- BTC/USD has resumed the recovery after a consolidation period.

- The critical resistance is seen on approach to $10,000.

Bitcoin (BTC) is attempting to clear $9,800 during European hours on Monday. The first digital asset touched the intraday high at $9,838 and retreated to $9,800 by the time of writing. BTC/USD short-term upside trend is gaining traction amid foreign currency crisis in Argentina.

Read also: Foreign currency crisis in Argentina might have triggered Bitcoin growth

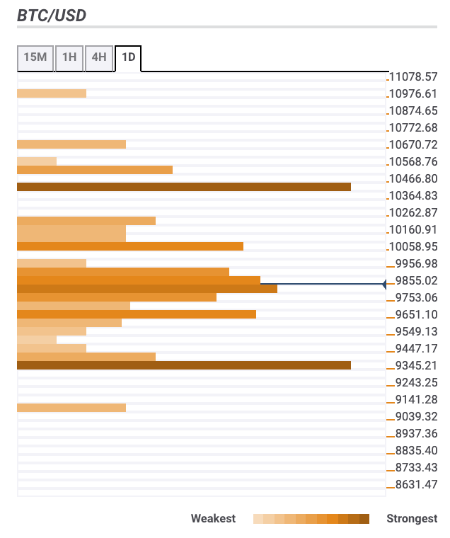

Bitcoin confluence levels

Now that BTC/USD cleared $9,600 barrier, the further upside looks highly likely. While the critical resistance is located on approach to psychological $10,000, the coin retains bullish bias as long as the price stays above $9,600. A way to the South is packed with strong technical barriers that may limit the downside correction.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$9,900 - SMA50 (Simple Moving Average) 4-hour and SMA200 1-hour, the upper line of 1-hour Bollinger Band

$10,000 - Pivot Point 1-day Resistance 1, 23.6% Fibo retracement monthly.

$10,400 - Pivot Point 1-week Resistance 1, SMA50 daily.

Support levels

$9,600 - the middle line of 4-hour Bollinger Band, 23.6% Fibo retracement weekly, SMA50 1-hour;

$9,350 - the lowest level of the previous month and the lowest level of the previous week, Pivot Point 1-day Support 3.

$9,000 - Pivot Point 1-month Support 1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.