Bitcoin Price Prediction: BTC/USD trapped inside a triangle again - Bitcoin confluence

- BTC/USD bulls will struggle at the upper boundary of the triangle pattern.

- An important support is created by $9,100-$9,000 area.

Bitcoin (BTC) recovered after a major sell-off on Thursday to trade at $9,450 by the time of writing. The first digital asset has gained over 2% since the start of the day, though it is is till down 5% on a day-to-day basis. Notably, Bitcoin (BTC) has returned inside the triangle pattern, while its upper boundary at $9,550 now serves as a local resistance. Once it is out of the way, the upside is likely to gain traction with the next focus on $9,800 and $10,000.

BTC/USD 1-hour chart

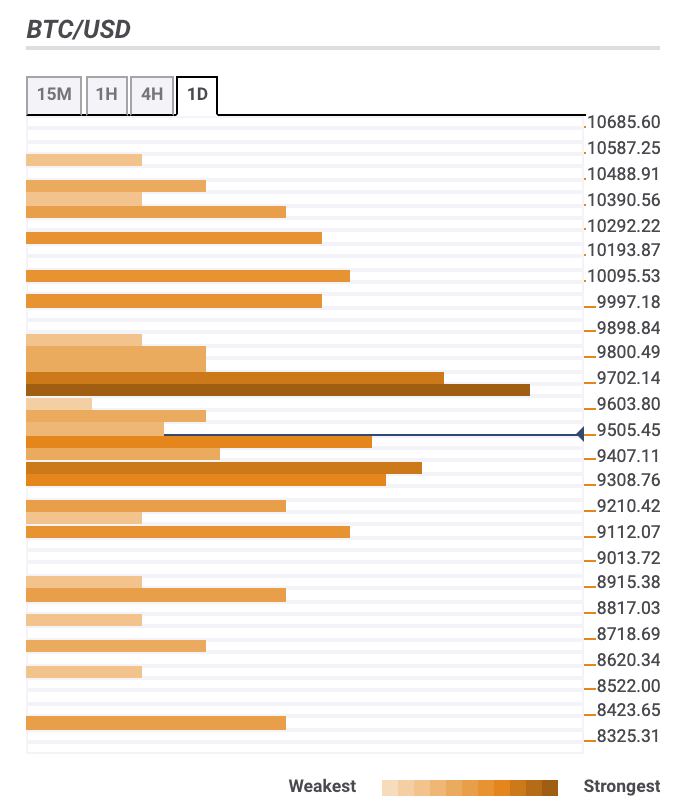

Bitcoin confluence levels

There are a lot of strong technical barriers clustered above the current price, which means, Bitcoin bulls might have a hard time building a recovery momentum. The downisde is the path of least resistance at this stage.

Resistance levels

$9,650 - 23.6% Fibo retracement monthly, 61.8% Fibo retracement daily, the upper line of the 1-hour Bollinger Band

$10,000 - 61.8% Fibo retracement weekly, the highest level of the previous day

$10,200 - Pivot Point 1-week Resistance 1, the upper line of the daily Bollinger Band

Support levels

$9,350 - 38.2% Fibo retracement monthly,

$9,100 - the lower line of the 1-hour Bollinger Band, Pivot Point 1-week Support 1, the lowest level of the previous day

$8,850 - 61.8% Fibo retracement monthly

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst

-637275493461228100.png&w=1536&q=95)