Bitcoin price prediction: BTC/USD resumes the upside, targets SMA100 daily – Confluence Detector

- BTC/USD has resumed the upside movement after a consolidation period;

- A sustainable move above $9,650 will take the price to $10,000.

Bitcoin (BTC) has resumed the growth after a period of range-bound trading. At the time of writing, BTC/USD is changing hands at $9,500, having gained nearly 2.5% since the beginning of the day and 3% on a day-to-day basis. The upside momentum is gaining traction, however, the further recovery may be limited by a strong resistance created by SMA100 (Simple Moving Average) on a daily chart. The coin has been trading below this indicator since the beginning of September.

Read also: Bitcoin (BTC) jumps above $10,000, what's going on?

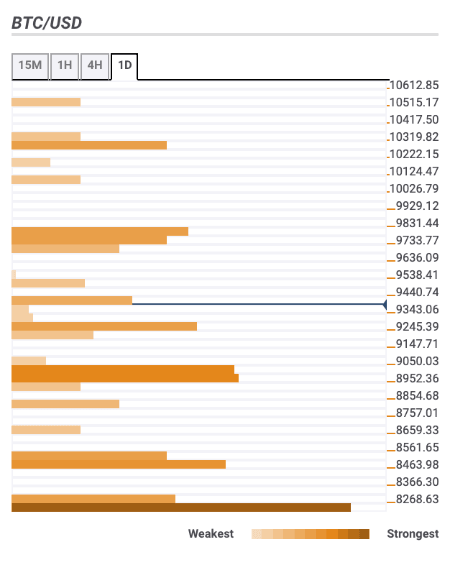

Bitcoin confluence levels

BTC/USD bulls resumed their attempts to take the coin to new highs. After a short period of consolidation, Bitcoin is growing again with the Relative Strength Index (RSI) pointing upwards on all intraday timeframes.

Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$9,650 - SMA100 (Simple Moving Average) daily, the highest level of the previous four-hour timeframe;

$9,800 - 38.2% Fibo retracement daily, Pivot Point one-week Resistance 2;

$10,000 - psychological level, 23.6$ Fibo retracement daily;

$10,300 - Point one-month Resistance 1;

Support levels

$9,000 - the upper line of the Bollinger Band on a daily chart, SMA200 on a daily chart, 38.2% Fibo retracement monthly;

˜$8,500 - 23.6$ Fibo retracement monthly and weekly, the middle line of four-hour Bollinger Band;

$8,200 - SMA50 and SMA100 on a four-hour chart, SMA200 on a one-hour chart, 38.2 Fibo retracement weekly;

Author

Tanya Abrosimova

Independent Analyst