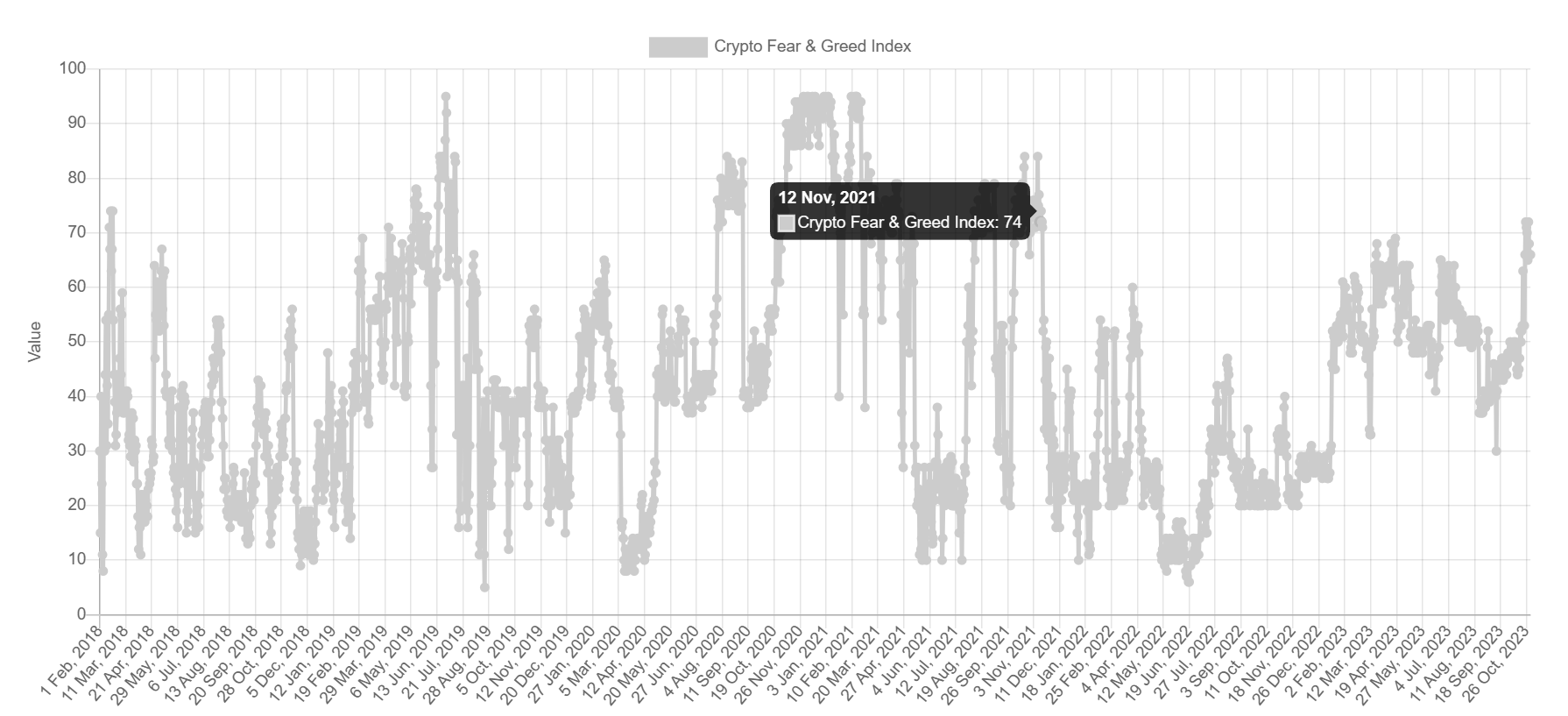

Bitcoin price rise has pushed investors to act extremely bullish, resulting in increased optimism. This rise in Greed is largely influenced by the spot Bitcoin ETF filing, hyped by the investors. Looking at the listing, however, it seems that while the impact of the exchange-traded funds (ETFs) will be on younger retail investors, the influence might come from some other cohort.

Daily Digest Market Movers: Spot Bitcoin ETFs target audience revealed

Bitcoin has millions of investors around the globe who have been patiently awaiting a spot ETF for a long time now. Applicants, including the likes of BlackRock, the world’s largest asset manager, have been relentlessly pushing the approval. But by the looks of it, these applicants have a different target audience in mind.

According to Eric Balchunas, a Bloomberg ETF analyst, the recent listing of ARK Invest, BlackRock and Invesco ETFs on the DTCC site suggests that these companies are aiming at money-loaded investors and/or institutional investors primarily. He stated,

“Each of the tickers chosen so far, $ARKB, $IBTC and $BTCO, shows these ETFs are being aimed squarely at advisors (and the rich Boomers they serve) vs aimed at retail (otherwise we’d see $HODL type tickers). Boring but smart IMO.

Spot Bitcoin ETFs listing on DTCC

While the comment may be harsh in tone, it is rather accurate when it comes to the crypto market. Retail investors have historically been known to pump tokens with no fundamental value that have either been trending owing to a pop cultural significance or due to an appealing name. This list includes the likes of Dogecoin, PEPE, Squid Games token, DogeElon Mars, etc.

Besides, since the next bull run will come at the hands of institutions, it makes sense as to why these ETFs are primarily catering to them. This would, regardless, prove to be beneficial to retail investors as BTC should climb further. The recent rally injected significant optimism into the market as observed on the Crypto Fear and Greed index.

The index is presently at a two-year high, sitting at 66, but reached 72 in the past week. This level of figures was last seen in November 2021. This sentiment is expected to act as a catalyst for Bitcoin price, which has performed exceptionally these past ten months despite facing investor bearishness.

Crypto Fear and Greed Index

Since the year began, BTC has grown by 109% to date, eclipsing other major investment options by a mile. The closest competition to the cryptocurrency after Ethereum was Apple and NASDAQ, both of which grew by 30% since January 1, 2023.

Can you spot the outlier? pic.twitter.com/y5IIY1fVyx

— ecoinometrics (@ecoinometrics) November 1, 2023

This development will keep the bullish momentum going for the asset, which is crucial for the forecasted price rise.

Technical Analysis: Bitcoin price has high targets

Bitcoin price is presently trading at $34,603, bouncing off the short-term support level of $33,901 on the 3-day chart. Testing this level as a support floor is necessary for BTC to sustain the uptick it has achieved in the past few weeks and push the cryptocurrency toward the next major barriers.

Bitcoin has its eyes set on $36,833, the reclaiming of which is crucial for a rise toward $40,000. Breaching this level would likely mark the beginning of the bull run that the market has been waiting for since 2023 began.

The Moving Average Convergence Divergence (MACD) indicator suggests the bullish momentum is far from waning as the green bars continue to increase on the histogram, which is a positive sign.

BTC/USD 3-day chart

However, if Bitcoin price loses the support of $33,901, a drawdown to $31,507 is likely and potentially inevitable. This would also push short traders to bring the cryptocurrency down to $30,000, and breaking through that level would invalidate the bullish thesis for good.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.