Bitcoin price prediction: BTC/USD stalled in the range, $9,200 remains unconquered — Bitcoin confluence

- BTC/USD bulls struggle at the resistance zone.

- An important support level is created by $9,150 handle.

Bitcoin (BTC) resumed the recovery as the bears failed to push the price below $9,000. However, the coin hit the area marginally above $9,200 and retreated to $9,190 by press time. Obviously, the upside momentum is not strong enough to take the first digital asset out of the range.

BTC/USD 1-hour chart

BTC/USD has gained 1.23% since the start of the day and for a short-period of time moved outside the Bollinger Band (BB) on 1-hour chart. Now the the upper line of this BB at $9,215 serves as an initial resistance that needs to be taken out before the recovery gains traction. The next resistance is created by the highest level of the previous week at $9,288.

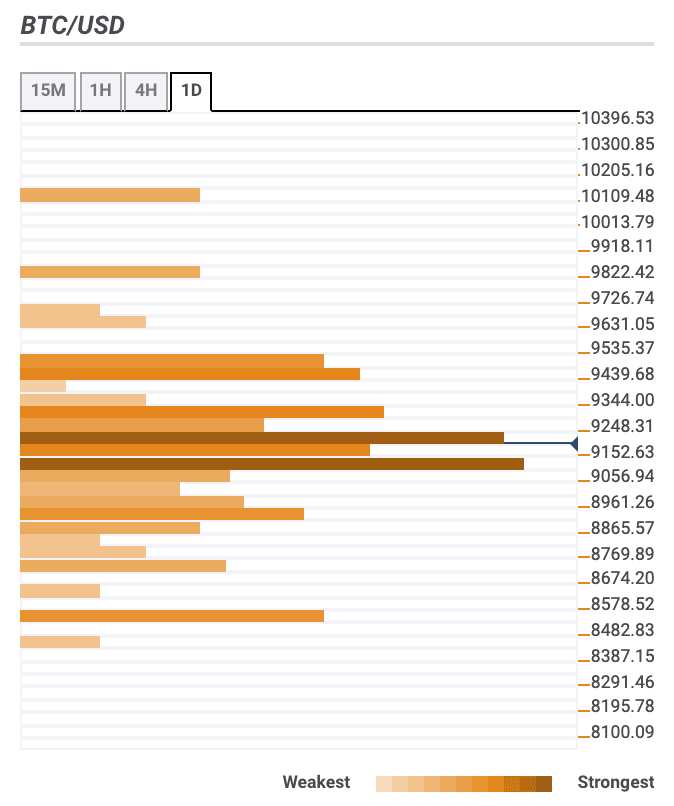

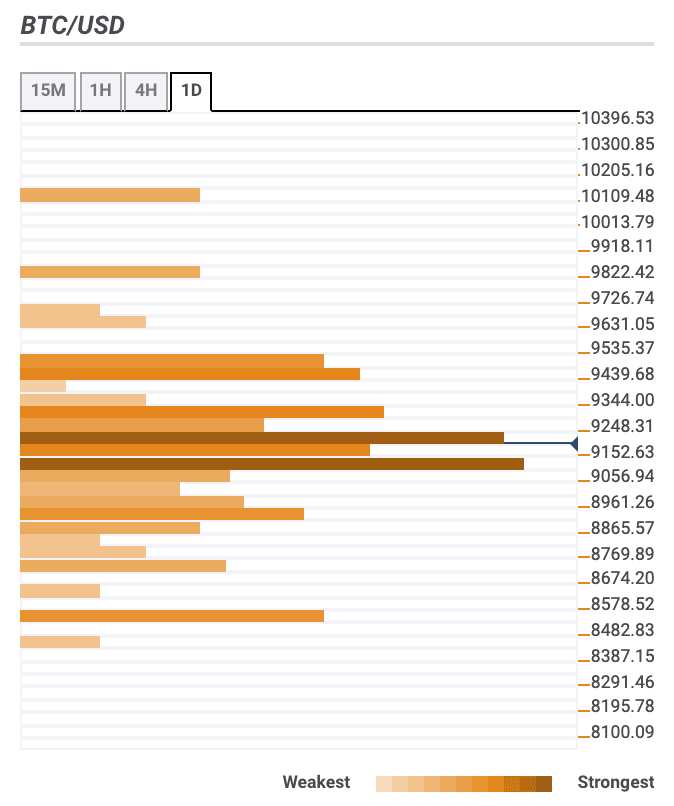

Bitcoin confluence levels

BTC/USD has been oscillating in a tight range since the beginning of the previous week Many experts wait for sharp movements once the price breaks free from the channel; however, the short-term technical picture is uncertain at this stage as there are quite a few barriers both above and below the current price.

Resistance levels

$9,250 - 23.6% Fibo retracement monthly, 38.2% Fibo retracement weekly the upper line of the 4-hour and 1-hour Bollinger Band, Pivot Point 1-day Resistance 1

$9,400 - 38.2% Fibo retracement monthly, daily SMA50

$9,800 - 61.8% Fibo retracement monthly

Support levels

$9,150 - 61.8% Fibo retracement daily, the middle line of the 1-hour Bollinger Band, 1-hour SMA100

$8,950 - Povot POint 1-week Support 1, the lower line of the daily Bollinger Band, the lowest level of the previous day

$8,500 - Pivot Point 1-month Support 1, Pivot Point 1-week Support 2.

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst

-637296246359733852.png&w=1536&q=95)