Bitcoin Price Prediction: BTC/USD risks return to $8,900 – Confluence Detector

- Bitcoin struggles to hold above $9,100 (pivotal level) amid the crypto market’s widespread consolidation.

- BTC/USD risks plunging under $9,000 in July especially if the pennant pattern’s support is broken.

Bitcoin bulls are working around the clock to escape the bear traps between $9,000 and $9,200. Gains heading to $9,200 have become unsustainable while support at $9,100 is not strong enough to guarantee the aversion of losses to $9,000.

Meanwhile, BTC is trading at $9,133 as it battles the resistance at the 50 SMA. On the downside, the initial support is the 100 SMA aided by an ascending trendline (part of the bearish pennant pattern).

It is essential that the price holds above $9,100 because that will allow bulls to focus on $9,200. However, if losses come into the picture and pennant support is shattered, BTC/USD could plunge below $9,000 and even test the recent support at $8,900.

From a different technical angle, the ongoing consolidation could last longer based on the signals from the RSI and the MACD. Both indicators are moving sideways at their respective midlines. The RSI is horizontal at 50 (average) while the MACD at 0.00 (midline). If they remain in the same condition longer, consolidation would also last longer.

BTC/USD 1-hour chart

-637291719378493918.png&w=1536&q=95)

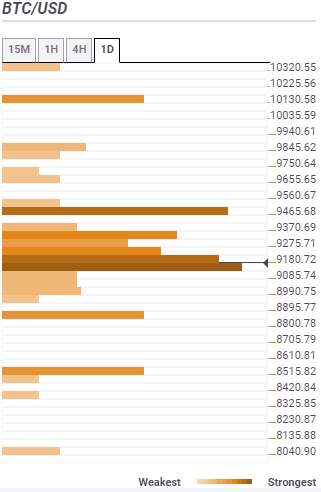

Bitcoin confluence support and resistance levels

Resistance one: $9,180 – This is a region that converges a cluster of indicators such as the SMA 50 1-hour, SMA five 15-minutes, the previous high 15-minutes, previous high 1-hour, the Bollinger band 1-hour middle and the SMA 50 15-minutes.

Resistance two: $9,275 – Home to the Fibo 161.8% one-day, Fibo 38.2% one-week, SMA 100 4-hour, the Bollinger Band one-day middle curve and the pivot point daily resistance three.

Resistance three: $9,465 – This is the region that brings together the SMA 50 daily, the Fibo, SMA 200 4-hour and the Fibo 61.8% one-week.

Support one: $9,085 – Highlighted by the previous low one-day and the pivot point one-day support one.

Support two: $8,895 – Is a region that hosts the previous month low and the pivot point one-week support one.

Support three: $8,515 – Highlighted by the pivot point one-month support one and the pivot point one-week support two.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren