Bitcoin Price Prediction: BTC/USD upside capped by one paramount resistance – Confluence Detector

- Bitcoin is battling the key resistance at $8,696 in the fight to return to levels above $9,000.

- Bitcoin faces a situation of scarce support areas; forcing the buyers to defend the $8,600 support at all costs.

The crypto market has once again started the week in the red. The drab action comes after a very fruitful weekend that saw Bitcoin rise above $9,000. The entire market also corrected upwards on Sunday. However, Bitcoin established a new January high at $9,184 before reversing back into the $8,000 range. The support at $8,500 came in handy, allowing the buyers to push for gains above $8,600.

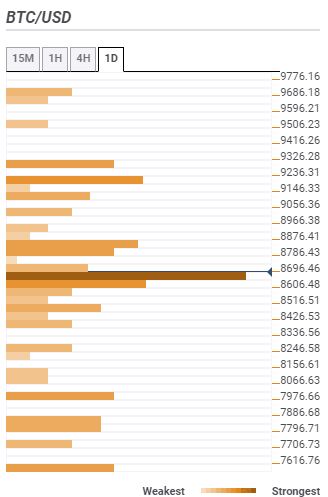

Bitcoin confluence levels

Confluence levels help to identify resistance and support levels that are valuable in trading. The daily confluence detector places the initial and the most significant resistance at $8,696. Various indicators converge at this point including the SMA ten 15-minutes, SMA ten 1-hour, SMA five 4-hour, Bollinger Bans 15-mins upper, previous high 15-mins and the SMA 100 15-mins.

Bitcoin bulls have one big task; to clear the resistance at $8,696 because heading to $9,000, the hurdles at $8,786 and $8,876 are relatively weak. However, correction above $9,000 will come face to face with more hurdles at $9,236 and $9,326.

Examining the downside, I can tell that support levels are scarce. Therefore, the bulls must be careful and sustain BTC above $8,600 support as highlighted by the previous low 1-hour, Fibo 161.8% one-month, Bollinger Band 1-hour lower and SMA 50 4-hour. Further correction southwards could lead to losses into the $7,000 range. Besides, the next tentative support areas include $7,976 and $7,796.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren