Bitcoin Price Prediction: Is this the bull trap that will bring BTC below $14,000?

- Bitcoin price slips as all gains get erased during the week.

- BTC could slide further as the global outlook turns negative.

- With more negative headlines from several corners, it looks likely that $16,020 is up for another test.

Bitcoin (BTC) price results from a very violent week regarding economic data and central bank speakers. Even without those elements, BTC has no reason to rally substantially higher as the global market situation on its own is deteriorating quite rapidly. Several news outlets and newspapers are reporting massive layoffs in the banking industry, and tech giants have already confirmed job cuts that mount over a million people out of a job worldwide. The Covid pandemic is spreading like rapid fire throughout China, threatening to halt the world's biggest producer again.

BTC is in no Christmas mood at all

Bitcoin price is the sum of all the factors that are currently making the top headlines in the world: Covid building body count in China, job cuts in all developed economies, Ukraine unresolved with the threat of nuclear bombs still imminent, inflation and energy prices still highly elevated, more common families near the brink of poverty because of those massive energy bills…. These are just a few headlines and themes that have dominated 2022. This week almost seemed pivotal, as if all these issues would get solved in just one week, as bulls ventured to go long BTC on the break of the 55-day Simple Moving Average at $18,000.

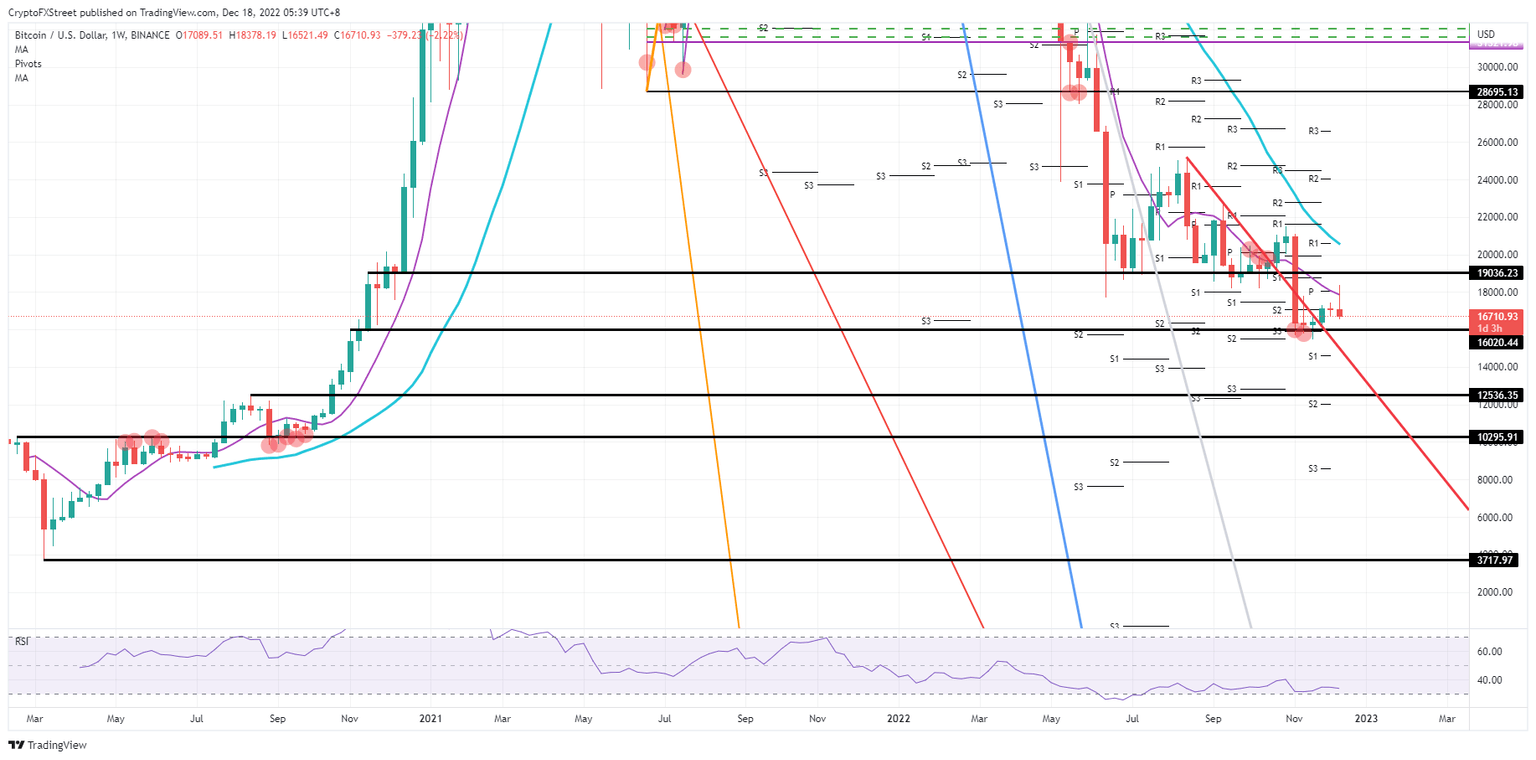

However, BTC has been sliding back lower as the reality was still there after a lower but elevated US inflation number. Several central bankers this week came with the same message and warning that the start of the new year does not mean that suddenly we get a clean slate and get to start all over again. These issues will be there on January 1st, and with that narrative, BTC is set to drop further towards $16,020 with the risk of seeing investors turning their backs again from cryptocurrencies; risk comes with a max 20% decline towards $12,536, which is the next solid technical support level, bringing BTC below $14,000.

BTC/USD weekly chart

The positive side of this is that a recession looks inevitable, which means that demand for commodities should start to diminish and see oil, copper and gas decline under falling demand. That, in its turn, is good news for households that will see the energy bill drop further and open up the disposable budget. Of course, a portion then can be relocated again towards investments, which is good news for cryptocurrencies, with BTC set to see an inflow of fresh investors by the middle of next year. Some pre-position in the first weeks of 2023 could bring Bitcoin price up towards $20,000 on the back of that motivation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.