Bitcoin Price Prediction: BTC/USD pushed back below $7,400 amid uncertainty – Confluence Detector

- BTC/USD could not keep up with the upside momentum.

- The critical support level is located right below the current price.

BTC/USD is hovering below $7,400 after despite an attempt to settle at $7,447 ahead of the European opening. The first digital coin has been moving inside a tight range limited by $7,300-$7,430 as the upside momentum fails to gain traction. BTC/USD has gained 2.2% on a day-to-day basis and stayed unchanged since the beginning of the day.

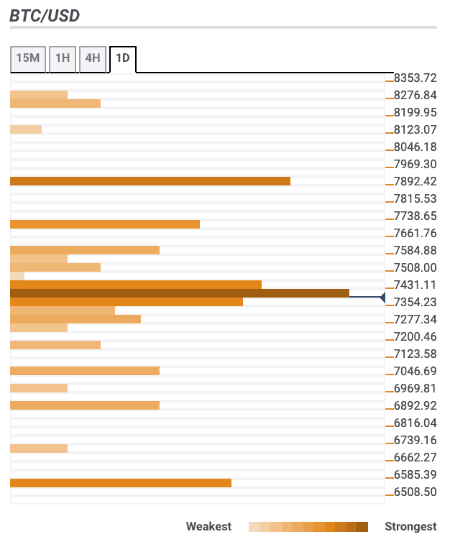

Bitcoin confluence levels

Looking technically, strong barriers are clustered around the current price. Once the coin is out of the above-mentioned range, the movement in either direction can gain traction. Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$7,400 - 38.2% Fibo retracement daily and weekly, the middle line of 1-hour Bollinger Band, a host of short-term SMA (Simple Moving Average) levels, SMA50 (Simple Moving Average) and SMA100 4-hour, SMA200 1-hour, 23.6$ Fibo retracement daily

$7,700 - 38.2% Fibo retracement monthly, Pivot point 1-day Resistance 2

$7,890 - Pivot Point 1-day Resistance 3, the highest level of the previous week.

Support levels

$7,250 - the lower line of 1-hour Bollinger Band, a host of short-term SMA levels, SMA50 1-hour

$7,040 - 61.8% Fibo retracement weekly, Pivot Point 1-day Support 2

$6,500 - the lowest level of the previous week and the lowest level of the previous month

Author

Tanya Abrosimova

Independent Analyst