- Glassnode on-chain data shows that 78.9% of all Bitcoin addresses are currently in profit.

- Matt D’Souza, the CEO of Blockware solutions believes correlation with the stocks is not entirely a bad thing.

- Retail investors and traders are likely to hold onto the asset (Bitcoin) that makes them money.

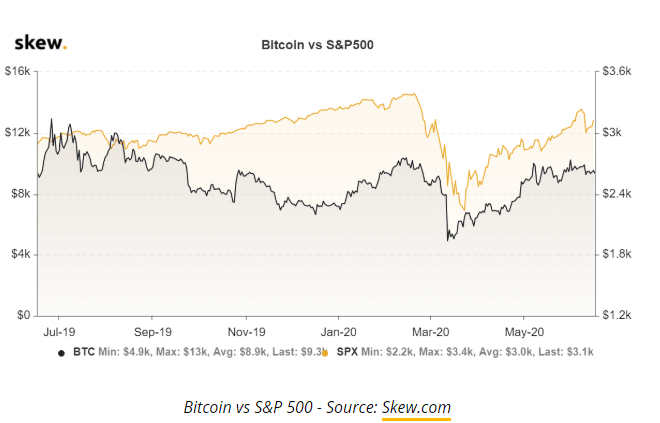

Bitcoin’s recent fall to $8,900 must-have allowed more investors to join the market. However, the king of cryptocurrencies has continued to struggle with the resistance at $9,500 and $9,600 respectively. For gains towards the critical $10,000, these two zones need to flip from resistances to support areas. Bitcoin is also struggling to decouple from the stock markets. However. Some correlation still exists considering the fall on Monday that happened in tandem with S&P 500 futures. According to a Twitter thread by Matt D’Souza, the CEO of Blockware solutions:

What is fascinating about BTC are the multiple short-term correlations that emerge. We have witnessed strong, short term correlations to Gold, to USD/CNY, and most recently US Equities. this signals an expanded breadth of market participants owning Bitcoin.

D’Souza’s opinion regarding the correlation with the stocks and the US securities is such that Bitcoin is getting more attention from the institutional investors as well as retail portfolios. In other words, “Each correlation indicates a different use case - Digital Gold, Vehicle for Capital Flight, Risk-On Asset (Disruptive Technology).”

Bitcoin investors remain bullish

Global equity markets are beginning to recover from the pandemic-triggered market crash. It is also essential to note that Bitcoin investors are also profiting from the recovery witnessed since March in spite of the price struggling to recover above $10,000. Data by Glassnode, an on-chain analysis platform shows that 78.9% of Bitcoin addresses are now profitable. The percentage is arrived at by using a metric that takes into account the time the Bitcoin wallets received the coins the current price of Bitcoin. This way Glassnode is able to tall if the holder is in profit or loss.

D’Souza believes that the retail investors and even traders are unlikely to dump Bitcoin in order to recover from the losses accrued in the traditional markets. However, they will tend to hold onto the assets that make them money.

The way retail/traders operate is once they go underwater they’re overwhelmed and upset so once they hit breakeven they sell and are relieved. This creates what’s called ‘overhead supply’. But if everyone is a winner then they’re holding and enjoying the ride and the asset moves up quicker. So the more winners the better the asset moves higher without people sitting around trying to get out at breakeven and creating selling pressure.

Bitcoin price analysis

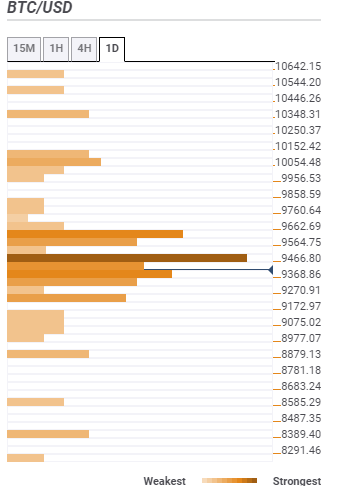

Looking at the daily confluence levels, Bitcoin is facing resistance at $9,466. This zone is highlighted by the SMA 50 4-hour, SMA 200 1-hour, and the Bollinger Band 1-hour upper curve. A break above $9,600 must brace for another strong barrier at $9,662.69 as shown by the Fibonacci 61.8% one-week and the SMA 100 4-hour.

On the downside, the digital asset expects support at $9,368 as highlighted by the Bollinger Band 15-minutes lower curve, the previous 4-hour, the Bollinger Band 4-hour middle curve, the SMA 50 15-minutes and SMA 100 1-hour. Other lower support levels include $9,270 and $9,075.02.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP breaks out of downtrend as RLUSD receives greenlight from New York regulators

Ripple's CEO Brad Garlinghouse announced on Tuesday that the company received a green light from the New York Department of Financial Services on the launch of its stablecoin RLUSD.

Could Google's supercomputer crack Bitcoin? Crypto community maintains positive outlook

Bitcoin faced mixed sentiments on Tuesday after crypto community members spoke on the potential of Google's new quantum chip Willow's ability to crack blockchain networks and render the security of public key cryptography useless.

Crypto Today: Microsoft Rejects Bitcoin Reserve Plan, as Cardano, XRP Lead Market Rebound

Amid an escalating geopolitical crisis, the global crypto market crash on Monday saw over $1.5 billion worth of liquidations, triggering double-digit losses across top-ranked digital assets.

Litecoin Price Prediction: LTC to hold $100 support as traders deploy $10M of leverage

Litecoin price broke below the $110 level on Tuesday, down 20% in a frenetic 24 hours as rising geopolitical risks triggered volatility across global crypto markets.

Bitcoin: Long-awaited $100K milestone meets profit taking

Bitcoin ends the working week hovering around $98,000 after a very volatile Thursday when it surpassed the $100K milestone and underwent a sharp correction. Strong institutional demand, whale accumulation, and the choice of a pro-crypto figure to lead the US SEC fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.