Bitcoin price prediction: BTC/USD range-bound until when? Confluence Detector

- Bitcoin bulls are running out of options fast; either they break above $9,281 or risk plunging under $9,000.

- Technical levels remain drab further limiting Bitcoin’s chances of recovery.

Bitcoin price is stuck in a range between $9,600 and $9,000. Technical indicators have remained lethargic since the week started. An attempt to break past $9,600 was met by a sloth of bears. This put the key $9,000 in grave danger. Bitcoin has since made a shallow stride above $9,200 but the journey ahead is not going to be smooth.

Bitcoin confluence levels

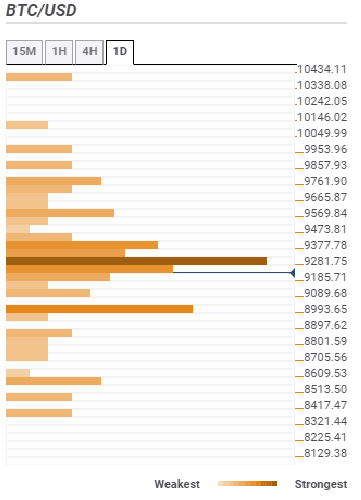

Bitcoin is gradually grinding into a strong resistance at $9,281 hosting stacks of technical indicators including the SMA 100 1-hour, SMA five one-day, SMA 10 one-day, Bollinger Band one-hour upper, previous high 4-hour, SMA 50 four-hour and Fibonacci 61.8% one-day. It is apparent that this is the most prominent resistance Bitcoin bulls will battle on the way to $10,000. Other mild hurdles include $9,377, $9,569 and $9,857.

On the flip side, the initial support area is observed at $9,185. Some of the indicators at this zone range from the 38.2% one-day, Bollinger Band one-hour middle, SMA 50 15-minutes, previous low one-hour and previous low 15-mins. Glancing lower, a break under $9,000 will find support at $8,993 where the previous week low and SMA 100 4-hour meet.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren