- The biggest hurdle for Bitcoin is slightly above the current market price.

- Bitcoin risks plunging to lows close to $3,500 as traders continue to lose confidence.

It is important that Bitcoin trends higher and even breaks above $4,000. This move will increase the traders’ confidence who will want to bring BTC/USD above the critical $4,200. Meanwhile, Bitcoin is still in the red at press time with losses amounting to 1.4% on the day. The entire market is swimming in the sea of red with all the top five digital assets showing declines between 0.5% and 3%.

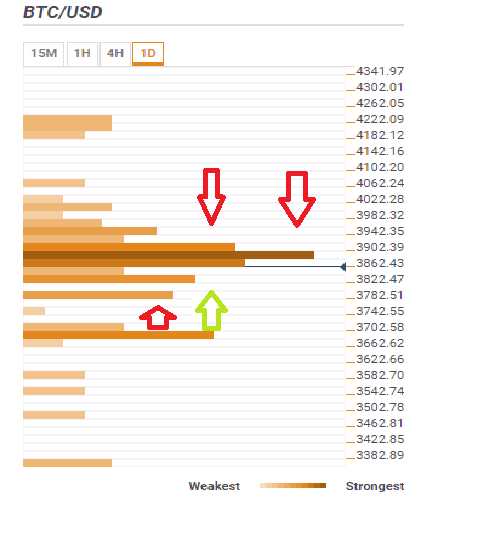

Bitcoin confluence detector levels

The biggest hurdle for Bitcoin is slightly above the current market price at $3,902.39. Bitcoin is exchanging hands at $3,844. The confluence of indicators at the hurdle are the Bollinger Band 1-hour middle curve, 5 SMA 4-hour, 100 SMA 15’ chart, the 38.2% Fibonacci retracement level daily range, Bollinger Band 15’ upper curve, Bollinger Band 4-hour middle curve, 10 SMA 4-hour, 50 SMA 1-hour, 200 SMA 15’ and the 61.8% Fibo.

The second hurdle is seen between $3,902.39 and $3,942.35. The range is characterized by the previous week high, the previous high daily range, the Bollinger Band 1-hour upper curve, pivot point 1-day R1, Bollinger Band 4-hour upper curve, the pivot pint 1-week R1, the pivot point 1-day R1, the pivot point 1-day R2, the 161.8% Fibo daily range, and the pivot point 1-day R3 confluence.

Bitcoin needs to clear these hurdles for a correction above $4,000 in order to pave the way for further gains. However, the asset risks plunging to lows close to $3,500 as traders continue to lose confidence in the digital asset’s ability to trend higher. Before that, buyers will try to find support at $3,822.47 highlighted by the previous low 1-hour, the 38.2% Fibo weekly chart and the pivot point 1-week S3. Another support is support is seen at the 61.8% Fibo ($3,782.51) and between $3,662.62 and $3,702.58 with a confluence of the 100 SMA daily range, pivot point 1-month S1, the 61.8% Fibo 1-minute range, the Bollinger Band 1-day lower curve, and the Bollinger Band 1-day lower curve.

If Bitcoin bears clear this region, expect Bitcoin to plunge further down and possibly find support close to $3,500.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin Price Forecast: Bulls deploy $355M in DOGE longs amid Gensler exit confirmation

Dogecoin price crossed $0.40 on Friday, after a weeklong consolidation that saw DOGE tumble 13% from last week’s peak. Derivative market reports link the DOGE rally to Gary Gensler’s imminent exit.

Crypto Today: XRP gains 10%, Cardano, XRP, and DOGE price rallies, delay Bitcoin’s $100K breakout

The global cryptocurrency sector pulled $230 million capital inflows on Friday, as markets reacted positively to news of SEC Chair Gary Gensler’s imminent exit.

Cardano Price Forecast: ADA could rally by another 30% as on-chain data signals bullish sentiment

Cardano (ADA) surged 24% to $0.98 on Friday following rising weekly active addresses, increased open interest and spot buying pressure.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.