- Bitcoin price hit a new all-time high at $48,142 after Tesla announced the purchase of $1.5 billion worth of BTC.

- Many on-chain metrics show that retail investors are looking to buy Bitcoin.

- Nonetheless, investors need a plan to exit in case of a crash.

After Tesla’s big announcement of a $1.5 billion purchase worth of Bitcoin and the possibility of accepting the digital asset as a payment option, the flagship cryptocurrency had a massive move to a new all-time high at $48,142 and aims for more.

Bitcoin price can hit $50,000 as interest grows significantly

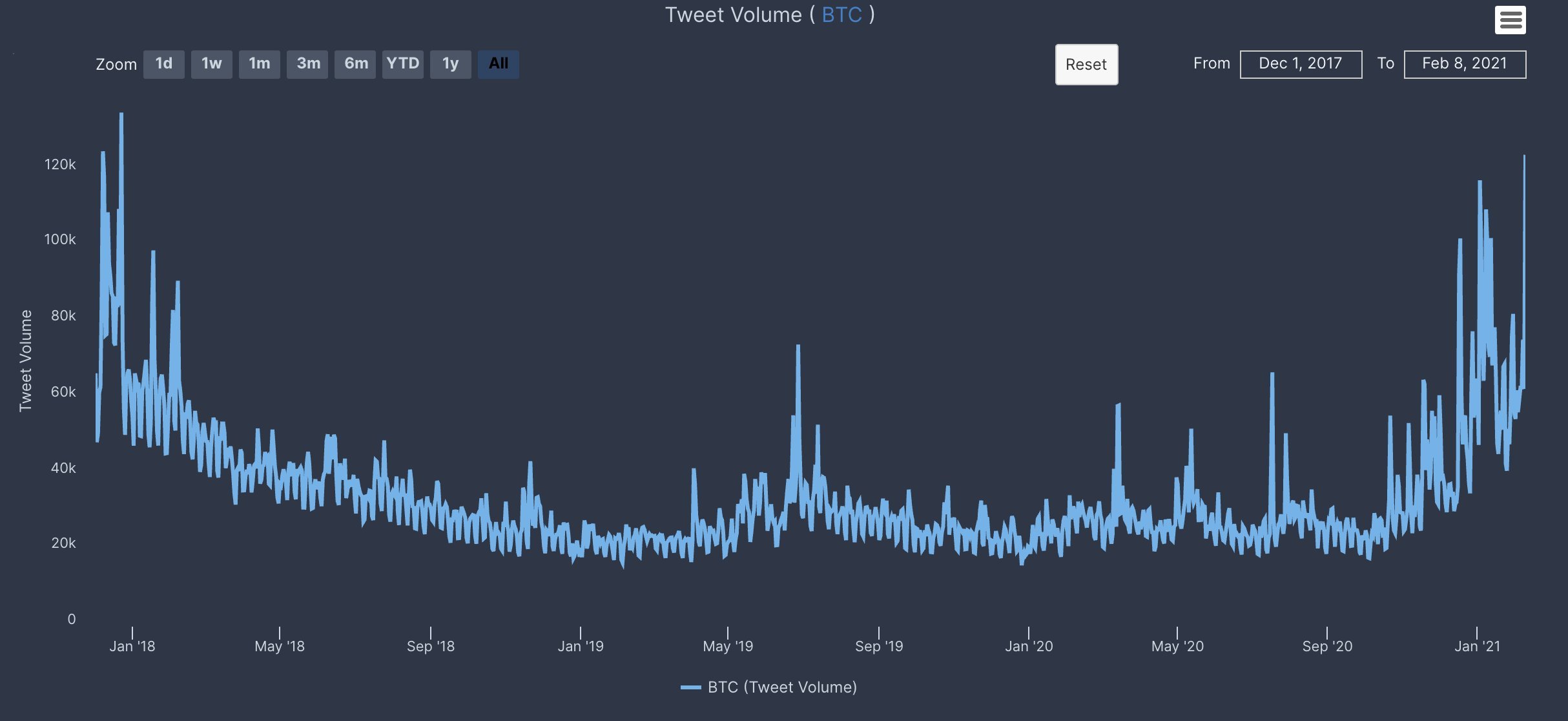

After the most recent rally towards $48,142, Bitcoin’s Twitter volume has just hit a new all-time high with around 143,000 tweets sent in just 24 hours, beating the previous high of December 22, 2017.

Bitcoin Twitter Volume

This number indicates that retail interest in Bitcoin and cryptocurrencies has grown significantly but could increase even more. On top of that, the number of active addresses has also seen a massive increase over the past several months.

