Bitcoin price prediction: BTC/USD resumes the decline, $8,000 still holds up – Confluence detector

- BTC/USD lose some ground as upside momentum is fading away

- A sustainable move below $8,000 will take the price back again to $7,700.

Bitcoin (BTC) resumed the decline after unsuccessful attempts to break above the resistance at $8,300. The first digital coin topped at $8,344 and retreated to $8,180 by the time of writing. BTC/USD has gained 2.8% since this time on Monday and stayed unchanged since the beginning of the day.

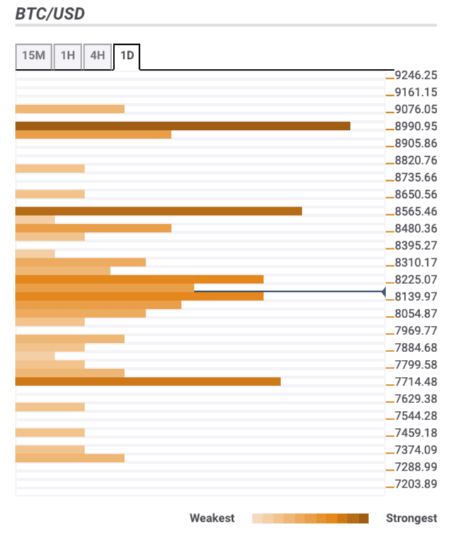

Bitcoin confluence levels

BTC/USD touched $8,153 twice during European hours on Tuesday. Both times, the fresh buying interest located on the approach to $8,150 support helped to stop the decline. Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$8,250 - 61.8% Fibo retracement weekly, SMA10 (Simple Moving Average) daily

$8,300 - the intraday high, the upper line of one-hour Bollinger Band

$8,550 - Pivot Point one-week Resistance 1, SMA200 daily

Support levels

$8,150 - 32.8% Fibo retracement daily, SMA5 daily

$8,000 - psychological level, 38.2% Fibo retracement weekly

$7,700 - the lowest levels of the previous week and the previous month

Author

Tanya Abrosimova

Independent Analyst