Bitcoin Price Prediction: BTC/USD pullback to $12,000 eyed – Confluence Detector

- Bitcoin price stalls under $11,400 following a retest of the primary support at $11,100.

- BTC/USD reversal to $12,000 is still possible but it’s best to wait for a confirmed breakout above the key trendline.

Bitcoin bulls are working hard to hold the price above short term support at $11,300. For the second time in less than a week, Bitcoin has tested support at $11,100. The second fall followed the most recent rejection at $11,500. Buyers managed to create some volume that saw Bitcoin make an immediate reversal from $11,000 but it was not been enough to sustain gains towards $11,500 let alone break the next hurdle at $11,400.

The 4-hour chart shows the big wick bearish candle (red) that gave way for an instant pullback from the support at $11,100. However, with the resistance at $11,400 intact, traders should wait for a confirmation before betting on Bitcoin’s ability to hit $12,000 in the coming weekend session.

Meanwhile technical indicators clearly show that consolidation is bound to take over. The RSI is holding horizontally at 45 after a gradual but steady recovery from levels closer to the oversold. The MACD is, however, stuck in the negative region, which highlights the fact that selling pressure is present. Therefore, bulls should be aware in order to plan to keep Bitcoin above $11,300 and focus on the path towards $12,000.

A break above the descending trendline would add gasoline to the fire ignited by the bulls. Bitcoin would then be rocketed above multiple resistance zones highlighted at $11,600, $11,800 and the ultimate $12,000.

BTC/USD 4-hour chart

%20(28)-637341913089764508.png&w=1536&q=95)

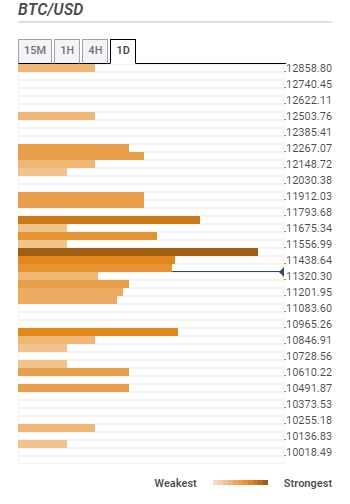

Bitcoin confluence levels

Resistance one: $11,438 – This seller congestion zone is home to a cluster of indicators including the previous high 1-hour, the Bollinger Band 15-minutes upper, the Fibonacci 61.8% one-day and the SMA ten 4-hour among others.

Resistance two: $11,556 – As highlighted by the Bollinger Band 1-hour upper, the previous month high, the SMA 200 4-hiur and the previous week high.

Support one: $11,320 – A medium strong support that that hosts the previous low 4-hour, the Fibo 38.2% one-day and the SMA 15-minutes.

Support two: $11,201 – Home to the Bollinger Band 4-hour lower curve and the pivot point one-week support one.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren