Bitcoin price prediction: BTC/USD retreat seeks possible bottom at $7,200 – Confluence Detector

- Bitcoin is said to be retracing the trend in 2018 and is yet to find a bottom for a significant rally.

- Bitcoin only has one more support protecting it from a potential dive to levels around $7,200.

Bitcoin’s recent could have found a pit stop at $8,500 but not a credible bottom. For this reason, the recovery momentum could not overpower the bears’ front staged at $8,800. Meanwhile, the ongoing retreat casts danger on the zone at $8,500 (recent support). According to Mike McGlone, an analyst with Bloomberg the current downtrend is in no hurry to stop.

“The best way to describe the market is its’s retracing last year’s bear market.” He continues, It’s in no hurry to take out the old highs – there’s a hangover of the residual selling from the parabolic rally in 2017. There’s just a lot of people who it, got way too overextended, who will be responsive sellers.”

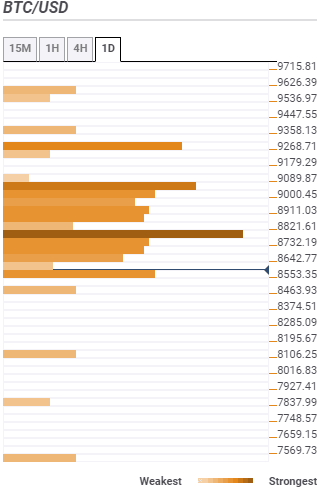

Bitcoin confluence levels

The technical confluence indicator places the first and significant resistance in a range between $8,6452 and $8,732. Multiples of indicators crowding this zone show that upward correction will not come easy. Some of these indicators include the SMA ten 15-minutes, Bollinger Band 1-hour upper, previous week low, Bollinger Band 15-mins middle, previous high 1-hour, pivot point one-day support one, previous low one-day and SMA 15-mins among others.

The strongest support is highlighted at $8,821 by the SMA 100 1-hour, Fibonacci 61.8% one-day, SMA 100 15-mins, Fibo 23.6% one-day and Bollinger Band 15-mins.

It is important that Bitcoin bulls come out strongly to push Bitcoin towards $9,000. However, the largest crypto is just one more support break from plunging to levels around $7,200 (possible bottom). Such a drop is not entirely a bad move as it is likely to create more demand from those waiting to buy at a lower price.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren