Bitcoin price pulling back after a 50% rally means this for the crypto market

- Bitcoin price is beginning to exhibit market top-like signals, which suggests selling pressure may be ona the rise.

- Lack of movement at the hands of whales toward stablecoins despite a hike in social mentions suggests interest is at a low.

- The MVRV ratio for the biggest cryptocurrency is well into the danger zone, which further backs the possibility of selling.

Bitcoin price has gained significantly throughout the last couple of weeks, but by the looks of it, the green candle streak might be coming to an end. On-chain data highlights that while on the surface, the crypto market is still bullish, signs of potential selling are becoming evident when delved deeper.

Bitcoin price might begin trending downwards

Bitcoin price registered a 50% increase in value over the duration of a month from mid-March to mid-April. This resulted in the social volume toward BTC rising by 81% in the last 30 days, month on month.

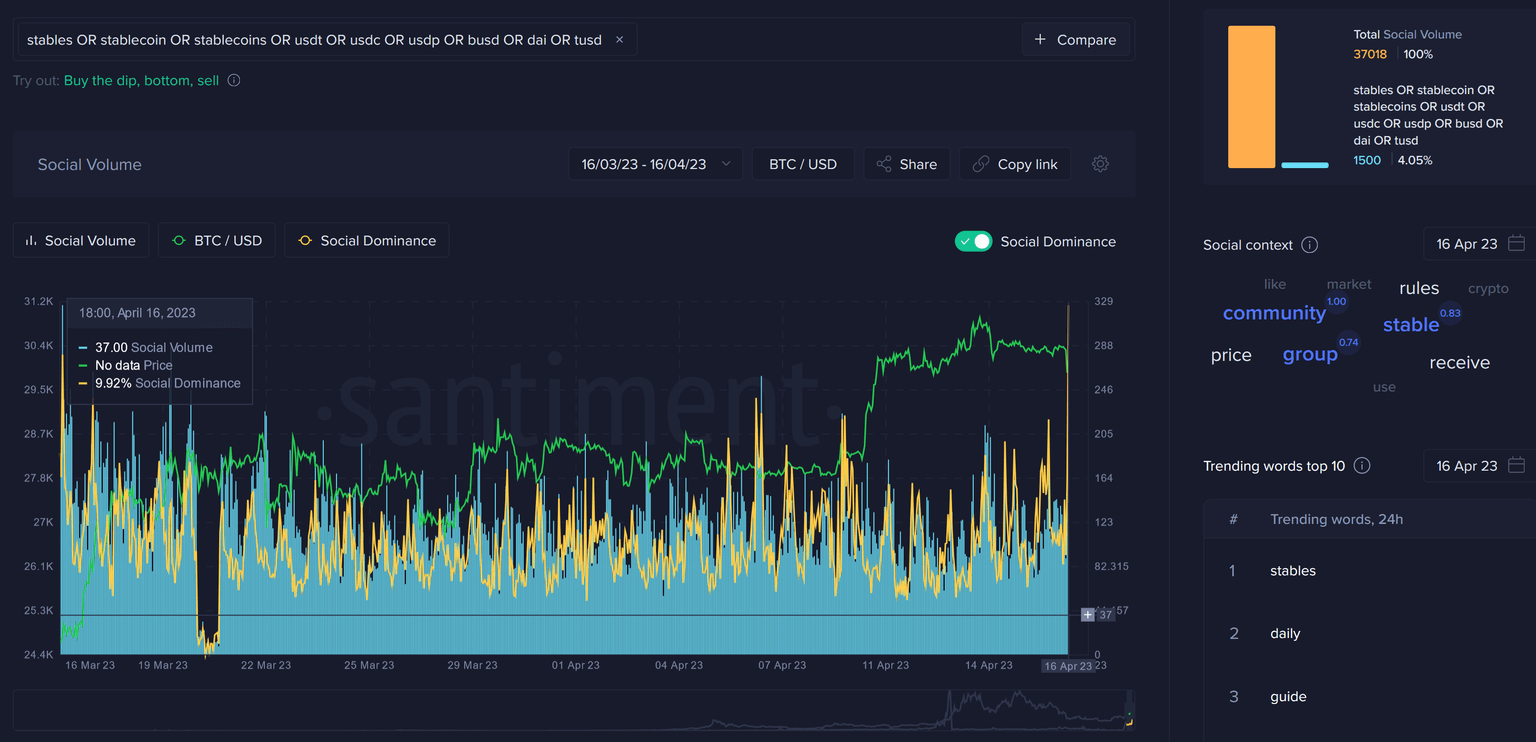

However, the biggest cryptocurrency in the world is not alone in this, as stablecoins are also observing high social mentions. This, according to Santiment, is usually a bearish signal and points towards profit-taking as traders consider the market conditions as toppish in nature.

Stablecoin social volume

However, even as the social volume around the dollar-pegged assets is rising, the whales are showing no significant interest. The transactions worth over $100,000, which is typically a whale movement indicator, have been within the normal ranges for all top-cap stablecoins.

Furthermore, the discussions surrounding crypto overall are also declining, although it doesn’t indicate much since FOMO could bring that back at any time.

Stablecoin whale movement

But the real signals come from looking at past patterns. The 365-day Market Value to Realized Value (MVRV) ratio has been on an incline. In the span of a month, the indicator has risen from the neutral line to just under 30% at the time of writing.

Usually, a breach above 30% puts Bitcoin in the danger zone, which is synonymous with corrections. In the past, too, BTC reaching beyond 30% has resulted in a price drop, case in point November 2021, December 2020, and September 2019.

Bitcoin MVRV ratio

Thus if the formation plays out as it has in the past, Bitcoin price is vulnerable to a decline. The cryptocurrency is observing a 2.84% drop at the time of writing.

Bitcoin MACD

Plus, the bearish crossover taking place on the Moving Average Convergence Divergence (MACD) suggest the same. The signal line (red) crossing over the MACD line (blue) is evidence of potential bearishness, which could significantly impact the price going forward, setting off a correction for BTC.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.09.22%2C%252018%2520Apr%2C%25202023%5D-638173638177754143.png&w=1536&q=95)