Bitcoin Price Prediction: Is the real bull run starting now?

- Bitcoin price performs an impressive fake out, rallying 18% in two days.

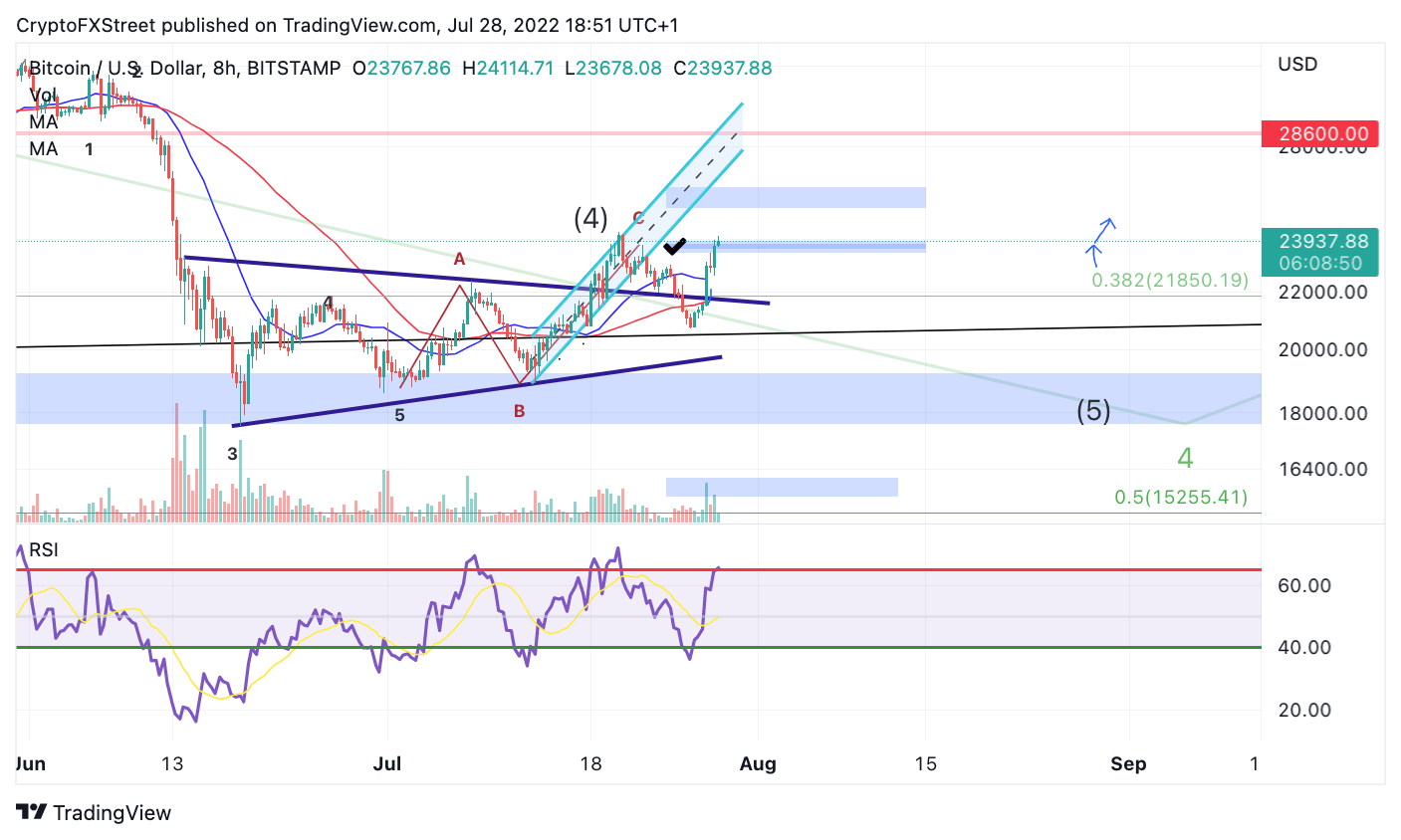

- The 1-2-1-2 wave pattern can justify a sharp incline in the coming days towards $28,000. A bullish case should not be ruled out entirely.

- Invalidation of the uptrend is a break below is a break below $20,690.

Bitcoin price has shown an impressive rebound following the highly anticipated Fed decision. More upside potential is possible, but reducing risk should be prioritized during the uptrend.

Bitcoin price prepped to shock the world?

Bitcoin price has rallied nearly 18% since the July 26 lows at $20,690. The peer-to-peer digital currency is on a steep incline aiming for new monthly highs at $24,130. Calling an end to the uptrend will be challenging as the rally does not look like a clear impulse wave since the $18,900 lows on July 13. Still, Elliott wave theory has shown in the past that Choppy 1-2 1-2 patterns can lead to surging bull runs.

BTC/USDT 8-Hour Chart

Bitcoin price can still rally as high as $30,000. The bullish scenario is an unfavorable narrative based on the unclear technicals but still a valid reason for explaining a future moonshot impulse wave in retrospect. Don't sleep on Bitcoin price. It can still rally higher under erratic behavior. The first targets lie in the mid $28,000 zone.

For traders looking to take risks, the trade is justifiable. If this is the beginning of wave 3, then the BTC price must not breach below $20,690 under any circumstances. If $20,690 is breached, the BTC price could see a fall towards $16,200, resulting in a 30% decrease in current market value.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.