Bitcoin Price Prediction: BTC yet to face its toughest hurdle at $19,100

- Bitcoin price explodes due to five-month bullish divergence but is yet to encounter a critical hurdle.

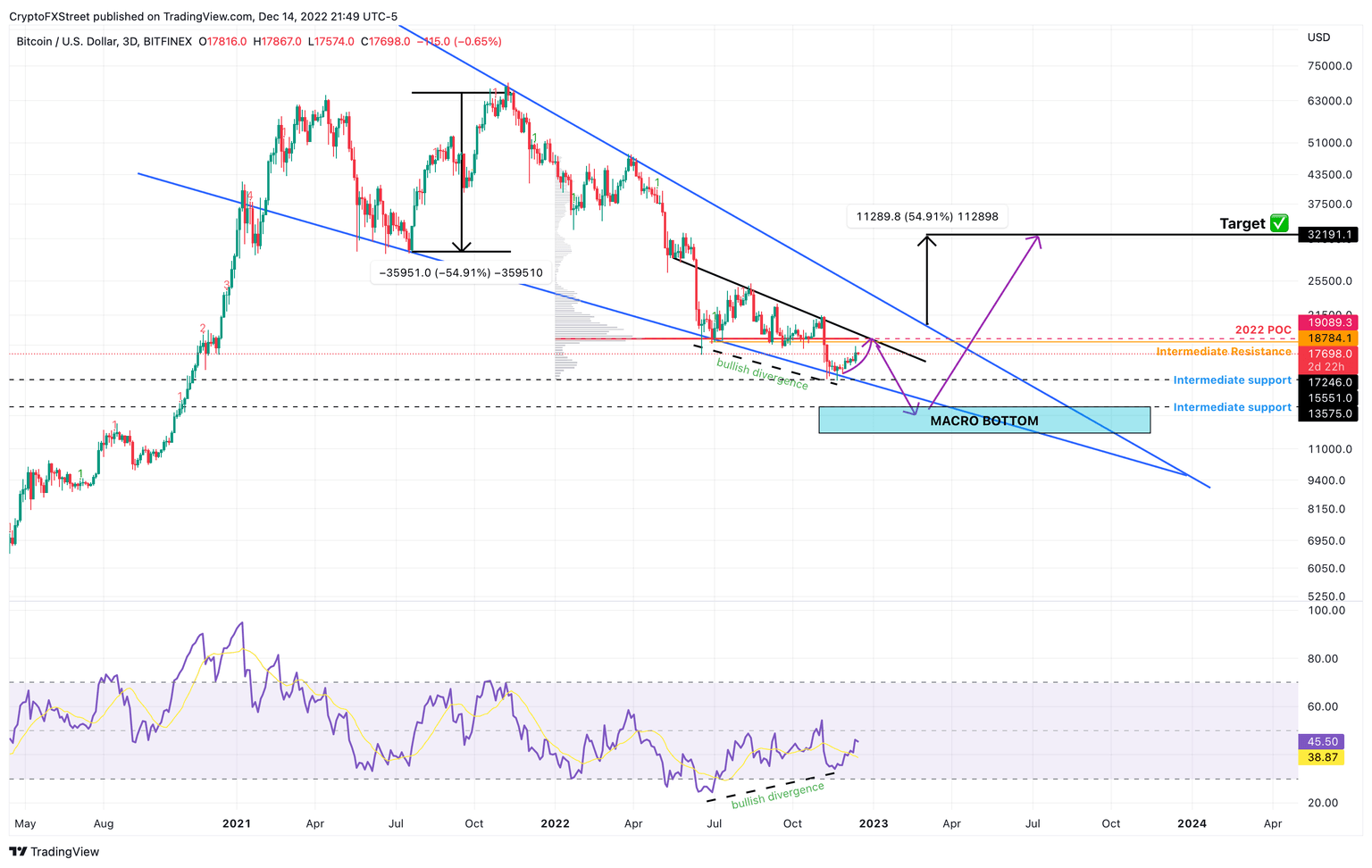

- The 2022 POC at $19,089 will be a major blockade if BTC continues to extend higher.

- A daily candlestick close below $15,551 will invalidate the bullish thesis.

Bitcoin price shows a recent explosive move that has overcome an immediate hurdle. As impressive as this run-up is, BTC needs to tackle another resistance level that will likely provide a major pushback.

Also read: FOMC Recap: Fed hike impact on Bitcoin, Ethereum and Gold

Bitcoin price kick-starts bear market rally

Bitcoin price rallied roughly 9% over the last 11 days. This move comes after days of tight, directionless consolidation. Although BTC has moved above the June 18 lows at $17,593, it needs to hold above this level for a sustained move to the upside.

A pullback to the $17,303 intermediate support seems likely before any massive move originates after the recent move. This retracement will allow buyers to recuperate and push Bitcoin price to the 2022 Point of Control (POC), which is the highest traded level at $19,089.

Overcoming this blockade will be crucial for the Bitcoin price rally to shift from being a short-term move to a longer term bear market rally. Therefore, investors need to be patient.

BTC/USDT 1-day chart

On the other hand, if Bitcoin price produces a daily candlestick close below $15,551, it will create a lower low and skew the odds in the bears’ favor. This development will invalidate the bullish thesis for BTC.

In such a case, Bitcoin price could revisit the $13,575 support level, which is the upper limit of the potential macro bottom that stretches up to $11,898.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.