Bitcoin price prediction markets bet BTC won't go higher than $138K in 2025

BItcoin (BTC $87,005) retains a $138,000 price target for 2025 as the market recovers from US trade tariffs, new analysis concludes.

Data covering bets on prediction service Polymarket suggests that BTC/USD could still gain around 60% from current levels this year.

“Conservative” polymarket users cap BTC price upside at 60%

Bitcoin bull market projections have taken a beating this quarter thanks to multiple setbacks impacting crypto and the wider risk-asset spectrum.

Now, an assessment of all potential BTC price outcomes on Polymarket concludes that the bull market cycle may be capped at around 60% before 2026.

The results were uploaded to X by user Ashwin on March 27 and show that price bets extend all the way down to $59,000.

“The great thing about this analysis is that it not only provides a market sentiment score, like the Fear and Greed Index, but also attaches to it the expected price target for both bearish and bullish scenarios,” he explained.

This offers a reference to compare one's price prediction with the market's.

BTC price targets on Polymarket. Source: Ashwin/X

Ashwin deconstructed the methodology used to analyze odds across multiple Polymarket arenas, resulting in a potential BTC price range between $59,040 and $138,617.

“The $138k Bitcoin price target may not seem bullish to most Bitcoiners, who are accustomed to hearing hyperbolic valuations. However, the market remains conservative as it recovers from the Trump tariff uncertainty,” he continued.

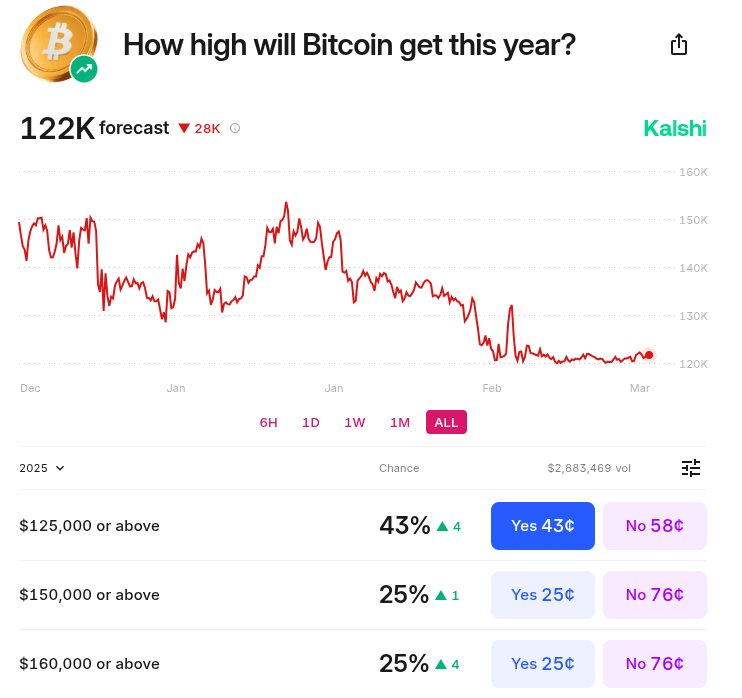

The modest expectations for BTC/USD mimic those elsewhere. On fellow prediction site Kalshi, one average BTC price target stands at $122,000 — just $11,500 beyond current all-time highs.

BTC price odds (screenshot). Source: Kalshi

Bitcoin support failure remains a risk

As Cointelegraph continues to report, market participants have drawn lines in the sand that price action should not violate in order to protect the broader bull market.

These include the area around old all-time highs at $73,800 and the 2021 peak at $69,000.

Earlier this month, a historically accurate forecasting tool, which its creator describes as showing where Bitcoin “won’t be” in the future, gave a 95% chance of $69,000 holding.

In his latest update, popular trader Aksel Kibar stressed that the yearly average of $76,000 must stay in place.

“Extremely important for the price not to breach the year-long average,” he told X followers on March 26.

BTC/USD chart. Source: Aksel Kibar/X

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.