- Bitcoin re-entered the $8,000 range after gains to $10,000 cut short at $9,200.

- BTC/USD path of least resistance is to the south as $8,400 bottom becomes apparent.

Bitcoin price is in the middle of a battle to defend the short term tentative support at $8,800. An attempt to break above $9,600 resistance last week not only bounced but also culminated in a drop under $9,000. Bitcoin explored the levels below $9,000 on Friday to the extent of testing $8,600.

Meanwhile, the shallow recovery that beat the consolidation over the week stalled short of $9,200. BTC/USD is back under $9,000 while the sellers have eyes on $8,400. Correction to this level will not be entirely a bad idea as it is likely to create fresh demand in preparation for a potential end of the year rally.

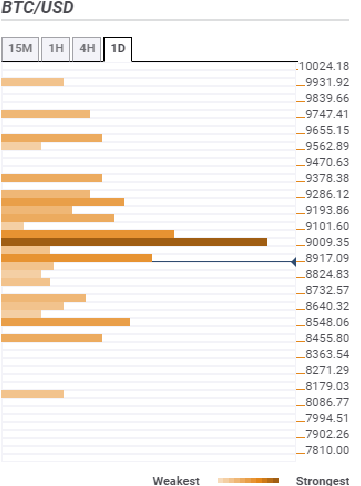

Bitcoin confluence levels

Bitcoin’s path of least resistance is to the south as displayed by the confluence detector tool. The upside is marred with a prominent resistance level at $9,009. The 38.2% Fibonacci one-week, SMA five 1-hour, the previous low 4-hour and the Bollinger Band 15-minutes middle converge in the zone to form the resistance.

Marginally above $9,009, BTC will encounter more resistance at $9,100 as highlighted by the previous high 4-hour. In range leading to $10,000, there are numerous mild resistance levels.

On the downside, support areas towards $8,000 are still in grave danger. Some of these tentative mild support levels include $8,824, $8,732, $8,548 and $8,455.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.