Bitcoin Price Prediction: BTC/USD relaunches journey to $14,000 – Confluence Detector

- Bitcoin resumes the uptrend above $12,000 on Monday reviving the hope for a rally to $14,000.

- BTC/USD bulls must seek support above the $12,000 to ensure declines are averted in favor of gains eyeing $12,200 resistance.

Bitcoin's price has finally reclaimed its position above $12,000. This comes after a period of consolidation between support at $11,500 and resistance at $12,000. The weekend session remained bullish but bulls lacked the volume to sustain gains with price action mainly limited under $11,800.

Bitcoin is trading at $12,017 at the time of writing following a 2.90% gain on the day. An intraday high has been traded at $12,083 marking a temporary stop to the rally that still eyes $14,000. Last week Bitcoin hit new yearly highs at $12,145 but retreated massively. The largest cryptocurrency by market capitalization spent most of the week trying to reverse the trend and of course bring down the selling pressure at $12,000.

The current gains seem substantial enough to be contained above $12,000 as buyers focus on higher levels; starting with $12,200. The RSI is making another entrance into the overbought region after a shallow retreat below 70.

Other technical levels show that buyers are at the helm of Bitcoin’s expected price action in the near term. The MACD, for instance, is holding at 598 and features a bullish divergence as an emphasis on the building bullish grip. It is essential that buyers find support above $12,000 in order to focus on gains towards $14,000.

Read more: Bitcoin tops $12,000 amid broad-based crypto recovery

BTC/USD daily chart

%20(17)-637326330676706712.png&w=1536&q=95)

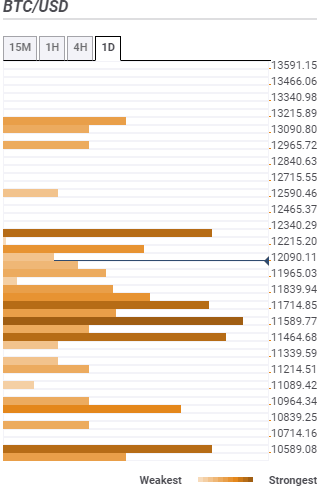

Bitcoin confluence levels

Resistance one: $12,215 – Highlighted by the pivot point one-day resistance three and the previous week high.

Resistance two: $12,340 – Home to the pivot point one-month resistance one and the pivot point one-week resistance one.

Resistance three: $12,965 – Holds the pivot point one-week resistance two.

Support one: $11,965 – Home to the Bollinger band 15-mins middle curve, the Bollinger Band 4-hour upper, the pivot point one-day resistance two and the Bollinger Band 1-hour upper curve.

Support two: $11,714 – Highlighted by the previous low 4-hour, the Bollinger Band 1-hour idle, the SMA 50 1-hour, the Fibo 61.8% one-day and the SMA 15-minutes.

Support three: $11,589 – Hosts the Fibonacci 23.6% One-day, the Bollinger Band 15-minutes lower curve and the Fibo 38.2% one-day.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren