- Bitcoin hovers above the $20,000 level following the recent Fed-hike announcement.

- On-chain metrics show bears are already underwater and may still need to capitulate.

- Invalidation of the bullish thesis is a breach below $19,610.

Bitcoin price is at a make-or-break decision. Currently, the peer-to-peer digital currency is hovering above a key level. If market conditions persist, bulls may be able to pull off another rally going into the new year.

Bitcoin price shows bears underwater

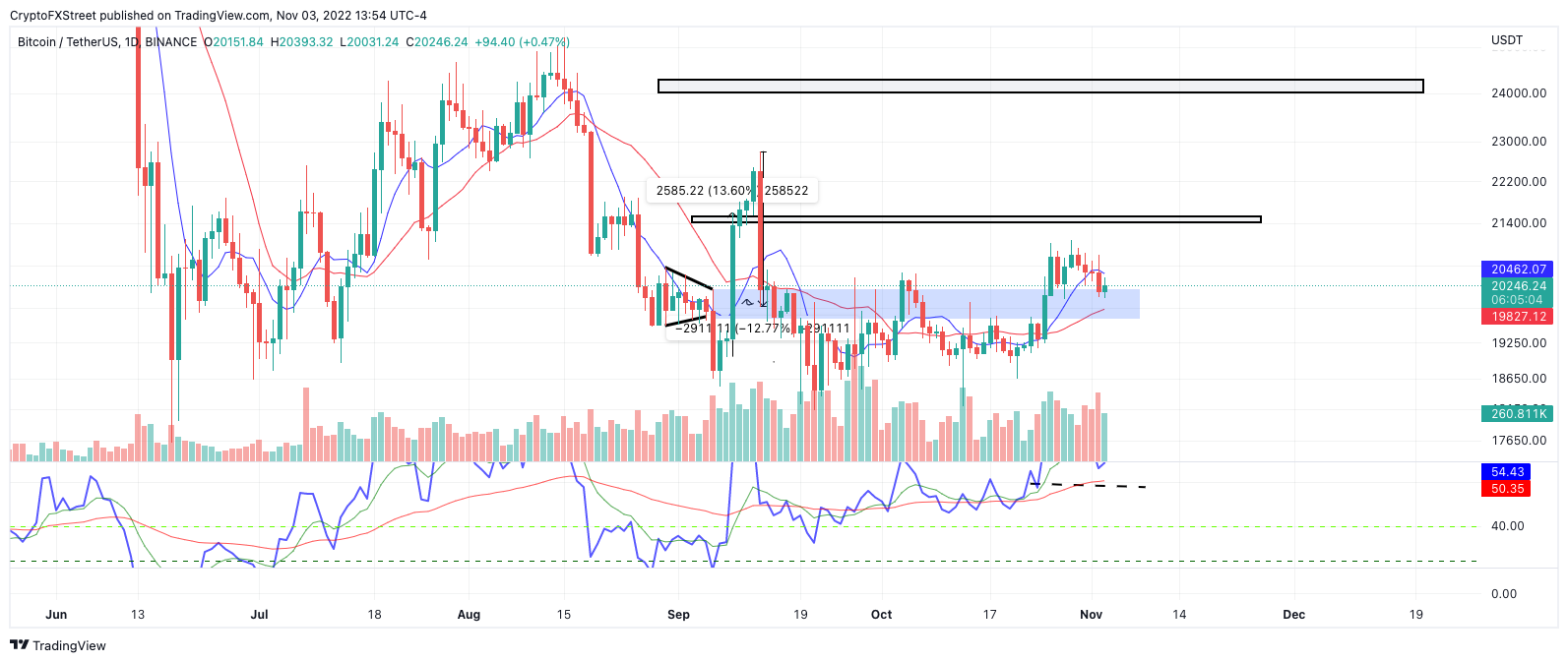

Bitcoin is finding support above the previous triangle apex near the $20,300 price level. On November 2, the bulls lost support from the 8-day exponential moving average following the Fed-hike announcement. Although nothing is certain, BTC’s ability to sustain above the previous congestion zone is an optimistic signal that BTC may be able to dodge inflation’s depreciating effects on the economy.

Bitcoin price currently auctions at $20,305. The Relative Strength Index (RSI) shows a bearish divergence between the last two highs, which likely enticed bears to flex their power following the Fed monetary policy announcement. Still, it is very rare for the RSI to top on the first bearish divergence signal. If the bulls can stabilize in this zone, a challenge of the last-minute October highs at $21,000 will stand a fair chance of occurring.

BTC/USDT 1-Day Chart

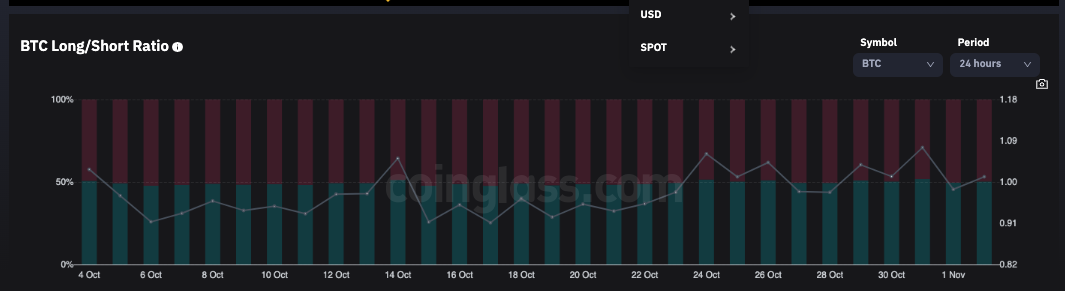

Coinglass’ Long vs. Short Ratio compounds the idea that the bears may soon face a challenge, as the last week of October shows most retail traders positioned short in the market. Nearly six of every ten traders were positioned short on October 24, when BTC traded between 19,602 and 19,157, and October 31, when BTC traded between $20,845 and $20,237. Market makers may use this evidence to challenge bears underwater by moving the market higher to forge a liquidation event. Short-term targets lie at $20,500, while a $24,300 level may be a Santa Rally target zone.

Coinglass’s Long vs. Short Ratio

Invalidation of the bullish thesis is possible if the bears breach the $19,610 level. The breach could result in a further decline toward liquidity levels near $18,700. Such a move would create a 7% decrease from the current Bitcoin price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

ETH could see new all-time high in 2025 as blobs top burn leaderboard

Ethereum (ETH) is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

PEPE Price Prediction: Last-minute $121M whale demand sparks 1,500% 2024 rally

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

These three narratives could fuel crypto in 2025, experts say

Crypto narratives like Real-World Asset tokenization, Artificial Intelligence and Bitcoin as a treasury asset could gain relevance in 2025. Experts say meme coins could emerge as a key vertical next year and strike a cautious note about Solana and XRP ETFs.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.