Bitcoin price rallies past $30,000, fuels bullish narrative in altcoins Solana, Toncoin and Hedera

- Bitcoin price climbed past the psychological barrier of $30,000 and instilled confidence among crypto market participants.

- Analysis shows a spike in bullish narratives for Solana, Toncoin and Hedera emerging among traders.

- Altcoins led a market-wide price rally with Bitcoin’s recovery this week.

Bitcoin price pushed back above the key $30,000 level on Tuesday, instilling confidence among market participants. The $30,000 was considered a key psychological barrier and a break past this level has painted a bullish picture for altcoins as well.

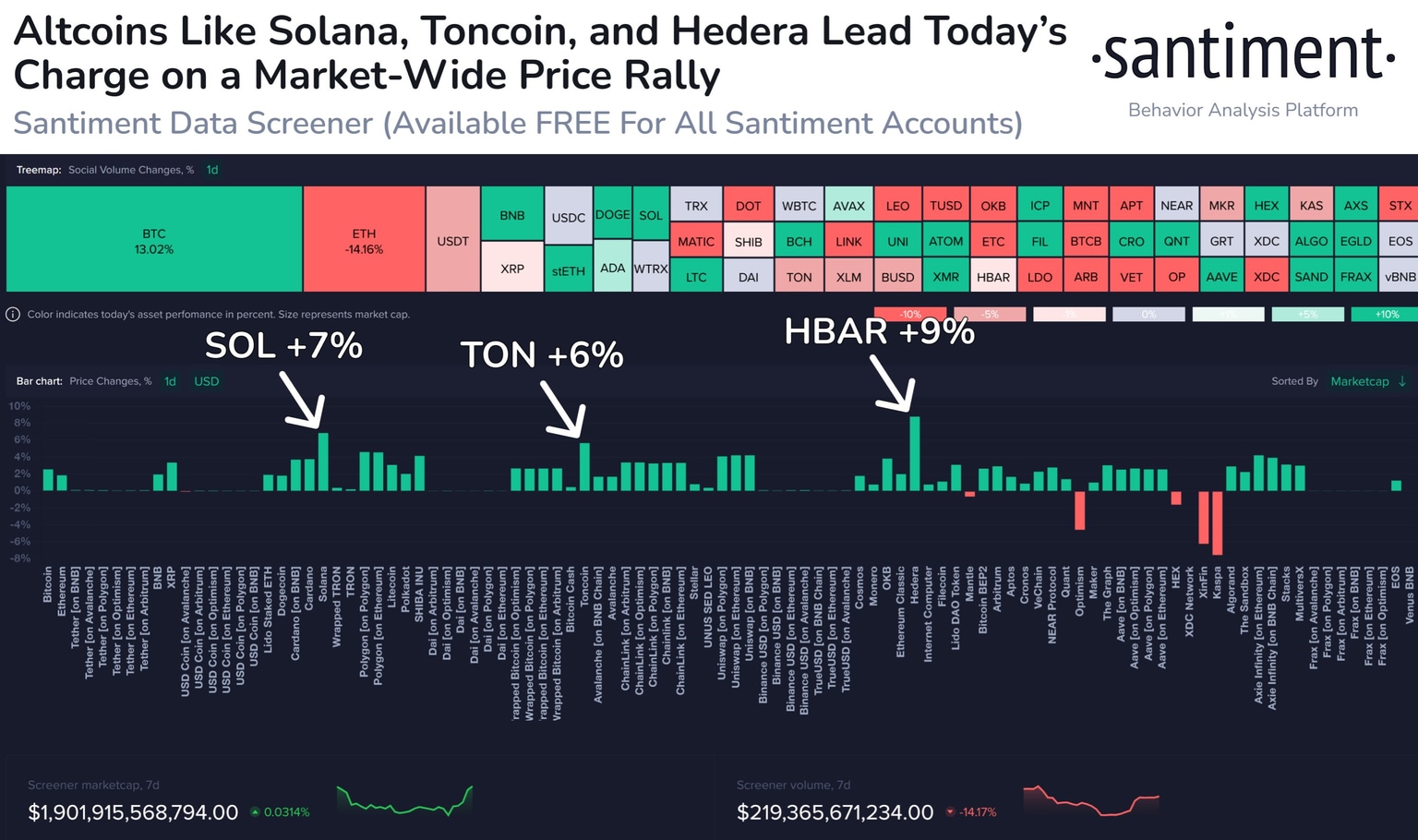

Altcoins Solana (SOL), Toncoin (TON) and Hedera (HBAR) yielded between 6% and 9% gains for holders overnight, a bullish narrative for alternative cryptocurrencies emerged.

Also read: Ripple XRP price eyes $21 bullish target, analysts are bullish on the altcoin

Bitcoin price bullish break above $30,000 kickstarts gains in altcoins

Crypto analysts and influencers like pro-XRP attorney John Deaton have informed traders in the community that a recovery or a rally in altcoins is likely in a Bitcoin bull market. Bitcoin’s bullish break past the $30,000 fueled a bullish sentiment among altcoin holders and SOL, TON, HBAR emerged as the top three altcoins yielding between 6% and 9% overnight gains for traders.

Analysts at the crypto intelligence tracker Santiment analyzed the performance of altcoins, in response to the BTC rally on Tuesday. As seen in the chart below, altcoins have attempted a comeback with recovery rallies in several tokens like MATIC, LTC, AVAX and UNI, among others.

Altcoins leading a market-wide price rally in response to BTC break past $30,000

The altcoin month index on Blockchaincenter.net reads 65 on a scale of 0 to 100, signaling that the market is closer to an alt season than before. An alt season is a period in which gains from Bitcoin and fresh capital flows into altcoins and DeFi tokens. This is marked by top 50 altcoins according to market capitalization, outperforming Bitcoin over a 30-day time frame.

Altcoin Month Index from Blockchaincenter.net

Once altcoins in the top 50 dominate in gains, they are likely to kick off alt season, yielding massive gains for holders of DeFi tokens, exchange tokens and top 50 cryptocurrencies by market capitalization.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.