Bitcoin active addresses

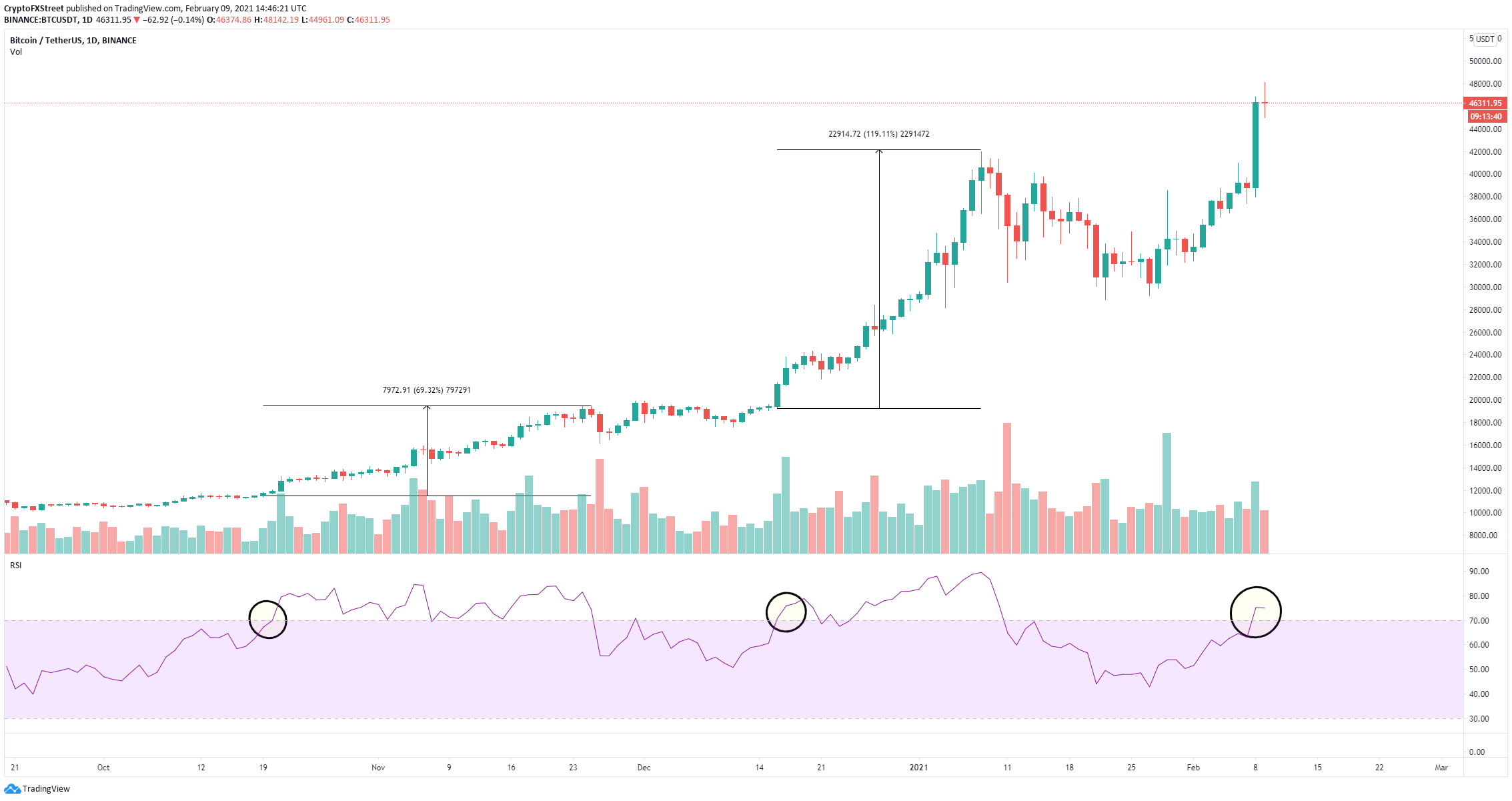

The rise in active addresses indicates that the climb to $48,142 is justified as it matches the activity of the network. After the recent 25% price spike, the RSI is overextended on the daily chart again.

BTC/USD daily chart

However, the past two times this happened, Bitcoin prices continued to surge even higher. In October 2020 the RSI was overextended but Bitcoin climbed 70% until it cooled off. Similarly, back on December 16, 2020, BTC had a 120% rally despite the RSI being overextended. This theory seems to suggest that Bitcoin price is poised for a significant move within the next few weeks.

Stages of a Bubble as seen by a 45 year trading veteran

— Peter Brandt (@PeterLBrandt) February 9, 2021

Stage 1. A neighbor asks me what I know about $BTC

Stage 2. A friend ask if $BTC is a good buy

Stage 3. A relative asks if he/she should buy $BTC

Stage 4. A person I've not seen in 30 yrs, calls, bragging he/she bought $BTC

Despite Bitcoin’s momentum, trading veteran Peter Brandt has warned investors that Bitcoin’s bubble could pop soon. According to Brandt, when average people ask about Bitcoin, if it’s a good buy or a good investment, the asset could be on the verge of a correction. This theory makes sense as Bitcoin and other assets can normally experience pullbacks when their social volume spikes.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

White House Crypto Summit could boost adoption across financial markets: Binance exec Rachel Conlan

Trump’s White House Crypto Summit is hours away, and executives maintain optimism and a positive outlook on crypto adoption. Rachel Conlan of Binance expects increased institutional and retail participation.

Bitcoin Weekly Forecast: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

Solana’s co-founder says ‘No Reserve’ to SOL as a part of Trump’s Crypto Strategic Reserve

Solana price stabilizes and trades around $142.8 at the time of writing on Friday after falling nearly 20% this week. Solana co-founder Anatoly Yakovenko raised concern about SOL as part of the US Crypto Strategic Reserve on his social media X.

BTC, ETH and XRP struggle despite Trump’s Bitcoin Reserve order

Bitcoin price is extending its decline on Friday after falling more than 7% so far this week. Ethereum price is retesting its key support level at around $2,125; a close below would extend the correction.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[15.47.08,%2009%20Feb,%202021]-637484794874808679.png)