Bitcoin price rally this week is just a mere drop on a hotplate

- Bitcoin price ekes out gains for the week after a two-week negative print.

- BTC price, however, is nowhere near any signs of recovery and could be set for another leg lower next week.

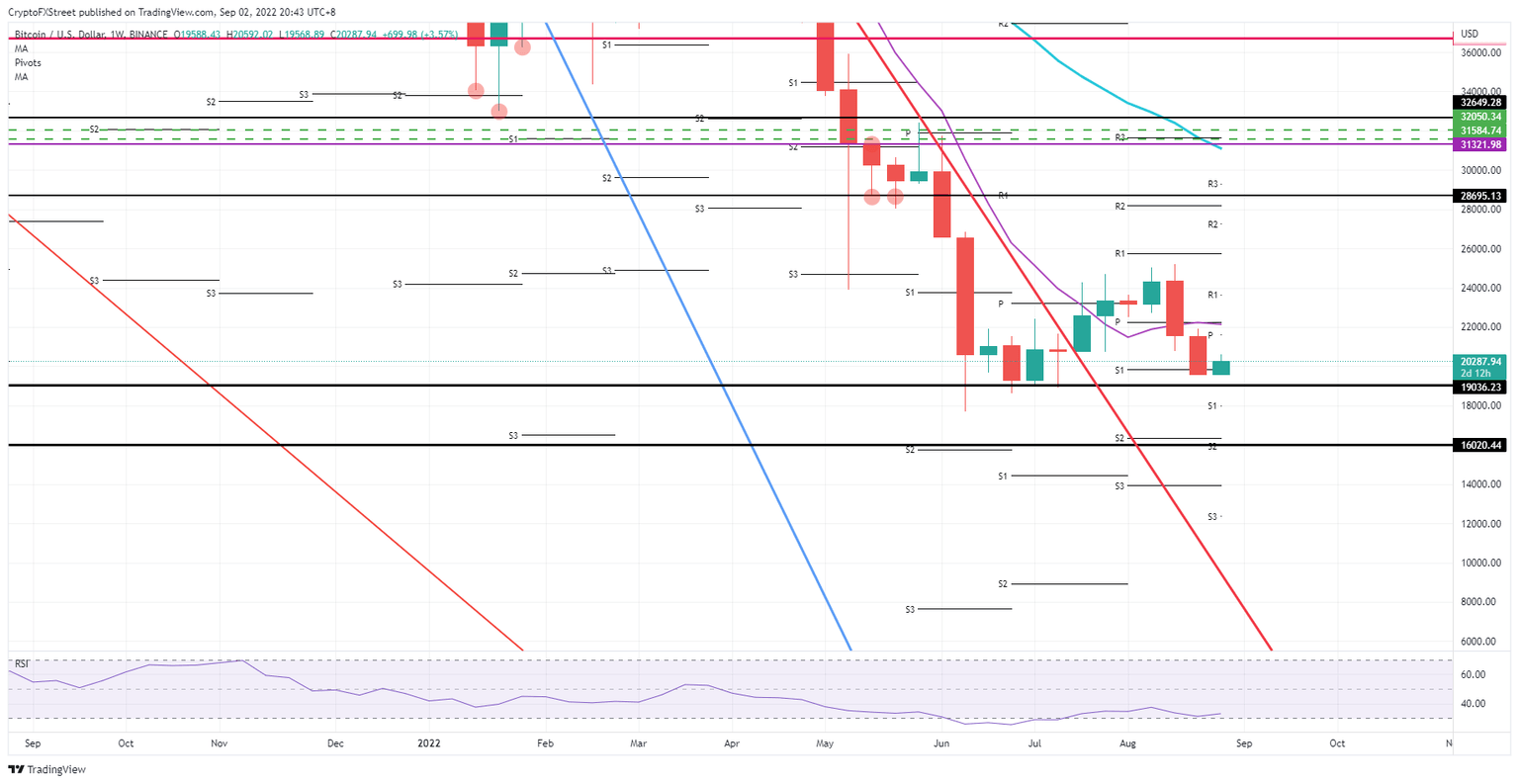

- Expect price action to be pushed against $19,036 and could drop in the coming weeks towards $16,020.

Bitcoin (BTC) price rewards brave bulls with gains for the week after price action finally pushed back against the bear trend where Bitcoin is in. Unfortunately, a weekly price chart does not show a nice picture with no signs of a turnaround. Instead, a squeeze to the downside continues with lower highs, set to see BTC price say goodbye to $20,000 for the last quarter of 2022.

BTC price is getting chopped by the bond market

Bitcoin price is undergoing a harsh law in economics, finance and investing as the cash drain out of cryptocurrencies continues. Investors are switching their attention towards US treasury notes that are currently paying out roughly 3% or more on yield as the US Fed keeps hiking, making bonds more and more attractive as a product of investment. Why would one still pour its money into cryptocurrencies that are having their worst performing year in their existence while safe government bonds return you over 3% coupons?

BTC price thus is not in a sweet spot against the current macro dynamics that are seeing investors flee into safe havens. Expect price action to decrease at the high while the low end gets further pushed against $19,036 until it breaks. To the downside, BTC could go as far as $16,020, where the new monthly S2 support for September falls perfectly in line with that level.

BTC/USD Weekly chart

Markets and Bitcoin believers require a bullish signal from their favorite cryptocurrency. The green weekly close would already be a good sign, and should BTC price break above $22,000 and close above the 55-day Simple Moving Average (SMA), something significant would have changed in the price dynamic in cryptocurrencies. Not that $28,695 or $30,000 would be back in the picture, but at least $26,000 would come back to play in the medium-term.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.